Back by Popular Demand: REITs and Interest Rates | November 2017

November 2, 2017

Despite consensus expectations for rising long term interest rates over the past five years, the US 10 year Treasury yield is still trading at below where it was four years ago. Now, with a new Federal Reserve Chair nomination expected by November 3, global economic growth picking up, potential for tax reform, and tightening Fed policy, long term interest rates are once again expected to increase.

In our base case scenario, we believe the 10 year US Treasury yield slowly grinds upward from 2.4% as of October 30 over the next few years, but will have trouble staying above 3% for long without any major change to inflation. In such an environment, REITs can still be an attractive investment. In particular, we believe active management of REIT portfolios will be essential as cap rate compression will no longer ‘raise all boats’.

The Current State of Affairs

As of January 2017, when the 10 year US Treasury yield was 2.5%, the average economist prediction for the end of 2017 was 2.8% assuming three rate hikes. With greater than an 80% probability of a rate hike in December as of October 30, it appears that the 2017 rate hike expectations will be met. However, as of October 30, the yield stood at 2.4%. As of the most recent Fed meeting, current Fed Chair Janet Yellen has telegraphed another three rate hikes in 2018. We believe there are several factors that make the three hikes in 2018 and an increase in long term interest rates potentially less certain.

Unprecedented Policy

The Federal Reserve has as its mission to “promote the effective operation of the US economy”, and its Federal Open Market Committee (or FOMC) has been given three tools for which to employ monetary policy: setting the discount rate for overnight bank deposits (the ‘federal funds rate’), establishing reserve requirements for banks, and conducting open market operations, which includes the issuance and purchase of securities.

Following the 2008-2009 recession, the FOMC embarked on an unprecedented period of Quantitative Easing (or QE), lowering the federal funds rate from 5-5.25% to 0-0.25% and purchasing $4.5 trillion of US Treasuries and mortgage backed securities (or MBS). Now, nine years later, the Fed has begun tightening by raising the federal funds rate to 1-1.25%, and it plans to shrink the bond portfolio to $2.5 trillion. This is also unprecedented.

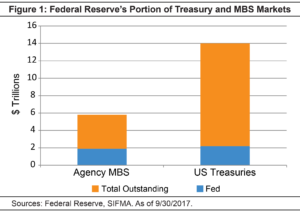

Although this creates uncertainty, we believe the effects on the 10 year US Treasury yield will be minimal for several reasons. First, the plan has been well-communicated to market participants. Second, it will take over six years for the Fed to reach its goal under its stated plan, minimizing effects in the near term. In addition, the Fed’s portfolio is comprised of about 40% MBS and 60% Treasuries, with only 55% of the Treasuries maturing in the next five years, which decreases the chances of a significant roll-off of a 10 year US Treasury bond in any one month in the near future. Finally, we believe the effects will be felt more deeply in the agency MBS market where the Fed owns over 30% of the outstanding paper, which compares to the much larger US Treasury market where the Fed owns less than 19%, as shown in Figure 1.

Upcoming Catalysts

The President is expected to nominate a new Fed Chair by November 3. The Fed Chair has more influence than anyone else in the country on monetary policy. Notably, current Chair Janet Yellen shared similar beliefs to her predecessor Ben Bernanke, and the end of her reign could result in a change in policy from the past eight years.

The favorites for the nomination are Jerome Powell, Yellen, Kevin Warsh, and John Taylor. The heavy favorite is Mr. Powell, who is considered to share similar beliefs to Yellen. Thus, if Powell or Yellen is nominated, we would expect a continuation of the plan that has been communicated. Mr. Warsh and Mr. Taylor would represent a change in philosophy and policy – both believe that rate hikes should be done much more quickly.

The other catalyst is the potential for tax reform. The least likely outcome is one that would reform the tax code significantly, both for individuals and for corporations. More likely, if any tax reform is passed, we believe there could be somewhat meaningful reform to the corporate tax code and little change to personal taxes.

