What to Do in a Global Pandemic and Looming Recession | May 2020

May 1, 2020

While we have never been through an experience such as this, we do know that the first thing to NOT do is panic. Since the outbreak of COVID-19 and its devastating impact on the US economy, our research has focused on first making a determination of the best ideas in sectors that can withstand a prolonged economic downturn and secondly, on the shape and timing of an eventual recovery. In addition to the impact on our daily lives, the virus has created unprecedented disruption in many economic sectors such as airlines, lodging, and retail (including retail real estate). Whereas these sectors would certainly have been hit hard in a typical recession, the virus has made it impossible for consumers and businesses to support these industries even if they have the capacity to do so, magnifying the effects well beyond any recession, and even calling into question what a rebound would look like.

It is for this reason that we’ve had to ‘throw out the book’ on how to invest in REITs during a recession and instead think ‘outside the box’ on who the winners and losers will be, and what prices we would be willing to pay for each. As such, we have been having conversations with people on all sides of the business, including tenants, brokers, private owners, public owners, economists, and consultants. Thus far, our highest conviction conclusion is that there will be uncertainty for an extended period.

However, our ‘ear to the ground’ research has begun to shape some opinions surrounding key debates that will influence our stock selection. These debates include: is it a V-shaped recovery or a U-shaped recovery? Which companies are defensive (play for a U-shaped recovery) and which companies are offensive (play for a V-shaped recovery)? What effect will the economic shutdown have on federal, state, and local balance sheets, and how will that manifest itself in commercial real estate cash flows and valuations?

Before revealing our opinions, we want to remind investors that equity REITs comprise over 15 different property sectors, and the differentiation among these is the most pronounced in history. Navigating what could be profound changes in consumer behavior, changes in the workplace, and increased government intervention creates ambiguity and necessitates multiple forecast scenarios.

And, as our focus in research has been on the risks to the recovery, we want to make sure that investors are differentiating between general commercial real estate risk and stock specific risk, as we can diversify away the stock specific risk or avoid it entirely. Furthermore, valuation is the ultimately equalizer, meaning many of the risks may already be factored into current prices given the -21.0% year to date total return of the MSCI US REIT Index (Bloomberg: RMZ) as of April 30. If investors focus too much on the risks, they could easily miss attractive entry points for certain REITs that are enjoying positive fundamentals. In this outlook, we present some early observations and forecasts that we believe will adequately protect our clients’ investments during this period of uncertainty while also providing attractive upside under the backdrop of highly discounted valuations.

State of the Union

As of May 1, all schools, most businesses, and all ‘non-essential’ retail are shutdown. ‘Work from Home’ has forced employees to establish new workflow processes, conference calls have skyrocketed, and parents have had to become teachers. Those businesses that have been unable to produce revenue have had to layoff workers at an unprecedented rate. In fact, from March 21 to April 25, there were over 30 million unemployment claims, an all-time record. This compares to the 2nd largest six week total unemployment claims of less than 5 million in January 2009.

Believers in a V-shaped economy are hoping that a re-opening of the economy will result in the re-hiring of most of these workers quickly, thus bringing back the economy to its pre-recession highs within a few quarters. However, we contend that V-believers are underestimating the duration of the economic impact of the changes in consumer habits. We do not believe people will resume their historical habits until there is a cure, vaccine, or widespread testing. As this could be months from now at best, we believe our consumer-led economy will be dealing with demand shocks across most property sectors, high unemployment rates, and reduced retail sales for an extended period.

To date, ample evidence exists that people want a return of normalcy when it is safe, so we are leaning heavily toward the belief that we should experience a U-shaped recovery that will take until 2022 to get back to levels witnessed in 2019. To combat the effects of business contraction, the government has launched an unprecedented stimulus program, now totaling over $2.8 trillion. We think this is ample to prop up the economy for a quarter or two, but again we do not think it will save businesses that will suffer due to permanent consumer behavior changes.

In addition, we are worried about the long term effects of our national debt exceeding GDP for the first time since World War II. While it may help real estate in the near term due to the need for low interest rates for an indefinite period, there are numerous examples of long-lasting economic issues from running national debt above GDP for an extended period.

Furthermore, we are worried about the financial condition of state and local governments experiencing enormous declines in tax revenue due to reduced sales tax collections and what could be declining property taxes as investors demand higher returns (in the form of lower valuations) to compensate for increasing risks. We will be diligent in watching for heavy-handed hikes in property tax rates and/or intervention into commercial property operations by mandating such things as rent moratoria or rent control.

