REITerating our Conviction on High Quality Retail Real Estate: Strip Centers | August 2017

August 1, 2017

It seems every day a negative news article is written about brick-and-mortar (B&M) retailers, questioning the future of retailers and retail real estate due to the impact of e-commerce (also read “Amazon” (NASDAQ: AMZN)). As a result, the S&P Retail sector ETF (NYSE: XRT) is down 5.9% year to date, and the Bloomberg REIT Shopping Center index (BB: BBRESHOP) has returned -10.9%, as of July 31, 2017.

We believe e-commerce will continue to have an outsized impact on the retail sector. However, it is not as much an argument of online-only versus B&M, but of retailers willing to blend the two into an omnichannel strategy versus retailers that are stuck in their old ways. Some of the world’s largest retailers such as Amazon, Alibaba (NYSE: BABA), and Walmart (NYSE: WMT) have made billion dollar bets on this new direction for retail, and it is even spreading to grocery, an industry previously perceived to be resistant to e-commerce. Similar to retailers, there will be winners and losers within the retail real estate space, where high-quality and well-located retail center REITs can attract the winning retailers, and thus maintain occupancy and rent growth at the expense of lower quality centers.

Online-only versus Omnichannel

E-commerce is known for competitive prices, as well as “free” returns and “free” shipping. Yet, with profit in mind, it should be difficult for the three to coexist. According to Jerry Storch, CEO of Hudson’s Bay Company (TSE: HBC), direct-to-home supply chain costs for online-only retailers are three times more than a B&M based model. Even Amazon has struggled to be profitable in their retail business due to high costs. In 2016, Amazon’s shipping losses were over $7 billion as shipping revenue (even after including a portion of the amounts earned from Prime memberships) only accounted for 55% of the costs. So, unless AMZN charges more for items than they would be in a store, it will be difficult for the company to be as profitable as a B&M retailer.

Returns are a vital, but often forgotten, aspect of omnichannel retailing. Not only do physical locations provide a quick and easy exchange process or return of money for the customer, but research has shown that 70% of online shoppers make an extra purchase when returning items in-store. Whether it is on the delivering or receiving end of the supply chain, as retailers continue to focus on customer convenience to drive sales, B&M locations will play a pivotal role as the cheapest, and thus most profitable, touch points for retailers. Otherwise, the costs of shipping returned items, assessing quality, re-stocking inventory, and selling at a potentially discounted price will offset ‘savings’ from not having to pay rent for a storefront.

An omnichannel distribution network incorporating the physical store, online, pick-up, and delivery looks like the only way to sustain profits in the long-term. Contrary to online-only, it gives the company a structure to win over customers through convenience and investors through profitability. Though it has yet to proliferate to the majority of retailers, there are already multiple case studies of positive results achieved by adopting an omnichannel strategy. For example, Best Buy (NYSE: BBY), was struggling to maintain growth while its EBIT (Earnings Before Interest & Taxes) margin fell 250 basis points from 2011 to 2014 in the face of competition from e-commerce. After all, electronics is often mentioned as one of the easiest industries to be disrupted by e-commerce and has the highest penetration rate among all retail sectors. In response, Best Buy’s management team decided to embrace omnichannel and, in 2012, changed its view of its B&M locations from merely a ‘store’ to mini distribution hubs that can also be a store. The change in perception allowed the company to better serve the needs of customers, while also saving costs due to more efficient inventory management. As of 2017, 40% of online sales are either picked up at or delivered from a storefront, and the company has posted positive annual same store sales comparisons for the past three years, driving stock performance of +468% from 2013 through July 2017.

Omnichannel – The Next Step Forward

If there was any doubt that omnichannel was the next step in retail, one should just look toward the strategies of some of the world’s most dominant retailers. Walmart, the world’s largest retailer, has been primarily a B&M retailer since 1962. However, after 16 years of struggling to incorporate e-commerce on its own, the company purchased Jet.com for $3.3 billion in 2016. Jet.com was one of the fastest growing e-commerce companies in the country, and Walmart was able to gain Jet’s co-founder Marc Lore as part of the acquisition (who was quickly appointed CEO of Walmart E-commerce US). The talent and innovative pricing technology of Jet, which saves both the customer and company money on online orders, has become the backbone of Walmart’s new omnichannel platform. Since Jet, Walmart has continued to accumulate e-commerce brands and talent by acquiring companies such as ModCloth, Moosejaw, ShoeBuy, and Bonobos. Though it’s early in Walmart’s shift to omnichannel, the changes are already beginning to show up in top-line numbers as US e-commerce sales were up 63% in Q1 FY2018 versus Q1 FY2017. For comparison, AMZN’s online retail product sales were up 16% in the same period.

