REITs and Rates: The Trade That Works Until It Doesn’t | October 2018

October 1, 2018

Since we published our March 2018 REIT Outlook titled, “Equity REITs at Bargain Prices: An Asymmetric Opportunity,” on March 1, the FTSE NAREIT Equity REIT Index (Bloomberg: FNRE) has produced a total return of +14.1% through September 24. This compares to +8.8% for the S&P 500 (Bloomberg: SPX) over the same period. Interestingly, the 10 year Treasury yield has increasedfrom 2.9% to 3.1%. In fact, the 10 year Treasury yield is within four basis points (or bps) of a seven year high! In this report, we demonstrate that investor’s reliance on the 10 year Treasury yield as a predictor of future returns can be misleading.

The Fed Model

Originally referenced in a Federal Reserve paper from 1997, the ‘Fed Model’ states that the earnings yield of equities should track the 10 year Treasury yield over time.

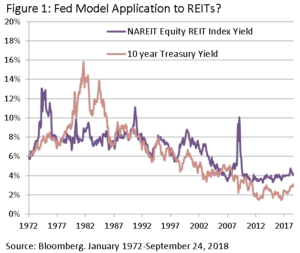

Because REITs are often thought of as a ‘yield alternative’, market participants have applied the same logic to the REIT dividend yield as it relates to the 10 year Treasury yield. Figure 1 shows that the FNRE dividend yield tracked the 10 year Treasury yield fairly well over certain periods – but not all periods.

From 1978 to June 2018, the monthly correlation of the FNRE yield and the 10 year Treasury yield was 77%, indicating a somewhat strong relationship. However, there are quite a few periods where the relationship breaks down, and even some where they move in the opposite direction! Recently, the FNRE yield was highly correlated with the 10 year Treasury yield from 2012-2017, but the correlation actually turned negative in 2011 and in 2018, among other periods.

Market participants have deemed the average ‘spread’ between the REIT dividend yield and the 10 year Treasury yield as the marker for ‘expensive’ or ‘inexpensive’ territory. The average spread since 1994 has been 127 bps, where approximately 54% of months had an above average spread and 46% of months had a below average spread.

As of September 24, 2018, this spread had declined from more than 200 bps earlier in the year to 112 bps, the lowest since 2014. Thus, subscribers to the Fed Model would also conclude that REITs are above fair value, and most certainly not at the “bargain prices” mentioned in the March 2018 REIT Outlook. So, should REIT investors be worried about future performance?

Does the Fed Model Work?

In 2015, the correlation between the FNRE total return and the US 10 year Treasury yield was -68% using daily data, meaning higher 10 year Treasury yields resulted in negative REIT performance. In comparison, the Barclays Aggregate Bond Index (Bloomberg: LBUSTRUU) and the S&P 500 had correlations of -90% and +22% with the 10 year Treasury yield, respectively. As a result of many years similar to 2015, REITs have been placed in the ‘yield alternative’ category, trading in similar patterns to fixed income and thus have been subject to speculation of price declines when long term interest rates are rising (or vice versa).

2011 and 2018 were not the only years when the Fed Model did not work, however. In fact, there have been five periods where the spread between the FNRE dividend yield and the US 10 year Treasury yield has been below the historical average since 1994. Each period lasted a minimum of 10 months, and the average period was 22 months, or almost two years! On average, these five periods produced an annualized total return of over 22% for REITs, a number that would cause many investors regret if they sold merely based on the spread crossing below the historical average. Through this publication on October 1, 2018, the spread has only been below the historical average for three months.

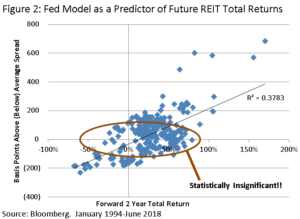

The mere observation of the spread versus a historical average is not a useful tool unless it helps to predict future performance. Figure 2 shows the forward two-year total returns of the FNRE versus the bps above or below the historical average spread. With a correlation over 60% and an r-squared of almost 40%, the relationship appears to be significant. The chart shows that more periods where the spread was positive produced positive total returns, and vice versa.

However, the relationship was only significant when the spread was extremely wide, while it was insignificant when the spread was within 100 bps of the average. In fact, the correlation for periods where the spread was greater than 100 bps from the average was over 80% since 1994, while the correlation drops negative 4% for periods where the spread was within 100 bps. Therefore, we concede that the Fed Model can work, but only in extreme scenarios. With the spread only 15 bps below the historical average as of September 24, we would argue that the Fed Model is ineffective.

