Essential REIT Evaluation: Self Storage | October 2020

October 2, 2020

The essentialness of self storage has been in doubt many times in the past due to its lack of institutional owners and widespread professional management. However, it’s stability in the Global Financial Crisis (or GFC) cemented its status as a defensive property type that can protect revenue losses in a recession, in spite of the short term nature of its leases. What surprised many market participants was what happened in the ten years following the GFC. Somehow, self storage had very little net operating income (or NOI) decline in 2008-2009, THEN was able to also lead same store NOI growth during the expansion phase that followed!

The result of the ‘newfound’ appreciation for self storage fundamentals in the 2008-2020 period has been record transaction prices per square foot driven by declining capitalization rates and leading NOI growth. With the secret out, however, supply was finally beginning to catch up with demand for the past few years, bringing NOI growth back in-line with the REIT average, even going negative in late 2019. As a result, it was the second-worst sector in 2019 by total return, beating out only regional malls, and trailing the MSCI US REIT Index by 1200 basis points (or bps).

The 2020 recession and ensuing ‘new cycle’ has once again made self storage a darling of the REIT universe. The cycle reset has delayed, or perhaps permanently cancelled, many self storage construction projects, bringing down the near term supply expectations. In addition, driven by several COVID-related effects on the four D’s of demand (death, dislocation, downsizing, and divorce), demand has picked up considerably. With the self storage sector now comprising over 7.6% of the MSCI US REIT Index as of September 30, 2020, which is more than shopping centers and regional malls combined, the sector is finally receiving recognition for its past and future essentialness. Within the Chilton REIT Strategy, our only concern is valuation, which we will compare to the other property types that we have reviewed over the past several months.

Pre-COVID

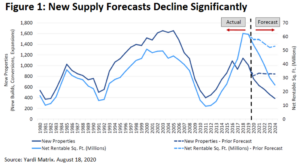

Going into 2020, self storage was in a supply and demand imbalance. Despite being able to post ‘decent; same store NOI numbers in the last few years of the prior cycle, there were not any discernable catalysts for a reacceleration of growth given the competition from new construction in lease-up aggressively cutting rents in favor of occupancy growth. Furthermore, the supply picture was only getting worse. As shown in Figure 1, industry research group Yardi Matrix expected that 2020-2024 new construction deliveries would be within 10% of the 2018 peak (dotted light blue line).

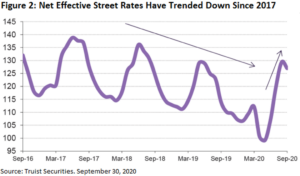

Demand was strong, but not strong enough to compensate for the high supply. However, the REITs used their superior resources to institute complex revenue driving and expense saving programs that facilitated cash flow growth in the face of seemingly negative fundamentals. One of the key drivers of future NOI growth is the ‘street rate’ or the advertised rental rate for move-ins. According to Truist Securities, net effective street rates were down in 2018 and 2019, and showing new lows even before COVID. As shown in Figure 2, it was remarkable that the REITs were able to grow same store NOI in the face of such sharp declines in street rates over the past several years.

The phenomenon that may not be fully appreciated about self storage is that, despite the one-month length of leases, the average tenant stays 14 months. As a result, only 7% of tenants are rolling into the ‘street rate’ each month. Further complicating the forecasting of net operating income for a self storage REIT, it depends heavily on what rent the vacating tenants were paying. For example, approximately 25% of tenants stay for three years or longer. In a three year period, a tenant may receive four or more rent increases, making the ‘mark to market’ on the rent on that unit wider than a tenant that stayed less than a year (approximately 54% of tenants stay less than a year). While it is impossible to accurately predict same store NOI growth even when given street rates, concessions (e.g. first month free), and move-ins versus vacates, a long period of declining street rates should eventually result in lower, or negative, same store NOI growth. Over a short period, the rent increases on renewing tenants and the lack of vacating tenants can offset the negative mark to market on the small percentage of vacating tenants.

As shown in Figure 2, street rent growth was negative for much of 2019 and the supply and demand picture appeared to be worsening going into 2020. As a result, the average self storage REIT guided to 2020 same store NOI growth of just 0.8% and two of the three REITs included negative same store growth as a possibility (Public Storage (NYSE: PSA) does not provide guidance).

