Lodging REITs: Poised to Outperform | May 2018

May 1, 2018

Since President Trump was elected on November 9, 2016, the lodging REIT sector (Bloomberg: BBREHOTL Index) has outperformed the MSCI US REIT Index (Bloomberg: RMS G) by over 2,350 basis points (bps) through April 16, 2018. The strong stock performance has likely been in anticipation of the pro-growth and pro-business agenda that President Trump’s election symbolized. This is in spite of the fact that hotel sector Adjusted Funds From Operations (or AFFO) per share actually fell 5.7% in 2017—the worst among all REIT sectors, which averaged +4.7% growth. AFFO is a REIT metric most similar to earnings per share and is representative of cash flow after capital expenditures.

The lodging REIT sector is one of the most levered property types to the economy due to the sector’s short-term leases (one day). When demand is strong, prices can be increased almost immediately; however, the opposite is true when demand is weak. As a result, the sector has also been one of the most volatile historically, posting a standard deviation of returns of 38% over the past ten years, which compared to 25% for the RMS as of March 31, 2018. In addition, the sector was one of the worst performers over the same period. In other words, investors took on higher risk while receiving lower return. However, across short time horizons there have been periods of outperformance which creates opportunities for active managers to generate alpha.

We are nine years into the current lodging cycle, having experienced positive Revenue Per Available Room (or RevPAR) growth in each year since the recession. However, RevPAR growth has decelerated in each year since 2014, and Smith Travel Research (or STR) had estimated 2018 RevPAR to grow by a cyclical low of only 2.7%. If tax reform could help 2018 RevPAR growth buck the trend, this could be one of the opportunities for lodging REITs to deliver outsized returns.

While important, RevPAR is not the only driver of lodging REIT performance. Heavy operating expenses and capital expenditures required to maintain relevance with guests can compress margins and cash flow available for dividend growth. In our opinion, this is one of the biggest reasons for the historical underperformance. Thus, it is important to find lodging REIT management teams that can skillfully allocate capital and drive AFFO growth, especially during periods of slowing RevPAR growth.

An Overextended Stay?

The economy has been accelerating since the presidential election, but the improvement in economic data hasn’t translated into improved hotel fundamentals—at least not yet. Despite the backdrop of a growing economy, RevPAR growth over the past few years has been just “O.K.” for the industry, and even worse for lodging REITs. New supply has accelerated every year since 2012, which has dampened growth, and is expected to reach 2.0% of existing supply in 2018, up from 1.8% in 2017.

Additionally, due to the locations within major markets and bias toward high quality, lodging REITs have experienced a disproportionate headwind from new supply. Supply within the major markets has grown 3.1% over the last twelve months and almost half of total supply is targeting upscale or higher brands. As a result, the average REIT RevPAR growth in 2017 was 1.3%, and the midpoint of 2018 REIT RevPAR guidance was only +0.9%.

Within the major markets, the lodging REIT portfolios are mostly weighted toward higher quality urban and full service hotels. In the industry, these hotels are labeled as Luxury, Upper Upscale, and Upscale, which include brands such as the Four Seasons, Marriott, and Courtyard, respectively. Being at the higher end of the chain scale, lodging REITs rely heavily on corporate travel, which represents 75% of demand for their rooms. As the economic recovery has gotten long in the tooth, many corporations have cut costs, which has included travel and conference budgets. Since 2010, Upper Upscale demand growth (a proxy for REIT demand, defined as total number of rooms occupied) fell from a peak of 8.6% to 2.1% in 2017.

Shrink to Grow

Due to the decelerating national RevPAR growth numbers that the lodging REITs have had to face over the past 3 years, many management teams have focused on finding operating efficiencies to lower expenses and drive earnings growth, as measured by EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortization). Since 2012, the lodging REIT average EBITDA margin has grown from 23.1% to 26.1%, reflecting effectiveness of management plans to lower, or hold steady, expenses as revenues have grown (albeit slowly).

EBITDA margins can vary significantly in the hotel business. Large ballrooms and convention space need to be used often to justify the upkeep costs. Hotel restaurants and bars can be significant drags to margins if they aren’t popular among guests and locals. Many cities have hotel labor unions that require certain wages and hours, which constrain the ability to cut expenses. Even how the guests are sourced can have a large effect on margins. Guests that book through Online Travel Agencies (or OTAs), such as Expedia (NYSE: EXPE) and Booking.com (NYSE: BKNG), have a 20-30% fee associated with the revenue generated from their rooms. Thus, finding the right balance between occupancy and room rate is not a simple equation.