Alibaba, China’s largest e-commerce company and the sixth largest retailer in the world, was one of the early adopters of blending online and offline shopping experiences in what it calls “new retail”. In contrast to Walmart, Alibaba started as an online-only platform and has had to make B&M acquisitions to implement its omnichannel strategy. Though it may sound contrary to the media’s onslaught on B&M retailers, Alibaba believes that online-only retailers will soon face “tremendous challenges”. In response, the company bought Intime, a Chinese operator of 29 department stores and 17 malls, for over $3 billion in 2017 (including a stake bought in 2014). Additionally, BABA purchased an 18% stake in Lainhua Supermarkets to enter the grocery business, as well as a stake in an electronics B&M retailer, among others. We believe many US retailers will emulate BABA’s concepts in order to succeed in the world of “new retail”.

Though Amazon has been an innovator, it is actually behind its peers in the shift toward omnichannel. The company has opened a few one-off pop-up locations and even a small number of book stores (the business it first disrupted), but, for the most part, the company has completely avoided physical locations while continuing to operate its online-only retail business model at operating margins below 1%. However, on June 16, 2017, Amazon changed its playbook and announced a $13.7 billion bid (which has been accepted) for Whole Foods Market (NASDAQ: WFM), an upscale B&M grocer with over 450 locations worldwide.

Amazon and Grocery – Omnichannel Case Study

Amazon’s purchase of WFM is a symbolic move as it is admission from the “category-killer” that online-only retailing was not sustainable as its competitors were moving to omnichannel platforms. Amazon had been trying to impact the $780 billion grocery industry through an online-only approach for over ten years, spending billions of dollars, and could not even reach a 1% market share. Its up-to-now mediocre offerings include Amazon Fresh, Amazon Pantry, Prime Now, Dash Buttons, and Subscribe & Save. Despite these attempts, Amazon struggled with the cost and speed of delivery needed to be successful in the grocery industry, which historically has been driven by convenience. The purchase of WFM was the giant admitting that physical locations close to the consumer base they are trying to serve is the way to become more profitable and take market share.

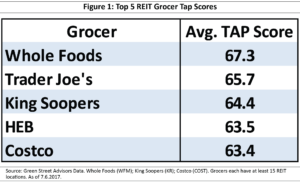

One reason Amazon may have been interested in WFM is its great locations. Figure 1 shows the location quality (TAP score) of the top five grocers that have at least 15 REIT locations. Created by Green Street Advisors, the TAP score judges a location based on the relative strength of the trade area and allows for comparisons across various markets (and costs of living). TAP scores range from 1 to 100 with 100 being the most attractive. As evidenced by the data in Figure 1, WFM boasts the highest TAP score among its peers, indicating its locations are in trade areas with high population density and household income levels.

Like all retail, population density and income levels are very important for the grocery market and for delivery. High population density not only provides the store with a large target market within a close distance, but also makes deliveries more economical due to savings in time and transportation costs. High income levels surrounding a property are indicative of higher discretionary spending and typically higher sales. Higher income households can also likely afford to pay for the service of delivery. In our opinion, WFM’s high-quality B&M locations combined with Amazon’s focus on logistics and customer satisfaction should give Amazon the best chance at finally being successful in their decade-long endeavor.

What Whole Foods Could Do

While the combination of WFM and AMZN will likely be stronger than if WFM and AMZN continued on their separate paths, we are skeptical to crown them the king of grocery. Starting with a mere 3% combined market share, it’s going to take significant changes and time to reach the likes of Walmart at 30% market share and Kroger (NYSE: KR) at 18%. We do believe Amazon will likely have a positive impact on WFM by cutting prices, adding delivery, and implementing click & collect. However, many other grocers have already incorporated omnichannel capabilities and are pursuing similar strategies.

Though it may not be profitable, the company should be able to implement a delivery system for WFM. This is not an original idea. Many traditional grocers have attempted delivery and have struggled to make it profitable. Individual packaging of products, temperature control during and after delivery, and scheduling the drop off time have made it difficult. Additionally, most consumers dislike online grocery because they cannot pick their own produce or meat. Despite offering online prices and delivery costs favorable to the consumer, the overall penetration of online grocery is only 2%. Furthermore, a majority of the products sold online are commodity products (i.e. diapers, paper towels, etc.) that grocers have already been shrinking in-store, choosing instead to focus on products more difficult to sell online such as prepared food. Regardless, with some demand for grocery delivery, many grocers already offer the service through third parties like Shipt and Instacart, which allow the grocer to avoid taking on the profitability risk themselves.