Observations by Property Type

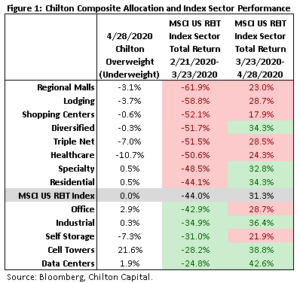

With the above assumptions underlying our conversations and analyses of the REITs in each sector, we present below some of our observations that are beginning to show which companies are defensive and which are offensive. As shown in Figure 1, some sectors outperformed in both the offensive and defensive periods, for which all three were overweights in the Chilton REIT Composite.

Residential

Residential REITs in the RMZ have produced a total return of -25.0% from February 21 to April 28. Overall, the sector is characterized by healthy balance sheets and conservative payout ratios. However, this is not without exception. The underperformers in the sector include Apartment Investment Trust (NYSE: AIV), which has elevated leverage at 7.6x debt/EBITDA, and Independence Realty Trust (NYSE: IRT), which has an 8.9x debt/EBITDA ratio and a dividend that is not covered by recurring cash flow. The average debt/EBITDA for residential REITs as of December 31, 2019 was 5.5x and the average payout ratio was below 75%.

For the high quality residential REITs, the capital markets remain open, although at slightly widened spreads. Of note, Camden Property Trust (NYSE: CPT) issued a $750 million 10 year bond in April at a 2.80% coupon. This compares to a $600 million bond that CPT issued in June 2019 at 3.15%. April rent collections came in well above expectations and are in excess of 90%, but May and June collections will be a key indicator of how resilient the sector is amidst unprecedented job losses. Notably, class A owners such as CPT reported rent collection of 94%, while IRT reported collections of only 89%.

Although ‘essential’ in nature, the residential sector is not without risks. Robust development pipelines, loss of pricing power and rent growth, bad debt, and potential rent control legislature are all risks the sector is facing. As of April 28, residential REITs trade at an average 5.2% implied cap rate, which compares to the 2-year average of 4.9% prior to February 21, 2020, meaning they are priced about 6% below the previous 2 year average valuation.

Retail

Shopping center, mall, and triple net (mostly freestanding retail) REITs have been among the hardest hit since February 21, 2020, and rightly so. Retail landlords have faced dramatic issues since the COVID-19 pandemic came to the United States. Both anchor and small shop tenants have been forced to close their doors temporarily and as such have resisted paying rent. Rent deferral may turn into bad debt at some point in the future. If one thing is certain, the declines in year over year cash flow will be pervasive. How deep of a decline? Current estimates range from -60% to -10%; the wide range reflects the high level of uncertainty in the space. Most shopping center REITs will likely cut their dividends as payout ratios will exceed 100% in the coming quarters. All mall REITs except for Simon Property Group (NYSE: SPG) have already cut their dividend. Triple net REITs have yet to cut dividends, though we would expect cuts as well if their tenants are still closed in June.

However, the unique tenant profile and property portfolio of each retail REIT create the possibility to find opportunity. Retail REITs with ‘essential’ tenants and those poised to resume to ‘business as usual’ as governmental restrictions ease are set up to outperform. Leverage profiles among retail REITs differ significantly, and could force some REITs to recapitalize via dilutive equity raises at inopportune prices, while others could use their balance sheet strength to take advantage of the dislocation.

Valuation metrics using 2020Q2-2020Q4 data are essentially meaningless given the low rent collection. For the sake of comparability, we are using 2020Q1 annualized net operating income (or NOI) for our implied cap rate estimates. As of April 28, average implied cap rates are in excess of 7.8%, which compares to the trailing three year average of 6.2%.

Risks to the sector cannot be understated. Changes in consumer behavior and the proliferation of online shopping, collections of current rent, tenant bankruptcies, extended vacancies, weakened pricing power, releasing costs, and the duration of social distancing all pose significant near term and long term risks to retail real estate.

Lodging

Lodging REITs in the RMZ have fallen -47.0% from their high on February 21, 2020 through April 28. Dividends across the sector have essentially been eliminated. The shock to hotel operators is unprecedented with Revenue per Available Room (or RevPAR) down -80% in recent weeks and many properties temporarily closed.

The hotel business is mainly comprised of three segments: leisure, business, and group. Visibility with respect to when each segment will return is minimal. Each segment is uniquely affected by the individual consumer, overall economy, propensity to travel, proliferation of ‘e-meetings’, and the return of mass gatherings.

Leverage and liquidity varies across the sector, but no names are so highly levered to be in immediate danger of bankruptcy, especially after freeing up liquidity through dividend cuts. Only one name, Hersha Hospitality (NYSE: HT) has suspended payments of its preferred dividend. Host Hotels (NYSE: HST) and Sunstone Hotels (NYSE: SHO) have significantly stronger balance sheets and more liquidity than their peers, and as a result have outperformed their peers by a over 2000 basis points (or bps) from February 21 to April 28.

