Silver Lining to Harvey & Irma: Surging REIT Fundamentals | October 2017

October 1, 2017

Natural disasters are, unfortunately, part of life. They are predictably unpredictable, which is an attribute that can influence population growth, job growth, and real estate. The invention of insurance, provided by companies that can diversify their risk among multiple cities, has enabled cities that are prone to such disasters to attract residents and employers alike. Whether the risk is an earthquake, hurricane, blizzard, or ‘superstorm’, theoretically, real estate prices (and insurance premiums) incorporate the risk of loss.

However, in the wake of extreme disasters, there is a tendency to ask if living or investing in a city is worth the risk. This thought of the potential for lower demand, combined with media coverage of impacted real estate, can create a sentiment that real estate prices must decline. In reality, this has not been the case.

Though every natural disaster is different depending on the type and location, prices are still influenced by the simple equation of supply and demand. First, any destruction creates at least a temporary decline in supply. The effects could be longer lasting if new construction is slowed. Second, there are hardly any property types that have lower demand. In fact, several property types can experience significant demand spikes.

In September, Hurricane Harvey and Hurricane Irma made landfall as Category 4 hurricanes, the first time that two hurricanes of such strength have done so in history. Millions of lives have been negatively affected, hundreds of thousands of homes and vehicles were damaged, and the US economy will feel the effects for years to come. Current estimates of the losses range from $150 to $200 billion. However, some REITs with exposure to Texas and Florida significantly outperformed the MSCI US REIT Index (Bloomberg: RMZ) during the month.

In this publication, we explore the effects of natural disasters on commercial real estate, and apply our conclusions to the publicly traded REIT market. Three property types we believe should benefit from a disaster are lodging, apartments, and self storage. Longer-term, outsourced data centers may also garner a larger share of the market. Otherwise, we believe the remaining sector outcomes will likely be neutral at worst.

Lodging

The lodging sector has historically been one of the most volatile in terms of performance and cash flows. The nature of a one day lease makes cash flows particularly difficult to predict. Natural disasters, including hurricanes, epitomize the unpredictability and suddenness at which fundamentals can change for a hotel REIT.

To start, a disaster is likely to have a short- and intermediate-term negative impact to supply, as rooms or entire hotels have to be taken offline due to damage. If damages are extreme, they must be inspected before reopening to validate that it is safe for guests. Repairs, both small and large scale, also can take longer than usual and cost more due to shortages of labor and higher commodity prices as hotels compete with all other construction/repairs in the affected area. Longer-term, new construction will also likely be more difficult to justify due to the higher costs.

The trajectory of demand is less certain. First, any evacuation from a city will be a short-term negative for hotels in that market; however, hotels nearby may experience a short-term benefit from evacuees. For example, due to evacuations in Florida in anticipation of Hurricane Irma, Atlanta hosted evacuees and posted RevPAR (Revenue Per Available Room) growth of +39% for the week of September 3-9, 2017, versus the same period in 2016. In contrast, Miami was evacuated on September 6 and posted a RevPAR decline of 26% for the week. Both compare to the top 25 market average of +5% over the same time period, according to Smith Travel Research. Depending on the damage, the RevPAR fluctuations around the evacuation period are likely short-term in nature.

The next determinant of demand is whether the market is a leisure destination or a population center. A leisure destination without a large population of full time residents will likely have short- and intermediate-term demand headwinds. For example, Key West was forced to evacuate due to Irma, sending RevPAR plunging. However, even if a hotel escaped unscathed, the damage to infrastructure on the island has made it un-bookable for tourists. According to the executive of a REIT with Key West exposure, he does not expect any tourist business in the market for at least 90 days, while other islands in the Caribbean may be off the radar for travelers for years!

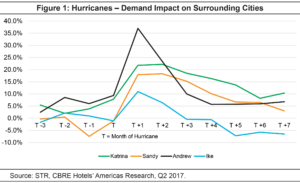

However, in a market with high population density and a disaster that causes displacement by residents, hotel demand is expected to increase (assuming no damage to the hotel), in both the short- and intermediate-term. For example, during the same September 3-9 week, Houston RevPAR was 106% higher in 2017 than in 2016 due to Hurricane Harvey. Historically, the boost to demand has lasted at least three months. According to Figure 1, hotels near the paths of Hurricanes Katrina (2005), Sandy (2012), Andrew (1992), and Ike (2008) experienced a increase in demand up to seven months later!