Amazon could also implement a Click & Collect system at its Whole Foods locations. Amazon has already tested this idea in Seattle with AmazonFresh Pickup. But again, Whole Foods would not be the only grocer with this offering. Walmart has added this component to almost 700 of their stores and plans to have it at 1,000 stores by the end of 2017. HEB, Kroger, Ahold Delhaize (AMS: AD), and Wegmans are also already using this feature at their stores, with several experiencing moderate success. So far, feedback from Walmart customers has exceeded expectations. The service for Walmart has an NPS (Net Promoter Score) over 80, which puts them in the “world class” category. The NPS is a rating system from -100 to 100 created by Bain & Company that rates the customer’s experience and loyalty.

Lastly, Whole Foods has some of the highest margins of its peers, which means AMZN could cut prices to take market share. Price cuts could drive incremental traffic to WFM, but the company’s relative size and market share may limit the overall impact to the industry. With only 450 locations versus an estimated 38,000 total grocery stores in the country, the new Whole Foods will be stressed to serve enough customers to make a dent with their current footprint.

Furthermore, price might not be the biggest driver of additional sales for WFM. Currently, 61% of people shop for their groceries from three or more formats, while only 11% choose to shop at a single location. Therefore, customers are choosing to split their basket across various formats based on their respective specialties, which means demand might be more product specific rather than price specific. This theme is playing out in high-quality shopping center REIT Regency Centers’ (NYSE: REG) Westlake Plaza in Westlake Village, California, which has three grocers as tenants. Vons, Gelson’s, and Sprouts (NASDAQ: SFM) occupy 40% of the space and have sales per square foot of $583, $789, and $526, respectively, which compares to the national grocer average of $400. Each grocer goes after a different market (traditional, organic/fresh, gourmet) and experiences cross-shopping. Therefore, even if Whole Foods draws more traffic than it did before, it may draw a portion of a customer’s sales away from other specialty grocers but have minimal impact on overall traffic to the center, including the small shop space.

Impact to the Real Estate

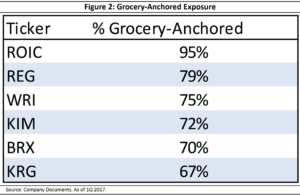

Within the strip center sector, we favor high quality grocery-anchored neighborhood centers due to their convenience, service-oriented nature, and dense locations. Figure 2 shows the REITs with the highest percentage of grocery-anchored centers. Among these REITs, Albertsons, Kroger, and Publix are the largest grocery tenants. Though WFM isn’t a top tenant among most REITS, Regency, Weingarten (NYSE: WRI), and Kimco (NYSE: KIM) have 5.8%, 3.7%, and 2.9% of centers anchored by a Whole Foods, respectively.

For the REITs, we believe the near-term risk of a fundamental change in grocers is limited. As anchors, grocers are most often locked into long term leases of 15 years, with several five or ten year options to extend the lease thereafter. The long-term leases make it difficult for the grocers to vacate the location (and stop paying rent) without relief, such as filing for bankruptcy. In our opinion, a laser focus on tenant quality and location has minimized the risk to the REITs in our portfolio. Moreover, the REIT locations for the grocers are often some of the chains’ best. For example, Weingarten’s largest grocers (Kroger, HEB, Whole Foods, and Publix) produce sales 23% higher than their respective company (based on locations that report sales to WRI). The high productivity of the locations makes it less likely for a tenant to vacate and easier to push rents on the small shop tenants.

For a grocer, simply being in a great location with convenient access for the consumer they are serving gives them a leg up against the competition. The average household lives two miles from a grocery store and will typically travel less than four miles to do their shopping. Additionally, the small size of grocery-anchored centers (relative to big box power centers or malls) allows them to serve dense locations, attracting the smaller service-oriented tenants such as hair and nail salons, laundry mats, urgent care centers, banks, and restaurants that typically make up over half of the center’s rent. In other words, a change in ownership of a grocer at a shopping center will likely have little effect on the main drivers of rent growth.

Excellent Opportunity

When Amazon announced its large scale entry into physical locations many B&M retailer investors anticipated a new “transformative” threat to the industry. However, transformative threats are not new to retail. Walmart was the biggest threat to retailers through the 1990s and early 2000s, causing hundreds of mergers and bankruptcies. From 1995-2005, though, the strip center REITs grew annual SSNOI 2.3% and maintained average occupancy of 93%, according to Green Street Advisors.

Currently, REIT strip center occupancies are near all-time highs and new development is well below the historical average. At today’s prices, we believe the stocks provide an excellent risk-adjusted return as the centers with the best location and demographics will likely continue to win the lion’s share of new tenants.

Blane T. Cheatham, CFA, bcheatham@chiltonreit.com, (713) 243-3266

Matthew R. Werner, CFA, mwerner@chiltonreit.com, (713) 243-3234

Bruce G. Garrison, CFA, bgarrison@chiltonreit.com, (713) 243-3233

Parker T. Rhea, prhea@chiltonreit.com, (713) 243-3211

RMS: 1979 (7.31.2017) vs. 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/reit-outlook.html.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.