REITWeek Review | July 2018

July 1, 2018

The Chilton REIT Team recently attended the NAREIT REITWeek conference in New York City, where we met with over 50 REIT management teams in a one-on-one or small group setting. The conference was especially important this year due to the significant discounts to Net Asset Value (or NAV) at which many of them were trading. We came away from the conference reassured in the strength of the private market for high quality, well-located real estate, thereby increasing our confidence that REITs are generally mispriced. We believe the discounts will close as public REITs post positive cash flow and dividend growth, and select REITs will use strategic alternatives such as mergers, spinoffs, and share buybacks as catalysts to close the gap more quickly.

Office

We met with Columbia Property Trust (NYSE: CXP), Vornado (NYSE: VNO), Boston Properties (NYSE: BXP), Empire State Realty (NYSE: ESRT), JBG Smith (NYSE: JBGS), Corporate Office Properties (NYSE: OFC), and Kilroy Realty (NYSE: KRC). Development continues to be the key driver of value creation for the office REITs, as it has been increasingly difficult to achieve positive growth in net effective rents (rents after free rent and tenant improvement allowances) in most coastal markets. Fortunately, the transaction market is extremely healthy for well-located, well-leased assets, thereby creating an attractive environment for dispositions.

Therefore, we believe the appropriate strategy in today’s market given valuations below NAV is to sell properties, using the proceeds to invest in development, reduce leverage, and repurchase stock. As such, the Chilton Composite holdings (BXP, VNO, JBGS, ESRT, and KRC) have development pipelines that average 11% of assets, well above the 2% average for all REITs. Excluding ESRT, the average is closer to 14%! Due to their development capital, none of them have pursued a significant stock buyback program; however, our conversations at REITWeek encouraged us that they would prioritize such a strategy should the discount to NAV gap widen further.

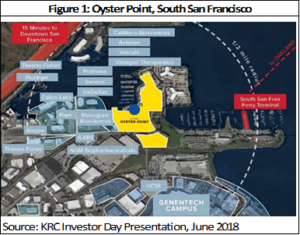

The most significant announcement at the conference came from Kilroy, which made public its purchase of Oyster Point, a $2.5 billion development opportunity in South San Francisco. On June 1, the company paid $308 million for 35 acres of land entitled for 2.5 million square feet (or sqft). As shown in Figure 1, the area is plentiful with life science tenants, making it one of the top life science ‘clusters’ in the country (close behind Cambridge, MA). However, rents lag Cambridge by almost 20%, leaving room for upside versus current projections. Using a stabilized yield of 7.5% and a market capitalization rate (or ‘cap rate) of 5%, the project could create over $12 per share in value, which compares to its stock price of $76.19 per share as of June 18, 2018.

Regional Malls

We met with Washington Prime Group (NYSE: WPG), Simon Property Group (NYSE: SPG), Macerich (NYSE: MAC), Taubman Centers (NYSE: TCO), Tanger Outlet Centers (NYSE: SKT), and Pennsylvania REIT (NYSE: PEI). At the November 2017 REITWorld conference, the regional mall sector was the hot topic due to the potential for mergers and acquisitions. Brookfield Property Partners (TSX: BPY) had recently made a bid for GGP (NYSE: GGP), and activists were swirling around TCO and MAC. Since then, GGP agreed to a revised offer from BPY, while MAC and TCO have made changes at the board level, and, in the case of MAC, changes to the CEO and COO. It remains to be seen if a transaction will occur with either of these companies, or among the lower quality mall REITs where the NAV discount is even deeper (30-50%!).

However, as a going concern, mall landlords are optimistic about their portfolios due to the positive tenant sales growth in 2018. Notably, MAC stated that their top 25 tenants have produced ‘low double digit’ sales growth through April. Stronger retailer tenant sales are also dramatically lowering the space lost due to tenant bankruptcy; TCO and MAC gave back about 90% less space in 1Q18 than 1Q17 due to bankruptcy. We were also happy to hear that Tanger has had very few requests for rent relief.

The other most-discussed topic was redevelopment, particularly in the boxes left by departing department stores. Though it can be time-consuming and costly, mall landlords are already seeing early fruit from their labor. According to WPG CEO Lou Conforti, the company has tripled the sales of the prior department store after replacing it with new tenants. WPG has lowered the number of department stores at its malls by 38% in the past three years, from 205 to 128. Importantly, co-tenancy clauses due to Sears (NYSE: SHLD) leaving a mall have not resulted in landlords witnessing a significant loss of rent from ‘in-line’ tenants. SPG COO Rick Sokolov stated that he views Sears only as ‘acreage’ which can be used for densification and redevelopment.