Most of the quality scale, with the exception of Luxury, will experience similar boosts to demand as the Department of Housing Services, FEMA, and other government agencies are subject to pricing limits. Some of these contracts can be extremely profitable for the hotels that fit the government criteria as they can extend six months or more. Luxury hotels may benefit from wealthier displaced residents and visiting insurance adjusters, but this will be somewhat short-term as displaced residents will look for a short-term apartment lease if they cannot get back into their house after a week or two.

Host Hotels and Resorts (NYSE: HST), the largest hotel REIT with a market capitalization of $13.5 billion as of September 20, 2017, owns four hotels in Houston and ten in Florida. According to a press release on May 15, 2017, “two of the properties [in Houston] are operating at full capacity with first responders, transient and group business”. The other two properties in Houston are a St. Regis and a JW Marriott, which we expect will receive a boost, although not as strong as the upper-upscale Marriott assets (George Bush Intercontinental and Houston Medical Center). Similarly, HST’s Orlando World Center Marriott and Tampa Airport Marriott are at full occupancy, per the press release. We would expect some of their higher end leisure hotels, such as the Ritz-Carlton Naples Beach and the Ritz-Carlton Naples Golf Resort, to post a decline in RevPAR due to trip cancellations. In all, the company disclosed a maximum financial exposure of $20 million, after insurance recoveries, as a result of the two hurricanes. $20 million equates to only 1.3% of HST’s 2017 EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) guidance of $1.5 billion. HST’s diverse geographic exposure lowers the volatility of earnings and increases predictability, which helps to dampen effects from natural disasters.

Apartments

In the wake of a disaster, apartment fundamentals typically experience an uplift in demand for temporary housing from displaced residents as well as laborers looking to help rebuild. The apartments that are left standing and accessible should immediately benefit from a rise in occupancy rates, which should then give landlords pricing power in future lease negotiations.

For example, when Florida was hit by multiple hurricanes in 2004, Camden’s (NYSE: CPT) Tampa and Orlando markets had an average occupancy increase of 150 basis points (or bps) from Q3 to Q4 as compared to a 90 basis point decline for the overall same store portfolio. The company also experienced a 150 bps reacceleration in revenue growth within those markets during 1Q 2005, the first full quarter following the hurricane.

As of June 30, 2017, CPT had 8,434 units in its Houston same store portfolio making up 10.9% of CPT’s share of net operating income (or NOI) and 8,121 units across Florida (16.8% of CPT’s share of NOI). CPT’s properties only experienced minor damages due to Harvey and Irma, while all properties remained operational. The company did announce, however, that it estimates $0.05-$0.06/share (or $4.5-$5.5 million) in storm related expenses during 3Q 2017, which compares to full year funds from operations guidance of $4.57/share at the midpoint. Notably, the unanticipated costs include donations toward relief efforts.

Though many parts of Florida sustained damage from Irma, fortunately, the destruction wasn’t as devastating as initially expected. The overall impact to the Florida apartment markets is likely only a slight positive as a result. But, the Houston market, on the other hand, witnessed a significant increase in demand from Hurricane Harvey. As of September 19, 2017, CPT’s Houston occupancy had risen to 98% as compared to 93% before the storm. CEO Ric Campo said the company had leased 500 units in Houston in the two-and-a-half weeks after the storm, versus 170 net units leased for the entire year through August. Typically, CPT’s revenue management system would try to maximize revenue by driving rental rate increases during times of extreme demand; however, management turned off the system for 30 days in an effort to help get the community back on its feet, freezing rents at the average rate for the two to three months prior to the storm.

The increased demand from Hurricane Harvey could help solve Houston’s apartment supply glut much sooner than initially expected. According to RealPage, the market has 21,769 units under development, equivalent to 3.3% of existing supply, which compares to 1.7% nationwide. As a result, Camden’s Houston same store portfolio ended the second quarter with occupancy down 80 bps from 2Q 2016 and a revenue decline of 3.7% over the same period. However, looking into 2018, if elevated occupancy rates hold, landlords could regain pricing power much sooner than the previous timeline of late 2018/early 2019. Additionally, damage from the storm and competition for labor and materials could push back the timeline for properties under construction, making the absorption of those units much more palpable. As a result, the Houston apartment market could go from one of the worst performers in the country to one of the best in a matter of months.

Self Storage

Self storage fundamentals are driven by available supply and the four D’s of demand: Death, Divorce, Downsizing, and Dislocation. When a market is hit by a natural disaster like a hurricane, dislocation is almost inevitable. As people await home repairs, many have resorted to self storage as a short-term solution for their belongings.