The Scenarios

In a scenario where Mr. Taylor or Mr. Warsh is nominated as the next Fed Chair, and only a mildly effective tax reform bill passes, we believe hiking interest rates too quickly could push the economy toward a recession in the next few years. Without inflation or rising real GDP growth, the interest rate curve would become inverted (long term rates lower than short term rates), thereby signaling a recession sometime in 2019. Though a recession would not be desirable for REITs, the lower long term rates could drive outperformance relative to equities.

Another scenario is the nomination of Powell or Yellen, combined with comprehensive tax reform. Comprehensive tax reform could be interpreted as inflationary, since that is what has happened historically when there have been tax cuts. However, we believe long term rates would come back down as the higher interest payments by the government would offset any of the benefits of higher consumer spending, corporate capital investment, and employment.

Finally, the most likely scenario in our opinion is a Powell or Yellen nomination and mildly effective tax reform, leading to an environment where long term interest rates slowly grind higher. In this case, a recession would likely be mild and not occur until 2020 or later.

We believe long term rates will also be weighed down by low rates internationally, particularly in Japan and Europe. Therefore, investors looking to capitalize on borrowing at low yields internationally and investing at high yields in the US will push down US yields. Even if global growth does continue to accelerate and maybe even lead to tapering of some QE, the lower relative risk of the US market should allow US Treasury yields to remain low.

Don’t Lose Interest in REITs

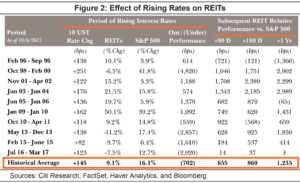

Common knowledge says that REITs should decline when interest rates rise. However, this has not always been the case. In fact, REITs have had positive performance in rising rate environments during six of the ten periods with rising interest rates over the past 25 years, and outperformed the S&P 500 in five of the ten! Noticeably, as shown in Figure 2, REITs performed extremely well after interest rates stopped rising, outperforming the S&P 500 in almost every subsequent period.

If we are in an environment with long term rates that rise gradually, we believe that the next several years will be marked by somewhat range-bound volatility that creates buying opportunities. Though it is speculation, we believe the relationship of REITs and interest rates breaks down eventually for several reasons. First, real estate prices are influenced by many factors, of which interest rates are only one. Second, higher interest rates are usually a sign of inflation, which causes an increase in construction costs, thereby lowering future supply. Finally, REITs are able to raise dividends, which can can help them to maintain yield spreads relative to long term interest rates.

Interest Rates and Prices

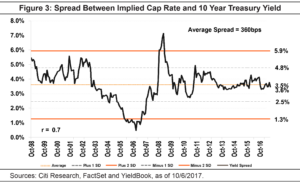

Real estate prices are usually measured in capitalization rates, or cap rates, which is the projected first year net operating income (NOI, defined as rent minus operating expenses) of a property or company, divided by the price paid. However, cap rates are the result of analysis that determines the value to a buyer given a myriad of variables, where risk, cash flow growth, and cost of capital are most important. Interest rates are part of the ‘cost of capital’ equation (cost of equity plus cost of debt, which is influenced by interest rates), but not the only component. In an environment where interest rates are rising due to a growing economy with inflation, cash flow growth could offset any increase in the cost of capital, thereby compressing spreads between cap rates and the US 10 year Treasury yield.

As of October 6, the spread stood at 350 bps, which compares to the historical average of 360 bps. As shown in Figure 3, over the past 20 years, there have been five years where the implied cap rate spread has been at or below 300 bps, and they usually were during phases where the economy was expanding. Notably, a 50 bps increase in the US 10 year Treasury yield would still be within one standard deviation of the historical average. In addition, we expect NOI to increase by over 3% annually for the next three years, which provides a cushion for REIT prices even if cap rates were to move up.

Still a Supply and Demand Equation

Interest rates play an important role in development decisions as well. If borrowing costs increase, a developer will need a higher return on the development to justify going forward with the project. In addition, if interest rates are rising due to inflation, the cost of land, labor, and materials required for a new development also increases. This raises the rent required to achieve an acceptable return. Therefore, we would expect construction to decline if interest rates were to rise. Assuming demand is at least steady, this would create a more favorable supply/demand environment for REITs, AND give them a cost of capital advantage over most other developers given their low leverage and ability to borrow unsecured.