Apartments

We met with AvalonBay (NYSE: AVB), Equity Residential (NYSE: EQR), Essex (NYSE: ESS), Independence Realty (NYSE: IRT), and UDR (NYSE: UDR). In 2018, apartment fundamentals have surprised to the upside as REITs reported same store revenue growth (SSRev) that is tracking ahead of guidance due to strong renewal rate increases and higher occupancy. For example, UDR reported year-over-year rent growth through May 29 above 2017’s level, implying an acceleration in SSRev.

Supply continues to be a slight headwind for the sector, however. Many REIT management teams originally expected 2017 to be the peak of new supply for most markets, but construction delays have pushed the peak into 2018, and some even into 2019. Thus far, elevated levels of supply have been absorbed by the strong job market, which has limited the negative impact on revenue growth. However, we are closely monitoring construction starts and permits to assess the risk of over-supply. The risk is somewhat mitigated by rising construction costs, which should make future development increasingly difficult to pencil.

The potential repeal of Costa Hawkins, a California law that exempts housing constructed after 1995 from local rent control, was another common topic across our apartment meetings. Costa Hawkins will be put to a vote on the November ballot, and a repeal could have a material impact on apartment REITs with California exposure. However, it should be put in context. Currently, only 15 of 482 California municipalities have passed some version of rent control, despite it already being legal to do so. Additionally, most cities have chosen only to have restrictions on pre-1980s built housing even though the law allows for restrictions on newer units. Lastly, if repealed, there wouldn’t be blanket rent control across the state. Each individual municipality would still have to pass its own rent control ordinances. Many experts, including researchers from Berkeley, have argued that rent control is not the best solution for California’s housing crisis.

Self Storage

We met with Extra Space Storage (NYSE: EXR), Life Storage (NYSE: LSI), and Jernigan Capital (NYSE: JCAP). New supply has been the biggest focus for the sector. JCAP expects 400-460 new self storage facilities to be delivered in 2018, which compares to 352 in 2017 and 254 in 2016. Development yields are still in the 8-9% range, which compares to class A self storage cap rates around 5.5%. Therefore, it is too early to assume that new supply has peaked. The spread is still very attractive to merchant builders and, though banks are restrictive with self storage construction loans, companies such as JCAP have stepped in to help fund development.

The self storage sector has outperformed the benchmark this year through June 20 as investors have bought into the thesis that the self storage REITs should be able to maintain SSRev growth in line with the historical average of +3-4%. According to one REIT, many investors expected the sector would experience double digit negative growth. The operating results over the past few quarters have helped to alleviate these concerns, but new supply still remains a risk to maintaining positive growth. Unlike the apartment sector where new supply is typically leased up within a year, the average self storage property takes 3-4 years to stabilize. Thus, a storage facility would not only have to compete with a property built this year, but also with facilities built in 2016 and 2017.

In response to the growing competition, the REITs have focused on technology to maintain their advantage. LSI, in particular, has made some significant strides. One initiative is called Rent Now, which should enable customers to go through the entire rental process through their phone. This is squarely targeting Millennials and is currently in the testing phase. The other is Warehouse Anywhere, which focuses on corporate clients. The program enables customers to manage and store inventory at scale through LSI’s portfolio and through the use of Intelligent Logistic Solutions’ distribution technology (LSI purchased the assets of Intelligent Logistic Solutions in 2016).

Shopping Centers

We met with Retail Opportunity Investments Corp. (NYSE: ROIC), Urban Edge (NYSE: UE), Regency Centers (NYSE: REG), Retail Properties of America (NYSE: RPAI), Kite Realty (NYSE: KRG), Federal Realty (NYSE: FRT), DDR (NYSE: DDR), and Weingarten Realty (NYSE: WRI). While 2018 store closures and bankruptcies have been below 2017 closures, bankrupt tenants such as Southeastern Grocers and Toys R Us (Toys) continue to make headlines. Southeastern Grocers has already completed its bankruptcy restructuring with a limited impact (if any) on most of the REIT portfolios. In contrast, the Toys bankruptcy process has been disorganized, but most of the REITs we met with are already deep in conversations with potential backfill tenants for their Toys exposure. Some REITs have even won bids on their Toys leases to take advantage of the significant mark-to-market opportunity. For example, REG expects to bring in a dominant grocer and achieve a 75% rent increase in a former Toys space in Aventura, Florida.