Self storage properties that have available vacancy should see an immediate impact through a gain in occupancy above the typical stabilized level of low 90% for a professionally managed property. The increased demand could also result in a decrease in the use of promotions as well. However, due to the short-term nature of self storage leases (one month), tenants will be able to move out as soon as their homes are repaired. This limits the expected benefit from storage demand to the short- to intermediate-term.

Longer-term, however, damage to existing properties and delayed construction due to lack of labor and materials could improve the overall supply picture for a particular market. For example, Public Storage (NYSE: PSA) announced they will demolish seven properties in Houston due to Hurricane Harvey.

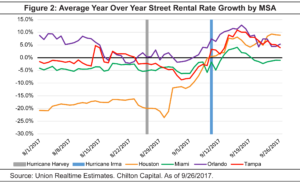

Life Storage (NYSE: LSI) had 12.5% of total square footage in Houston and 16.1% in Florida at the end of 2Q 2107, the highest among its peers. As of September 22, 2017, LSI has reported three wholly-owned and JV properties in the Houston portfolio and one property in Florida remain closed from the hurricanes. According to Union Realtime, a self storage data provider, street pricing in Houston and Florida has increased significantly since the hurricanes (Figure 2), while promotions have significantly decreased.

Prior to this hurricane season, Houston had been a “problem” market as supply ramped up and job growth slowed from the decline in oil prices. According to Union Realtime’s Radius platform, the market has an estimated 5% increase in supply under construction. In 2Q 2017, LSI’s Houston same store portfolio had occupancy of 92.0%, down 70 bps from the same period in 2016 and same store revenue decline of 3.6%.

Dave Rogers, LSI’s CEO, said that incoming calls for people looking for storage in Houston were up 15 times over the same period last year, and announced occupancy is currently 98%, up from 93% at the end of the second quarter. On the supply side of the equation, units expected to be delivered within the next year may also be pushed back due to resources going to other construction jobs.

Data Centers

Data center REITs may be one of the biggest beneficiaries of disasters over the long-term. The Texas and Florida metropolitan service areas (or MSAs) that were hit by Harvey and Irma are small markets for data centers, as companies prefer to locate these assets in less disaster-prone areas. However, because they have the global or regional headquarters of many companies, they have a large number of tenant-owned and managed data centers that are located in the same areas as third-party leased and managed data centers. The former sit on more disaster-proof parts of corporate office campuses and are called internal data centers. The latter, the domain of data center REITs, are located offsite on some of the most disaster-proof sites in their markets. They are called external data centers.

In both Harvey and Irma, external data centers outperformed internal data centers by much wider margins than they have over the past few decades. Neither we nor our contacts are aware of any downtime at the more than 100 Houston and Florida external data centers listed in a publicly available directory. By contrast, our sources estimate that several dozen internal data centers were without power or could not be accessed for days at a time. If ever there was a time for a data center REIT to pitch a Fortune 500 company on the benefits of outsourcing their data center operations to third party specialists or the cloud, this is it.

We believe that our largest data center overweight, Dallas-based CyrusOne (NASDAQ: CONE) will benefit more from these storms than its peers. In addition to having the largest exposure to Houston, San Antonio, and Austin, none of its properties experienced any downtime. It also has some of the best space available for lease in West Houston.

Long-Term Growth Drivers Endure

Importantly, we do not believe that this hurricane season will put a significant dent in the long-term forces driving strong population and job growth in Houston and Florida. Some communities in flood-prone Houston areas, as well as parts of Rockport, the Caribbean, and coastal Florida may not be rebuilt and repopulated to the degree they were previously, which implies a permanent repricing of their real estate.

However, Houston and Florida have long dealt with hurricanes and flooding. Both Houston and Florida overcame a lot of obstacles to get to where they are today, and each time they emerged stronger. Importantly, as other parts of the country increase regulations, minimum wages, and land-use restrictions, people and companies will continue to move to places like Houston and Florida. Lots of sunshine, low costs of living, good public education, and business-friendly environments got Houston and Florida to where they are today, and we believe high-quality REITs with exposure to those markets should continue to outperform.

Parker Rhea, prhea@chiltonreit.com, (713) 243-3211

Matthew R. Werner, CFA, mwerner@chiltonreit.com, (713) 243-3234

Blane T. Cheatham, CFA, bcheatham@chiltonreit.com, (713) 243-3266

Bruce G. Garrison, CFA, bgarrison@chiltonreit.com, (713) 243-3233

RMS: 1973 (9.29.2017) vs. 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/reit-outlook.html.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.