Recent cost-saving initiatives have been made possible due to advances in technology. For example, the use of a service called ‘OpenKey’, which allows guests to skip the lobby check-in and use their phones as the room key, lowers the need for personnel in the lobby. In addition, this keeps a lobby less crowded, which can allow the space to be used for another purpose. Some hotels are cutting back on room service, which has historically been unprofitable. Instead, the hotel can maintain margins by having guests pick up food near the restaurant where it’s prepared.

Pebblebrook (NYSE: PEB) CEO Jon Bortz has long been a proponent of imposing cancellation and change fees similar to the airline industry. He alleges (and we agree) that the current system is tilted much too far in favor of the consumer, where a hotel is required to hold a room off of its inventory for no revenue, while a guest can book multiple hotels, or even cancel and re-book another hotel while looking for the best price. An evolution in the hotel pricing model would help revenue and margins for hotel owners.

A Case Study in Value Creation

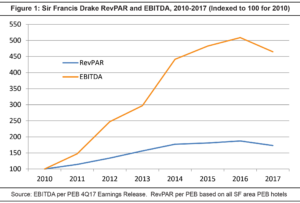

PEB has also been one of the leaders in cutting costs at the property level to drive EBITDA growth. The Sir Francis Drake hotel on Union Square in San Francisco was one of Bortz’s first purchases after taking PEB public in December 2009. PEB purchased the property for $90 million in June 2010. In Figure 1, one can track the EBITDA from the hotel from purchase in 2010 through 2017, in which it was the highest EBITDA-generating hotel in the portfolio. Over this period, EBITDA grew by 24% per year, but RevPAR only grew by 13% (based on all San Francisco area PEB hotels). Despite acquiring the hotel at a year one EBITDA yield of only 3.8%, the hotel generated a yield of over 14% in 2017, as measured by EBITDA/gross book value.

PEB invested $9 million into transforming guest rooms, took the hotel from a 3-diamond-rated hotel to a 4-diamond, and implemented best practices in the food and beverage (or F&B) segment to increase competitiveness and reduce costs. F&B best practices included a new purchasing program, revising the menu to reduce waste and control portions, installing beverage controls to monitor pours, and a monthly monitoring system. In all, the company identified $1.9 million in annual savings from F&B, which is remarkable considering the EBITDA in 2010 was only $3.4 million.

Chilton Positioning

As mentioned above, remarkably, lodging REITs have produced extremely strong performance recently in spite of the unremarkable earnings growth. Given the lackluster recent results, this is invariably based on a strong future outlook. The problem is lodging REIT valuations have been stretching as the stock prices have climbed higher than earnings over the past four years. As a result, AFFO multiples have increased from 8.6x in February 2016 to 11.4x as of April 23, 2018. This is above the ten year average of 10.9x for lodging REITs; however, it is still below the peak average multiple of 17.8x.

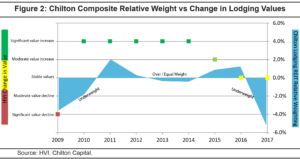

As shown in Figure 2, the hotel valuation index (or HVI), a measure of private hotel valuation) increased significantly (>10%) each year from 2010 to 2014 as a result of top line RevPAR growth and multiple expansion coming out of the recession. The Chilton REIT Composite maintained an overweight or equalweight allocation to lodging from 2011 to 2016, at which time we decided to look elsewhere for better value. Notably, while hotel values according to the HVI were stable in 2016 and 2017, the Bloomberg Lodging REIT Index increased by 33.7%.

There are only so many expenses that can be cut before revenues start to suffer due to poor quality and service. As a result of the slow revenue growth, the average lodging REIT has only been able to grow EBITDA per share by 2.5% per year, and AFFO per share by 2.6% per year over the past 3 years. Given the above average multiples, lodging REITs will need to demonstrate accelerating cash flow growth to generate outperformance going forward.

Opportunity Knocking?