However, they are in no better position to have revenues return quicker than their peers. Further, once travel does return, we expect it to be gradual. Until travel and occupancy return to stabilized levels, average daily rates will feel downward pressure. Investing in lodging REITs certainly feels like ‘flying blind’ amidst the current environment.

Cell Towers

The cell tower sector, an oligopoly comprised of American Tower (NYSE: AMT), SBA Communications (NASDAQ: SBAC), and Crown Castle Corp (NYSE: CCI), is our largest sector allocation at 20.8% as of April 28 and produced a roughly flat total return from February 21 to April 28. The three companies performed defensively as they benefited from long term tenant contracts and steadily growing demand for mobile data on the networks their infrastructure supports.

Moreover, the market is also beginning to appreciate and get more clarity of the immense investment coming as the world approaches the 5G network standard. T-Mobile (NASDAQ: TMUS) and Sprint, officially closed their merger on April 1, allowing them to begin 5G investment alongside AT&T (NYSE: T) and Verizon (NYSE: VZ). In addition, as a requirement from the Justice Department, Dish Network (NASDAQ: DISH) will enter the market as a fourth player with a legal obligation to build out nationwide network covering at least 70% of the population by 2023 (likely with the help of a partner).

Their relatively low dividend yields of 1.8% as of April 28 on average are supported by the high-single digit to low double-digit growth and payout ratios of only 50%. Leverage, at about one turn above the market, does not trouble investors given the contractual nature of their cash flows to investment grade tenants. With such superior businesses and low risk, how could there possibly be any consternation about the group? Valuation. The group trades at about 29.8x funds from operations (or FFO) as of April 28, which compared to its long-term average of 22.8x and all-time high of 32.6x. We believe this premium valuation is warranted because the predictability of tower cash flows has increased significantly with the closing of the Sprint T-Mobile merger and because interest rates are at all-time lows.

Data Centers

Data centers comprised 15.0% of the Chilton REIT Composite as of April 28, and were the best performing sector from February 21 to April 28, producing a total return of +7.3%. Thus far, two data center REITs have reported 2020Q1 earnings, and both were able to maintain 2020 guidance. In addition to the resilience of current cash flows as the digital backbone of companies has become truly essential, the need to work remotely has increased data usage, which should lead to higher than expected leasing for the REITs. According to Akamai Technologies (NASDAQ: AKAM), global internet traffic rose 30% between March and February, which compares to the historical month-over-month growth rate of about 3%. Comcast (NASDAQ: CMCSA) also cited a 33% increase in upstream traffic and a 13% increase in downstream traffic on its network since March 1.

The group is appropriately leveraged at 6.2x net debt to EBITDA compared to the REIT Index at 5.6x, especially considering their long-term recurring revenue. Therefore, they have adequate access to the capital markets. Although the blended dividend yield is only 2.1%, the average payout ratio is only 53% compared to the REIT universe at 76%. Consequently, the current dividend is extremely safe and we feel extremely confident in a long runway for growth. Long term risks to the sector are valuation, potential oversupply, and large tenant bargaining power (e.g. hyperscale tenants such as AWS and Google).

Office

The office sector made up about 15.4% of the composite as of April 28 (versus an index weight of 11.9%), and declined -26.5% from February 21 to April 28. At first glance, many investors would say a decline inline with the REIT index sounds about right. After all, the sector is highly sensitive to job growth, slightly more leveraged than the market at 7.3x net debt to EBITDA versus 5.6x, and the uncertainty of future behavior with respect to working from home. However, we would argue valuations are now in-line with market at 14.2x FFO, a 4% dividend yield at a reasonable 83% dividend payout ratio (market at 76%), and long-term leases from quality corporate tenants.

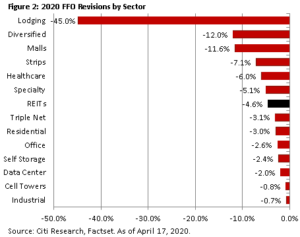

The long term leases have kept the sector’s YTD earnings revisions relatively modest at about -2.6% in 2020, which compared to all REITs at -4.6% in both years (see Figure 2). In terms of rent collection, early expectations are for about a 10% decline from March to April. Within the sector, the winners have been mostly those with tenant exposure to the government (Corporate Office Properties (NYSE: OFC) and Easterly Government Properties (NYSE: DEA)), TAMI (technology, advertising, media, and information), and life science (Alexandria Real Estate (NYSE: ARE)). The losers have been overleveraged, New York exposed companies such as SL Green Realty (NYSE: SLG), which we sold in March, and Vornado Realty (NYSE: VNO), which we sold in February 2019. We see risks mostly tied to anticipated vacancies and unleased development, as new leasing has already slowed significantly. In addition, companies are finding ways to make do with work from home, which will undoubtedly lead to some permanent changes. This should be somewhat balanced by an ‘un-densification’ for office-goers in an effort to avoid spreading of viruses in the future.

