Rotation Creates Long Term Buying Opportunity | March 2021

March 2, 2021

As we mentioned in the 2021 Chilton REIT Forecast, the rotation from the ‘COVID’ REITs (i.e. Cell Towers, Data Centers, Industrial) to the ‘Vaccine’ REITs (i.e. Regional Malls, Shopping Centers, Coastal Apartments, Lodging, Coastal Office) after the November 9 Pfizer announcement has been nothing short of extraordinary. While the increase in price over the past five months for some Vaccine REITs pricing in a ‘return to normal’ made sense, others have soared past pre-COVID valuations, while still others have been left behind. Improbably, some ‘COVID’ REITs with attractive long term growth are now below pre-COVID values despite a positive change to long term fundamentals. We will discuss below some of the specific sectors that have outperformed beyond what the vaccine news actually changed in terms of fundamentals (if anything) and isolate a few examples of ‘COVID’ REITs that are more attractive than they were a year ago.

What has Changed from a Year Ago?

As we are just hitting the one year anniversary of the beginning of the lockdowns in the US, it is instructive to compare valuation metrics in a pre-COVID world to today’s ‘vision’ of a post COVID world with the background of the external factors that influence such metrics. As of February 28, 2021, the 10 year Treasury yield was 1.5%, which compared to 1.1% at the same time last year. The unemployment rate was 6.3% as measured by U-3 (the most commonly cited figure) as of the February 5 employment report, which compares to 2.5% last year. Finally, GDP is projected to be $21,660 billion for 1Q2021, versus actual GDP of $21,561 billion for 1Q2020. Government stimulus has helped to bring the savings rate up to an all-time high of 20.5%, giving hope for consumer spending growth in 2021 and beyond, which has historically been a large contributor to GDP growth.

To summarize, the economy is in a worse but improving place versus last year, and the S&P 500 and Bloomberg Barclays Aggregate Bond Total Return Indexes are 31.3% and 1.4% higher, respectively, which justifies higher multiples for most REITs (+3.4% total return only over the same period as measured by the MSCI US REIT Index). However, as we mentioned above, the market has applied changes in multiples unevenly, seemingly based on a ‘reversion to the mean’ in prices. The justification for higher multiples through low interest rates and a potential ramp in the economy lies in the application of a lower discount rate to earnings streams, making the later years of earnings more valuable. Otherwise, multiples should increase due to higher earnings estimates, which would only occur for companies who are better off in a post-COVID environment than a pre-COVID environment.

Growth vs Value

In a recent paper by Howard Marks titled, “Something of Value,” he contends that an investment philosophy does not have to be mutually exclusive between ‘growth’ (high multiple companies with high growth rates) and ‘value’ (low multiple companies with low earnings growth). Instead, companies should be valued based on a discounted cash flow, which can justify high valuations for growth stocks as well as low valuations for value stocks. Warren Buffett agrees, stating, “There is no such thing in our minds as value and growth investing…Discounted cash proceeds is the appropriate way to value any business.”

Though the comparison to the COVID and vaccine REITs is not perfect, the reversion to the mean for some of the vaccine REITs is extremely similar to value investing, while the underperformance of some COVID REITs in the face of rising interest rates is common trait of growth stocks. For an active manager such as ourselves, bifurcation of performance between REITs is the ‘straw that stirs the drink’, as it creates temporary buying opportunities for REITs we do not already own. However, when it occurs for REITs that are already in the portfolio, our short term performance can lag the benchmark if we are overweight. Therein lies a challenge of portfolio managers across all industries.

The decision to sell or trim winners and buy or add to losers can heavily influence short term relative performance. For each of the 85+ REITs that we cover, there is a buy and sell price based on a required return and a two year price target. Since price targets move based on changes to earnings or valuation estimates, a REIT can stay in the portfolio well beyond reaching the initial price target that was determined to be adequate for investment. Accordingly, if the REIT never reaches the sell price then it is never sold, though it could be trimmed if it becomes too large for the portfolio.

When a price target is reached, should we sell or trim the business because it is now at a higher multiple than we anticipated? Rarely do stocks increase in a straight line, so we have to be sure of two things before selling: 1) has something changed since the last price target that would justify a higher price target? And 2) do we have something better to buy? If we have done all the work to determine the long term compounding potential of this business, are we lucky enough to sell in the ‘overvalued’ years and buy in the ‘undervalued’ years. As Howard Marks says in his memo, “When you find an investment with the potential to compound over a long period of time, one of the hardest things is to be patent and maintain your position as long as doing so is warranted on the basis of the prospective return and risk.” Ideally, if the cash flow stream is growing faster than the market anticipated, then there should not be a ‘reversion to the mean’ downward.