Going into COVID, the average self storage REIT had a debt to gross asset value of 16% and a net debt to EBITDA ratio of 2.8x, which compared to the REIT averages of 32% and 5.4x, respectively. Similarly, despite average annualized dividend increases of 3.8% in 2019, the average dividend payout ratio as a percent of 2021 funds from operations (or FFO) was 69% as of December 31, 2019, which compared to the REIT average of 65%. When adjusting for maintenance capital expenditures and non-cash items, the dividend payout ratio as a percent of 2021 AFFO for storage REITs was 76%, which compared favorably to the REIT average of 76%.

We believe the defensive balance sheets, average payout ratios, and the resilience in 2008-2009 drove strong performance from December 31, 2019 to the COVID bottom on March 21, 2020, even though fundamentals did not appear to be supportive of outperformance. Referring once again to Figure 2, street rates dropped precipitously as COVID began to hit. The Bloomberg REIT Self Storage Index (Bloomberg: BBREPBST) produced a total return of -22.5% during the period, which compared to -37.7% for the MSCI REIT Index.

COVID’s Effect on the Four D’s

Dislocation has historically benefited self storage during natural disasters such as floods, hurricanes, and earthquakes. While COVID was different in terms of property destruction, it did change people’s locations, and this time it wasn’t restricted to a particular locale; it was nationwide! The initial benefits manifested in the form of college students going home early, therefore pulling forward the typical summer demand (and increasing their length of stay). As other businesses were forced to close, including bars, restaurants, and event spaces, more self storage space was needed to protect items until they could re-open. This allowed occupancy to remain high throughout the spring, though the massive job losses made owners hesitant to push rates.

Though some were also subject to eviction moratoriums in some areas, which drove down collections, the overall rent collections for self storage REITs never fell below 97%, and were back to normal by the end of the second quarter. For example, Life Storage (NYSE: LSI), which has little California exposure, collected 99% of its historical average for the second quarter.

In addition to a pull-forward of demand and some potentially short term demand from business closures, COVID has also created potentially longer lasting changes that affect the four D’s of demand.

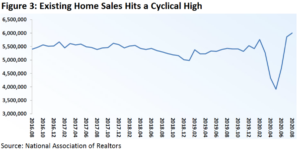

First, as mentioned above, ‘dislocation’ is usually the result of job losses or natural disasters. In the case of COVID, people are moving at a record pace, regardless of whether or not they have kept a job. The ability and acceptance of ‘work from home’ thanks to technology has inspired people to change cities, move to the suburbs, or buy a secondary home. This has driven existing home sales to a cyclical high, as shown in Figure 3. Although we won’t get the data on how many people moved in 2020 for another year, real estate technology company Redfin stated that searches on its website for houses outside of a person’s metro area hit a record high in the second quarter since they began tracking the statistic. Self storage typically serves to fill any gap in time between selling and buying a house, along with housing items that may not ‘fit’ (aesthetically or physically) in a new location.

Second, Americans are renovating their current houses more than ever as they have been spending more time than ever inside them. According to Houzz, an online home remodeling website, requests for contractor remodeling services were up 58% in June 2020 versus June 2019. When doing a home renovation, residents have to ‘downsize’, moving furniture and other items out of the rooms or floors that are being renovated. If the entire house is being renovated, the self storage REITs benefit further from the dislocation. Similarly, many have had to turn guestrooms or other rooms into temporary (or permanent?) home offices, which can often require an external self storage space for the room’s previous contents.

Explicitly linking death and profits feels a bit slimy, but self storage facilities play an important role in handling and organizing estates. Though the overall mortality rate of COVID appears somewhat low, it is high in senior citizens. According to the CDC, there have been more than 200,000 ‘excess deaths’ in 2020 through August, or deaths beyond what was expected. Albeit temporary, this is helping to drive demand in 2020.

Finally, we suspect that divorces could increase as a result of COVID and the recession. Therapists and divorce attorneys have warned of a spike in divorces arising as a result of COVID, likely due to economic and family stress. The city of X’ian in China reported record divorce filings in March after relaxing their restrictions, for example. The creation of a new household or potential downsizing that occurs as a result creates additional demand for self storage.