Factor Analysis

The expectation that a spread should return to some historical average may work for fixed income, but REITs are similar to equities in that earnings and dividends can grow (or shrink). Thus, the REIT dividend yield spread can function similar to a price to earnings ratio (or P/E). Intuitively, the P/E ratio should be higher when earnings are growing faster and vice versa. Similarly, the yield spread should be lower when dividends are growing faster, and higher if the opposite is happening. Some of the data we can observe to determine the direction of dividend growth would be payout ratio, cash flow growth, availability of capital, and capital needs.

In contrast to a P/E ratio, there is another variable needed for the yield spread: the expected change in the 10 year Treasury yield. The expectation of an increasing yield would imply a higher spread while the expectation of a decreasing yield would imply a lower spread. Some of the data that would indicate the direction of the 10 year Treasury yield would be inflation expectations, economic growth, and Federal Reserve monetary policy.

Fundamental Factors

REITs have been able to grow dividends well beyond the rate of inflation historically. However, dividend growth has varied in the cycle based on several factors, but principally from the growth in cash flow. As such, the correlation between dividend growth and cash flow growth, as measured by Funds From Operations (or FFO), from March 2000 to June 2018 is 50%. That was the strongest relationship that we were able to find between the spread and fundamentals. We would’ve expected the relationship to be even stronger, but a dramatic change in dividend policy over the past 20 years has dampened the correlation.

Based upon our observation of REITs since 1972, the ‘ideal’ payout ratio has changed from “whatever is needed to attract yield investors” to a more sophisticated model. As REITs gained acceptance from institutions into the late 1990s and 2000s, preferences shifted to a lower risk profile, which included a reduction in leverage and payout ratios. The new ideal payout ratio enhances predictability of future growth of dividends, and free cash flow that provides an additional capital source.

One of the oft-stated criticisms of REITs from generalist investors is that they must constantly tap the equity market. Unless there are dispositions to match future capital needs, the ability to use free cash flow after dividend payments can be a significant help to meet funding goals without having to tap the equity markets or increase leverage. While the correlation between ‘net acquisitions’ by REITs and dividend growth is low at only +31% from March 2000 to June 2018, we believe that it also can be attributed to the decline in payout ratios. Now that REIT dividends are getting closer to taxable net income, payout ratios have likely reached a floor. Going forward, we anticipate an environment with low net acquisitions to lead to higher dividend growth, holding all other variables constant.

Finally, the availability of capital can have a significant influence on dividend growth, at least in the short term. As we have seen in the past, the availability of capital can change quickly. Most notably, the Great Recession caused the availability of capital to disappear completely, even for the most highly rated REITs, causing many to cut dividends, or pay the dividend in equity, in order to retain as much capital as possible. We believe REITs should maintain payout ratios that will withstand a similar downturn in the future and thus should not make dividend increase decisions based on positive environments for raising capital; however, a functioning capital market is a minimum requirement for a dividend raise.

Economic Factors

In addition to speculating on the direction and amplitude of dividend growth, investors may also be speculating on the future changes in the 10 year Treasury yield when the spread is changing. For example, a wider than average spread could indicate the expectation of a higher 10 year Treasury yield, and vice versa. Predicting changes in the 10 year Treasury yield has proven difficult, but market participants often cite economic growth, inflation, and Fed policy.

The correlations between the dividend yield spread and the above mentioned economic measures are surprisingly high. The most powerful predictor of the yield spread has been the ‘Effective Federal Funds Rate’, which is managed by the Federal Reserve via monetary policy. With a correlation of -80% from 1978 to June 2018, this indicates that Fed tightening or easing has had the opposite effect on the spread. Therefore, while tightening may have had an effect on the 10 year Treasury yield (93% correlation over the same period), the REIT yield did not adjust in-line with the 10 year Treasury yield, causing the the spread to compress.

Both real and nominal GDP growth had significantly less correlation to the historical yield spread, with nominal GDP growth producing a -43% correlation and real GDP growth producing only a -22% correlation from 1978 to March 2018. The higher correlation for nominal GDP would indicate that inflation is having a larger influence than actual economic growth.

Accordingly, the correlation between the dividend yield spread and the University of Michigan one year inflation expectation index has been -53% since 1978. This is good news for those looking at REITs as an inflation hedge. Practically speaking, REIT income and property values should increase as a result of higher costs, which will should drive dividend growth and thus a lower spread.