Healthcare

Healthcare, the sector at the epicenter of the COVID-10 pandemic, was unrepresented in the Chilton REIT portfolio due primarily to our discomfort with its valuation premium and oversupply in senior housing in the years leading up to this most unfortunate outbreak. Historically an economically insensitive group, it was down -38.6% from February 21 to April 28, underperforming the index by over 1,300 bps. So far this year, analysts have revised the sector’s earnings by -6% in 2020 as they assess the impact COVID-19 will have on senior housing and skilled nursing, which comprises over half of the sector’s exposure. Since the elderly demographic and the less healthy skilled nursing patients are the most vulnerable to the coronavirus, there is considerable uncertainty regarding how low occupancy levels will decline.

We expect that the triple-net senior housing REITs will have to give deferrals as some rent coverages will become unsustainably low. Even high-quality senior housing companies like Welltower (NYSE: WELL) and Ventas (NYSE: VTR) have removed their 2020 guidance. The better performers have come from the more defensive medical office buildings (or MOB) and life science.

All of this has yielded a sector trading at 11.1x FFO as of April 28, which compares to the RMZ at 14.5x and healthcare’s long term average of 12.4x. While the dividend yield on the group is a tempting 7%, we caution that some dividends levels are at risk with a sector-wide 96% payout ratio. Three companies among the highest payout ratios that also have significant exposure to senior housing are WELL, VTR, and Healthpeak (NYSE: PEAK) at 102%, 106%, and 101%, respectively. Long term, the secular backdrop for these companies is very ‘healthy’ as aging demographics as well as products and services that are a necessity will likely overcome any near-term fear of outbreaks.

Self Storage

Self storage has been a place to hide, producing a total return of -15.9% from February 21 to April 28. We own no companies in this sector. Performance within the sector has been relatively tight among the four largest companies, and rightly so given similar leverage on all but Public Storage (NYSE: PSA), which remains one of the lowest levered REITs at only 1.0x net debt/EBITDA. Development is not significant for any of the companies and the shutdown has made it less likely that someone would decide to move things from a facility. However, it has also significantly slowed move-ins, which has caused many operators to drop rates, especially in the face of elevated supply. Furthermore, the sector has historically been resilient due to the four D’s of demand: Dislocation, Divorce, Death, and Downsizing. A ‘shelter in place’ may not cause a significant increase in these things, so demand may differ from historical recessions. At the same time, the sector is trading at 18.0x FFO as of April 28, which compares to the REIT average of 14.5x.

Industrial

Finally, industrial REITs have also outperformed the index, producing a total return of -11.2% from February 21 to April 28. Our portfolio weight is 13.4% as of April 28 versus the index weight of 13.0%. We believe these companies are positioned to benefit from the rapid shift to on line retailing that requires more supporting infrastructure and, longer term, this pandemic has shown the flaws in the ‘just in time’ supply chain that has resulted in shortages in many products. Moreover, we see more manufacturing returning to the US in the years to come. Performance within the sector has surprisingly varied despite widespread high quality balance sheets and low payout ratios. Prologis (NYSE: PLD) leads the pack since the peak, while Rexford (NYSE: REXR) trails given its concentration in Los Angeles and the potential for reduced demand due to less shipping container business in the LA/Long Beach ports. We believe the stratification of returns in the sector has created opportunities to invest in several companies that have defensive qualities, but we are watching carefully the supply picture as this property type could easily get overbuilt due to its current popularity among all investors.

Where Are We Headed?

Given that the portfolio has outperformed the index by 788 bps YTD despite not planning for a global epidemic or recession, we believe our process of finding companies with the best risk-adjusted reward gives us the ability to outperform in any environment. As shown above, we aren’t quite sure what the world will look like for the rest of 2020, but at a minimum have identified the direction and sectors we believe offer the best risk-adjusted returns. We strongly believe our process of finding defensive names at a reasonable price will prevail for the short to intermediate term until we have passed bottom of the economic fallout from the virus.

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

Richard J. Pickert, CFA

rpickert@chiltonreit.com

(713) 243-3211

Jonathan S. Rosen

jrosen@chiltonreit.com

(713) 243-3266

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

RMS: 1898 (4.30.2020) vs 2402 (12.31.2019) vs 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.