One additional demand driver that falls outside of the four D’s has been the country’s newfound appetite for purchasing recreational vehicles (or RV’s) and boats. With so many vacation destinations closed and activities limited to small groups, many families have opted to spend the ‘windfall’ of not flying somewhere for a vacation on a boat. According to the National Marine Manufacturers Association, May and June of 2020 motorized boat sales were up 30% from the same period in 2019, setting a new record.

Similarly, anyone that may have been considering buying an RV at some point in the future seems to have opted to pull forward that purchase given the lack of other options. For example, RV sales were up 54% in July from the same period in 2019. The RV Industry Association is now expecting 2020 to be the fourth best year on record despite having essentially zero sales for two months. They project 2021 RV sales to increase another 19%, making it the best year ever. Since most people do not have a place to store RVs or boats, self storage again benefits from providing a safe parking spot.

Therefore, we believe that self storage is extremely relevant in the short term and carries low risk. In the long term, the risk should also be low given that the property type has proven it can grow in multiple environments and is not merely a ‘covered land play’.

Valuation

Due to the low short term and long term risk, we can look at self storage REIT dividends, cash flow multiples, and even capitalization rates for valuation metrics.

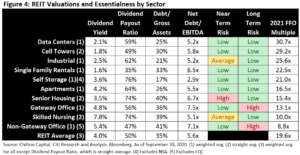

As of September 30, the average dividend yield of self storage REITs was 3.6%, which compared to the REIT average of 4.0%. We believe the yield reflects both the security in the current dividend (not likely to be cut) and the confidence in a long period of gradual increases. As of September 30, the weighted average payout ratio on 2021 FFO of 76% is higher than the REIT weighted average of 50%, but recall that over 50 REITs have cut or suspended their dividends completely this year. In contrast, self storage REITs have maintain their dividends in 2020.

As of the same date, self storage REITs traded at 21.0x 2021 FFO, which compares to the REIT average of 19.6x. Given the low interest rates and multiple avenues for FFO growth (including refinancing of debt at accretive rates), the relative spread to the average REIT may be too small. In particular, the self storage REITs have been finding new ways to grow revenue, either through third party management agreements, bridge loan financing to third party developers, development/expansion, and potentially accretive acquisitions when the market stabilizes. The six public entities own or control approximately 30% of the total square footage nationwide, but another 45% of properties are of institutional quality and could be targets for consolidation in the future.

The implied cap rate of 4.8% as of September 30 compares to the 10 yr Treasury yield of 0.7%. The resulting spread between the two of 410 bps compares to the five year average of 300 bps and the 10 year average of 380 bps. We believe that this spread should compress over time, especially if the Federal Reserve maintains its commitment to keep the 10 yr Treasury yield low through 2023.

Chilton Position

As of September 30, Chilton had a 0.0% allocation to self storage, which compares to the RMZ allocation of 7.6%. The underweight allocation reflects concerns on valuation and the risks to street rate growth given the record amount of self storage facilities currently in lease-up. However, we are becoming more constructive on self storage and the comparison versus other sectors shown in Figure 4, which shows a discount to other low risk sectors such as industrial, single family rentals, cell towers, and data centers.

Given the outperformance in 2020, there may be a reversal when the underperformers revert to the mean, but we believe that its position as a steady income stream regardless of a vaccine or economic restart make it a low risk long term investment.

Positive Outlook for Self Storage

In addition to the essential theme, the growing divide between the ‘haves’ and ‘have-nots’ is a prevalent theme in the portfolio today. Self storage REITs and REIT investors have firmly planted themselves in the ‘have’ camp given their access to capital, recent performance, and durability of income streams. Furthermore, referring back to Figure 1, the revisions of new construction by Yardi Matrix (dotted dark blue line) show that new supply will be declining significantly over the next few years, which should bring supply and demand back in balance.

While finding an entry point is important, we believe these companies will continue to use their scale as an advantage over smaller private owners, who are not able to spread around the cost of call centers and internet marketing. Thus, the gap between the self storage multiple and other public REIT sectors is more likely to widen than narrow as the cycle matures.

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

RMS: 1991 (9.30.2020) vs 2402 (12.31.2019) vs 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.