Income AND Growth

Though REITs are not classified as fixed income, they are sometimes referred to as a ‘yield alternative’. Thus, REITs are supposed to decline when interest rates rise. However, as we showed in Figure 2, that is not always the case. Unlike fixed income, REITs have the ability to increase dividends. From 2011 to 2016, REITs increased dividends per share by almost 8% annually, while cash flow per share (or AFFO) grew by 10% per year (according to Green Street Advisors), which has decreased payout ratios to a record low of 72% of AFFO.

We estimate dividend growth of 5.5% annually for the next three years, assuming no change to the record low payout ratios. It’s an important distinction to make, as the historical average spread of 100 bps between the REIT dividend yield and the US 10 year Treasury yield over the past 25 years was generated using an average payout ratio of 82%. If payout ratios were to increase back to 82% of AFFO, we estimate dividend growth would approach 9%!

Importantly, even using such conservative metrics, there is a 90 bps cushion (190 bps spread as of October 30 minus historical average of 100 bps) using the REIT dividend yield of 4.3% and US 10 year Treasury yield of 2.4%, meaning the US 10 year Treasury yield would have to rise 90 bps to return to the historical average. Conversely, if the REIT dividend yield were to fall 90 bps while holding the US 10 year Treasury yield constant and the spread was to compress to the historical average, REIT prices would increase by over 25%!

Portfolio Positioning

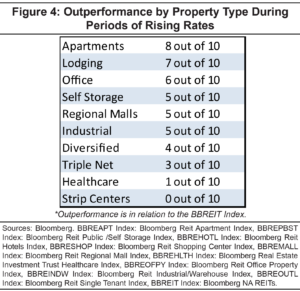

While we have shown that REITs as a whole do not always have to go down when rates are rising, it is also important to note that some REITs do better than others in such an environment. In theory, relative outperformance should be achieved by companies that benefit from rising inflation that quickly results in higher cash flow and dividend increases. As shown in Figure 4, the sectors that have outperformed during periods of rising long term interest rates are: lodging, apartments, regional malls, office, self storage, and industrial. In contrast, the sectors that have underperformed are: health care, strip centers, and triple net.

While the Chilton REIT Composite does not necessarily have overweights in every sector that historically outperforms (though it is overweight regional malls, office, and apartments) or underweight in every sector that underperforms (though it is underweight healthcare and triple net) during periods of rising rates, the portfolio does have a ‘low risk growth at a reasonable price’ theme. In other words, we favor companies with low dividend payout ratios and high potential cash flow growth, either through development or same store lease up and rent increases, while also trading at discounts to our proprietary fair value estimates. In addition, we reward companies that have low leverage, long weighted average maturities, and a high percentage of fixed rate debt to protect margins should interest rates rise. Importantly, we will use active management to change these allocations as the economy and market prices change so that the portfolio holds only securities that we consider to be undervalued.

Not a Horror Movie

While caution and awareness of risk is healthy, we believe that any ‘fear’ of significant increases in interest rates and the resulting effects on REITs is unwarranted. In the most likely scenario for a new Fed Chair and tax reform, we don’t see the US 10 year Treasury yield able to sustain yields much higher than 3% for the next few years. Even if rates rise to those levels, REITs should not be faced with a massive downward re-pricing given the current cushion between dividend yields and the 10 year US Treasury yield, mid to high single digit projected dividend growth, potentially better supply/demand dynamics, and a historical precedent for a below average cap rate spread under certain circumstances. Finally, each security in the Chilton REIT Composite was selected for its own idiosyncratic investment merits, and does not depend on low interest rates to reach our proprietary target prices.

Matthew R. Werner, CFA, mwerner@chiltonreit.com, (713) 243-3234

Parker Rhea, prhea@chiltonreit.com, (713) 243-3211

Bruce G. Garrison, CFA, bgarrison@chiltonreit.com, (713) 243-3233

Blane T. Cheatham, bcheatham@chiltonreit.com, (713) 243-3266

RMS: 1953 (10.31.2017) vs. 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/reit-outlook.html.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.