The conclusion now would be that these stocks are even more overvalued than they were back in 2016 when the Chilton REIT Composite went underweight to lodging. However, the current valuation of lodging REITs may be justified if RevPAR were to re-accelerate. We might already be seeing early signs of an upward trend in demand that would justify the recent outperformance, and possibly position the sector for future outperformance.

Notably, 4Q17 RevPAR accelerated to +4.2% from +1.9% in 3Q17, the first acceleration in RevPAR since 2Q16, and prior to that, 3Q14. However, 4Q17 RevPAR was significantly impacted by the worst hurricane season since 2008, which contributed significantly to the outperformance. While 1Q18 was also strong at +3.5%, one must look at the more sustainable drivers of demand to see if the new trend is here to stay.

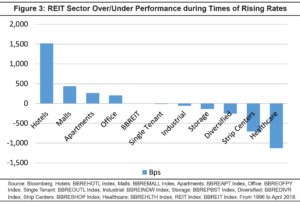

Historically, an improving economy marked by rising interest rates has been an indicator of future hotel outperformance (Figure 3). We could possibly be at the tipping point of one of these opportunities today. Spurred by the benefits of tax reform, the Federal Open Market Committee on March 21, 2018 stated, “the labor market has continued to strengthen and that economic activity has been rising at a moderate rate.” As a result, the committee announced the fifth rate hike since December 2016, raising the fed funds rate range to 1.5%-1.75%. As the short-end of the curve has moved up on the prospects of an improving economy, so has the long-end. This year, the 10 year US Treasury yield is up 59 bps to 2.99% as of April 26, 2018. Though the sector’s total return is slightly negative so far this year, hotels have continued to outpace the REIT sector by 700 bps.

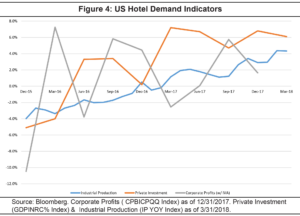

The demand indicators are looking up as well (Figure 4). Typically, hotel demand follows corporate spending, which is why some of the most important indicators for future demand are non-residential private investment, corporate profits, and industrial production. Each of the indicators has a correlation with hotel demand of 64% or higher going back to 2000. As of February 2018, demand growth remained above 3% on a year over year basis, 70 bps above the full year estimate. Foreign travelers, which make up 20% of hotel demand, could also drive incremental demand. As of April 20, 2018, the US Dollar was down 8% year over year versus a basket of foreign currencies, which would make a trip to the US relatively more affordable for foreign tourists. In addition, 2018 is expected to be the peak for new supply within the foreseeable future.

As a result of the positive and improving supply and demand picture, 2018 guidance may prove to be conservative, leading to guidance raises throughout the year. On April 9, 2018, Hilton announced preliminary 1Q 2018 results and increased their RevPAR expectations by 175 bps at the midpoint to 3.5% to 4.0%. Then on April 12th, Pebblebrook inadvertently pre-released a draft of 1Q results (which then led to an official “update” release). In the release, the company said improved business demand was much stronger than expected and concurrently increased their 1Q RevPAR guidance to (0.5%)-(0.25%), a 213 bps increase at the midpoint. If the speculation that there will be a reacceleration of RevPAR without having a ‘crash’ turns out to be correct, hotels could be one of the top performing sectors in 2018 and beyond.

Book Now!

We are incrementally positive on the lodging sector due to the potential for expanding demand and decelerating supply. The first quarter earnings season could reset future expectations for the entire lodging industry, which many had thought would experience the end of the cycle shortly. Readers may or may not have noticed, but AirBnB was not mentioned in any of the above analysis, and the lodging REITs were able to produce outsized returns over the past few years despite this ‘threat’ to traditional hotels. We refer any new readers to our October 2015 REIT Outlook titled, “AirBnB: Expanding the Definition of Lodging”, which summarized our thesis that it would have little effect on hotels.

Parker Rhea, prhea@chiltonreit.com, (713) 243-3211

Matthew R. Werner, CFA, mwerner@chiltonreit.com, (713) 243-3234

Bruce G. Garrison, CFA, bgarrison@chiltonreit.com, (713) 243-3233

Blane T. Cheatham, bcheatham@chiltonreit.com, (713) 243-3266

RMS: 1839 (3.31.2018) vs 2000 (12.31.2017) vs. 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/reit-outlook.html.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.