The shopping center REITs have also been focused on closing the valuation gap between the public and private markets that has persisted for almost two years. For example, many REITs are selling non-core properties and reinvesting the proceeds into upgrading core properties. REG has commenced a stock repurchase program and others could soon follow. KRG is deleveraging its balance sheet toward ratios that are in-line with peers, while also enhancing its communication with investors. ROIC has chosen to implement a portfolio review to highlight its valuation discount. Historically, the company has been light on details of its development and redevelopment plans, but the company will release its findings in late 2Q 2018 or 3Q 2018. Lastly, DDR announced a spinoff of its lower growth assets into Retail Value Trust (NYSE: RVI), which will liquidate its portfolio over the next several years, thereby allowing investors to realize the public/private market arbitrage.

Based upon our analysis, we see growth in cash flow (or FFO) returning in 2019 and beyond for the shopping center sector. The re-acceleration in growth should push multiples higher from 13x 2019 FFO level toward the REIT average of 16x 2019 FFO as of June 22, 2018. Growth drivers include: the positive outlook of retail sales, improving merchandising mix at many centers, densification projects, and pad site development.

Data Centers

Despite their underperformance versus the benchmark year to date through June 20, 2018, the data center REIT CEOs were as upbeat as ever. For the third NAREIT conference in a row, we met with all five US data center REITs: Equinix (NASDAQ: EQIX), Digital Realty Trust (NYSE: DLR), CyrusOne (NASDAQ: CONE), CoreSite (NYSE: COR), and QTS Realty (NYSE: QTS). The main takeaway was that demand for carrier-neutral multi-tenant data centers remains robust, with non-tech Fortune 500 enterprises taking a larger percentage of space in the more mature US and UK markets, and global cloud service providers dominating leasing in continental Europe, the Middle East, and Asia.

Development remains a key driver for data center REITs, although the development yield on wholesale data centers has fallen from the low teens to the high single-digits over the past five years. However, this remains well above weighted average expected development yields for office (7%), industrial (7%), and multifamily (6.5%). REIT executives believe current yields are appropriate after considering long-term re-leasing and obsolescence risk, and therefore do not expect them to fall much further.

Our most positive meeting was with EQIX, who directly addressed investor concerns about its integration of the Verizon/Terremark portfolio and the high multiple it paid for the Dallas InfoMart. An unexpected first quarter moveout at Verizon’s flagship Miami facility offset growth at other Verizon assets, but management expects Miami to be a tailwind by the end of 2018 as EQIX will deliver new capacity there just as several new subsea fiber optic cables drive even more US-Latin American data traffic through the EQIX-dominated market. Management explained that focusing on the InfoMart’s in-place multiple ignored the property’s significant lease-up and development upside, which should make it accretive within a few years.

Industrial

Unsurprisingly, industrial REITs were the most universally positive of any sector at NAREIT. We met with EastGroup (NYSE: EGP), Liberty Property Trust (NYSE: LPT), Rexford Industrial (NYSE: REXR), Prologis (NYSE: PLD), Terreno (NYSE: TRNO), First Industrial (NYSE: FR), and Monmouth (NYSE: MNR). Each team was surprised at how little new supply they had seen this cycle, especially in New York/New Jersey, Southern California, the San Francisco Bay Area, Seattle, and Miami. They were excited about the prospects for M&A in the space, given the strong private equity bid for last-mile industrial warehouses and the PLD/DCT Industrial (NYSE: DCT) merger agreement at a premium valuation. All remained committed to low leverage and exiting non-core properties.

Of note, management teams ranked central Los Angeles as the submarket with the highest future rent growth, supporting our thesis on REXR. Among property sub-types, REITs were most positive about urban last mile, high-quality light industrial, and modern suburban big box segments, respectively.

2H 2018 REIT Outlook

We came back from New York with a positive view on the sector as a whole, reassured that the negative performance in the first two months of the year was merely a bet on interest rates, and not evident of any degradation in REIT fundamentals. The strength in the economy, supported by consumer and corporate spending increases thanks to tax reform, has begun to filter through to the tenants of the REITs, most notably in the retail and residential sectors. With the recent drop in the 10 yr US Treasury yield to 2.8%, we revise our total return outlook for the year to +4-6%, assuming a steady 10 yr US Treasury yield and further dividend increases as REITs deliver cash flow results above prior guidance over the next several quarters. This would imply a +3-5% total return in the second half of the year.

Parker Rhea, prhea@chiltonreit.com, (713) 243-3211

Matthew R. Werner, CFA, mwerner@chiltonreit.com, (713) 243-3234

Bruce G. Garrison, CFA, bgarrison@chiltonreit.com, (713) 243-3233

Blane T. Cheatham, bcheatham@chiltonreit.com, (713) 243-3266

RMS: 1839 (3.31.2018) vs 2000 (12.31.2017) vs. 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/reit-outlook.html.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.