On the other side, should there be a reversion to the mean upward for underperforming stocks? Many stocks that appear undervalued are in fact ‘value traps’, meaning something has fundamentally changed with the business that permanently impairs cash flow growth. Furthermore, since these stocks have a built-in ceiling for price targets (the ‘mean’), these tend to only outperform for short periods. Very few managers can consistently time the market to pick the bottom and the top for a stock, and then do it all over again.

Our investment philosophy relies on our assessment of fair value based on net asset value, balance sheet metrics, management team capital allocation track record, and comparable cash flow multiples. Very rarely do we predict a change in multiples; instead we rely on estimated earnings growth over a three to five year period. Accordingly we would classify ourselves as ‘growth at a reasonable price’ (or GARP) investors. This philosophy has served us well since our inception in 2005, producing outperformance versus the benchmark over all 135 periods of rolling five-years, and 90% of the 159 periods of rolling three-years. However, there will be some periods where ‘junk rallies’ can cause short term underperformance.

Today’s Market

We are seeing the push and pull today between value and growth investors, applying different multiples to different years in the earnings streams, with some hoping to catch the momentum of a few years of growth off of a low base; but are they taking into account the long term earnings? Has the confidence in long term earnings growth increased or has the discount rate changed?

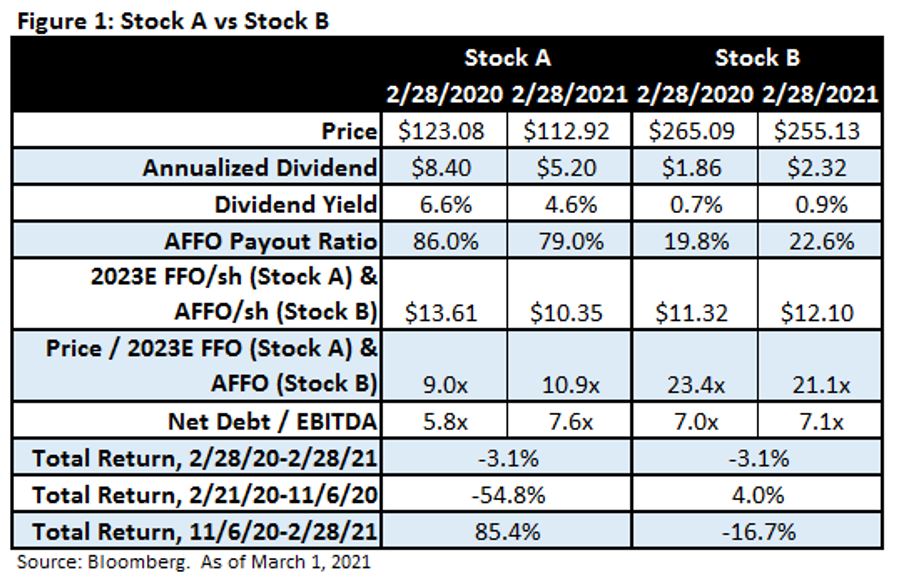

Let’s look at a few examples. Stock A and Stock B represent two different investments. In Figure 1 below, one can see the earnings estimate from a year ago for 2023 and the current estimate for 2023, as well as the prices, multiples, dividend yields, and payout ratios. After looking at the two, which would you buy? Are you surprised by the historical performance?

From November 6, 2020 to February 28, 2021, Stock A and Stock B produced the same total return of -3.1%, though they took very different paths. Stock A is Simon Property Group (NYSE: SPG), and Stock B is SBA Communications (NYSE: SBAC). SPG is a mall REIT, which has seen occupancy and tenant sales fall significantly due to COVID, while e-commerce has taken significant market share. SBAC is a cell tower REIT, which has a clear path for earnings growth due to the increased importance of mobile data and the 5G upgrade cycle to come.

While SPG was down 54.8% from February 21, 2020 to November 6, 2020, SBAC was up 4.0% over the same period. The change in earnings estimates justified at least some of the move upward in SBAC. In contrast, the move downward for SPG may have been overdone, but has the long term trajectory for malls improved in the past year? In response to the vaccine announcement, SPG has generated a total return of +85.4% from November 6, 2020 to February 28, 2021, while SBAC produced a total return of -16.7% over the same period.