A Key Flaw

One issue with something as simplistic as dividend yield spreads is that dividends do not have to be directly related to earnings power. REITs are required to payout at least 90% of taxable net income as dividends to satisfy IRS requirements, but equity REITs have the option of a dividend policy based upon cash flow that typically is considerably higher than net income.

For instance, a REIT may elect to pay out 100% of cash flow as dividends in an attempt to attract yield-oriented investors or simply because it does not have any other use for the free cash flow. Consequently, dividend growth in the future could be lower without the excess cash flow. In contrast, another REIT may decide to pay out only 65% of cash flow (but at least 90% of taxable net income) as dividends due to a variety of capital needs such as debt repayment or to fund an acquisition. The lower payout ratio provides ‘retained earnings’ and will likely contribute to higher future dividend growth. This is the most misunderstood aspect of equity REITs, but it is one of the most positive attributes utilized by REITs to generate a growing dividend stream.

“…if investors would like to use the yield spread as a predictor of REIT total returns, then they should be using the adjustedhistorical average of 76 bps instead of 127 bps. In this case, REITs would still be undervalued by 9.5%!”

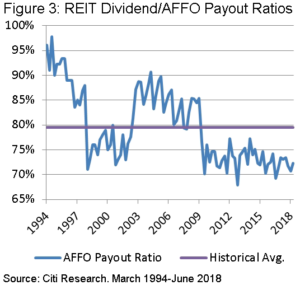

Therefore, because dividend yield can be manipulated, the historical average spread makes comparisons between periods difficult. In fact, when looking back at periods in the past when the dividend yield spread was higher, REITs employed much higher payout ratios. As shown in Figure 3, the dividend/AFFO (or Adjusted Funds from Operations) payout ratio has averaged 80% from the start of the modern REIT era in 1994 to June 2018, and averaged 90% from 1994 to 1997. Those high payout ratios contrast to the 72% payout ratio as of June 30, 2018.

We can adjust the historical payout ratios to the 72% employed today to make an ‘apples-to-apples’ comparison of today’s yield spread to the historical spread. Our calculated historical comparabledividend yield spread average is actually 76 bps, instead of the 127 bps used in the Fed Model. Therefore, the current yield spread of 112 bps screens attractiveversus the historical comparable yield spread, implying there is another 36 bps of potential dividend yield decline (or US 10 year Treasury yield increase) to reach the comparable historical average. For illustration purposes, a 36 bps decline in the REIT dividend yield would result in a 9.5% increase in REIT prices, holding all other variables constant.

Not a Total Return Predictor

The dividend yield spread has not been a consistent predictor of future REIT total returns, except in extreme scenarios. We also believe that predicting future REIT total returns based on changes in the 10 year Treasury yield can lead investors astray due to the ability for the spread to change. In fact, the 10 year Treasury yield had a negative 84% correlation with the dividend yield spread from 1978 to June 2018, indicating that the spread compresses when long term interest rates are rising.

Furthermore, predicting near term REIT total returns based on a reversion to the historical average yield spread is flawed due to the ability to manipulate payout ratios. In fact, when we adjust the dividend yields to a constant payout ratio, the correlation between the yield spread with the 10 year Treasury yield changes from -36% to -60% from1994 to June 2018, indicating a much stronger relationship. In other words, if investors would like to use the yield spread as a predictor of REIT total returns, then they should be using the adjusted historical average of 76 bps instead of 127 bps. In this case, REITs would still be undervalued by 9.5%!

We would warn those using the Fed Model that this could be an extended period of below average yield spreads. Dividend payout ratios are near all-time lows, the capital markets are wide open, REITs are making very few net acquisitions, and cash flow is growing at a mid-single digit pace. While the other indicators may be predicting a rise in the 10 year US Treasury yield, it is our confidence in the REIT fundamentals that allows us to remain positive on near term REIT performance. And, per our research above, the spread has historically contracted when the economy is growing and inflation is increasing.

Parker Rhea, prhea@chiltonreit.com, (713) 243-3211

Matthew R. Werner, CFA, mwerner@chiltonreit.com, (713) 243-3234

Bruce G. Garrison, CFA, bgarrison@chiltonreit.com, (713) 243-3233

Blane T. Cheatham, bcheatham@chiltonreit.com, (713) 243-3266

RMS: 1839 (3.31.2018) vs 2000 (12.31.2017) vs. 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/reit-outlook.html.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.