Chilton’s Reaction to the Market Action

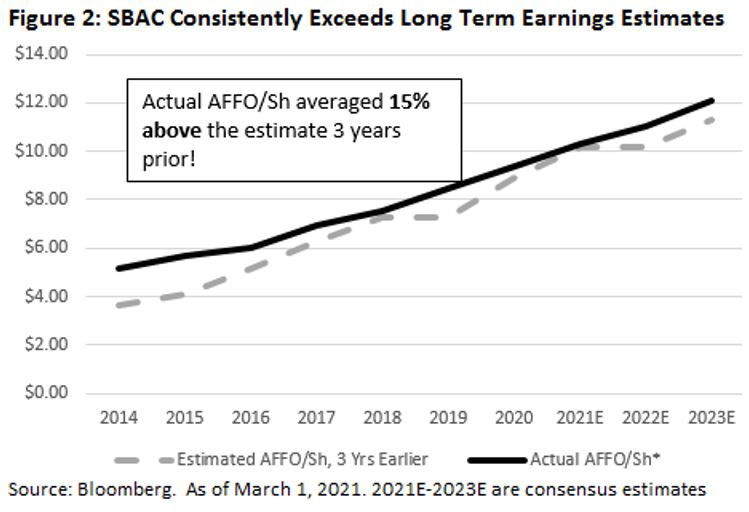

Without spending too many words on malls (see the November 2020 Chilton REIT Outlook for our opinion on retail), we have chosen Stock B for many reasons. First, if the market is applying a lower discount rate to earnings streams, making the out-years more valuable for cell towers, then the multiple should be justifiably higher today than a year ago for SBAC. Second, the market has consistently underestimated out-year earnings for SBAC, as shown in Figure 2. In fact, SBAC averaged AFFO/sh that was 15% higher than the estimate three years earlier. As we have said several Chilton REIT Outlooks in the past, many investors overestimate what can happen in a year, but underestimate what can happen in 10 years.

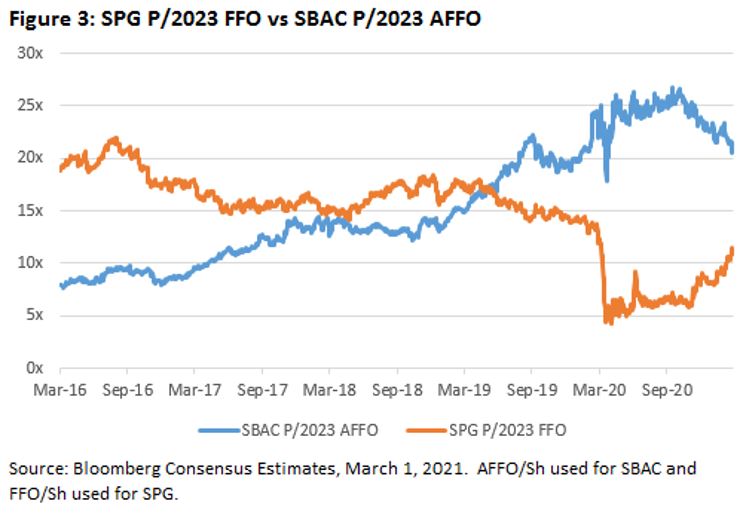

While COVID’s effect on stock prices created significant opportunities for investors that were betting on a quick rebound in multiples in stocks that had fallen the farthest, much of the return to pre-COVID valuations has already occurred. As shown in Figure 3, SBAC’s price/2023 AFFO (today’s estimate) multiple is down about 4% from a year ago, close to where it was almost two years ago, despite being two years closer to 2023. Furthermore, SBAC’s 2023 estimated AFFO/sh is already up 7% versus the same time a year ago. In comparison, SPG’s price/FFO multiple is down only 7% from a year ago despite a massive change in its business fundamentals. In contrast, SPG’s 2023 estimated FFO/sh is down over 24% from the same time a year ago. As a result, a year ago SPG was trading at 9.0x 2023E FFO/sh, but the lower estimate for 2023 as of February 28, 2021 means that SPG is trading at 10.9x the updated 2023E FFO/sh!

As of February 28, 2021, there is a renewed ability to purchase high quality growing REITs at ‘discounted’ valuations, thus creating an extremely attractive risk-reward scenario. The biggest opportunities we see today are in cell towers, single family rental homes, self storage, industrial, and data centers. We see some opportunities in vaccine REITs such as healthcare, student housing, high quality retail/mixed use, and Sunbelt office and apartments. We believe our current mix of COVID and vaccine REITs has an optimal potential risk-adjusted return.

With hindsight at 20/20, we could have dialed up risk to invest in malls, hotels, and coastal office, but the risk outweighed the reward in our opinion. For example regarding malls, what is the level of future store closings given bankruptcies and downsizing? What will be the capital expenditure requirements to repurpose empty boxes? What role will retail brick-and-mortar play in the future? Most investors that were making investments in mall REITs over the past year do not have concrete answers to these questions, and therefore were taking significant capital risk.

Similarly, we could’ve sold cell tower REITs because they were trading at cash flow multiples above their long term averages; however, that would be ignoring the future catalysts of 5G and a potential fourth carrier (Dish Network (NASDAQ: DISH)). In addition, many of our clients would’ve faced significant capital gains tax bills from such an action.

The best evidence of how we have reacted to the massive change in prices over the past four months is seen through the portfolio changes. Since November 9, 2020, we have made two sales and three buys, inline with our historical turnover rates. We sold Douglas Emmett (NYSE: DEI) and CyrusOne (NASDAQ: CONE) soon after the Pfizer announcement in reaction to strong market moves. Notably, DEI was up 11.6% on November 9. DEI is a West Coast office and apartment REIT, which we believe will struggle over the coming few years to achieve rent and occupancy growth due to the headwinds of outmigration and work from anywhere. CONE is a data center REIT that had reached our price target, and presented a less attractive risk-reward scenario than larger peer Digital Realty Trust (NYSE: DLR), which we bought soon after.

Over the same period, in addition to DLR, we initiated positions in Healthcare Realty (NYSE: HR) and American Assets Trust (NYSE: AAT). HR is a medical office building REIT with a stellar track record of investing in high quality on-campus or ‘adjacent’ buildings connected to well-capitalized health systems. HR actually increased FFO per share by 2.9% in 2020, and consensus expects FFO per share to grow another 4.2% in 2021. However, the stock is off 21.8% from its 52 week high. In our opinion, HR’s earnings resiliency is being underestimated by the market.

AAT is a diversified REIT with most properties on the West Coast and Hawaii, spread across primarily office, multifamily, lodging, and shopping centers. Each of the four property types has been a victim of COVID, particularly in coastal geographies. However, with the Pfizer announcement, companies with exposure to coastal office, multifamily, lodging, and retail have soared while AAT has lagged. AAT’s performance of +32.9% from November 6 to January 31, 2021 compares to performance of +46.3%, +19.0%, +38.2%, and +46.3% for the straight average of the coastal office REITs*, straight average of the coastal apartment REITs**, Bloomberg Hotel REIT Index (BBREHOTL), and Bloomberg Shopping Center REIT Index (BBRESHOP), respectively. Furthermore, AAT has contractual office leases signed that will start paying rent over the next few years, plus will benefit from the vaccine significantly in the retail and lodging portfolio. As a result, AAT’s consensus earnings growth from 2020 to 2023 is estimated to be 6% per year. AAT demonstrated its confidence in the business by increasing the dividend by 12% on February 9, 2021.

Conclusion

We believe we have built a long term track record based on patiently getting more return for the risk we take on each investment, and thus have historically underperformed the market during periods of ‘junk rallies’. The unprecedented action by the Federal Reserve and government (fiscal and monetary stimulus) has created a junk rally unlike anything we have ever seen. While some of the increases were justified, the declines in price by the COVID REITs are completely unjustified in our opinion. While cell tower REIT American Tower (NYSE: AMT) released projected revenue growth through 2027 on February 25, most retail REITs refrained from giving guidance for more than a quarter, if at all. The confidence in the seven year outlook should justify higher multiples instead of lower, and similarly the risk inherent in such unpredictable businesses should result in lower multiples. As a result, in our opinion, investors today have the ability to buy long term predictable growing businesses on sale.

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

RMS: 2313 (2.28.2021) vs 2220 (12.31.2020) vs 346 (3.6.2009) and 1330 (2.7.2007)

*SLG, VNO, ESRT, DEI, BXP, HPP, KRC, CXP, CLI, PGRE

**UDR, ESS, AIV, AVB, EQR

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.