Takeaways from the 2021 Citi REIT CEO Conference | April 2021

April 1, 2021

In what we hope was the last virtual Citi REIT CEO Conference, we met with 16 REIT management teams directly and participated in approximately another 20 virtual meetings to discuss the current business fundamentals and what the post-COVID world may look like.

In general, the tone at the conference was extremely positive, even for some of the non-essential REITs that have suffered the worst hit 2020 earnings. The rebound may differ in timing for some, but the recovery in the economy and the successful rollout of the vaccine has added certainty to a return to normalcy in the back half of 2021. We met with companies across all property types and will summarize our thoughts as such below, but the most significant takeaway was the overall positive sentiment that we believe solidifies our view that the new real estate cycle is well underway, and thus warrants premium valuations for REITs.

Lodging

We met with Ryman Hospitality Trust (NYSE: RHP), a lodging REIT that owns large group-oriented hotels, as well as an entertainment business (including the Grand Ole Opry). The company has been pleasantly surprised by the amount of leisure business that has replaced cancelled conferences, weddings, and galas. While the total spend has not been enough to make up for it completely, the company expects to be breakeven by 3Q21, and its group schedule has been pushed back such that the pent up demand should lead to results beyond 2019 before many other lodging REITs.

In addition, the company has been using live streams of the Grand Ole Opry performances on its ‘Circle’ channel to maintain the brand, obtaining 1 million or more listeners on a regular basis. At the onset of COVID, RHP cancelled a contract to purchase Block 21, a W Hotel attached to the Austin City Limits Live venue in downtown Austin. The clarity the company has now, in addition to a renewed cost and availability of capital, could give it the confidence to restart talks on the acquisition, which would yet another foothold in to the entertainment business.

Shopping Centers

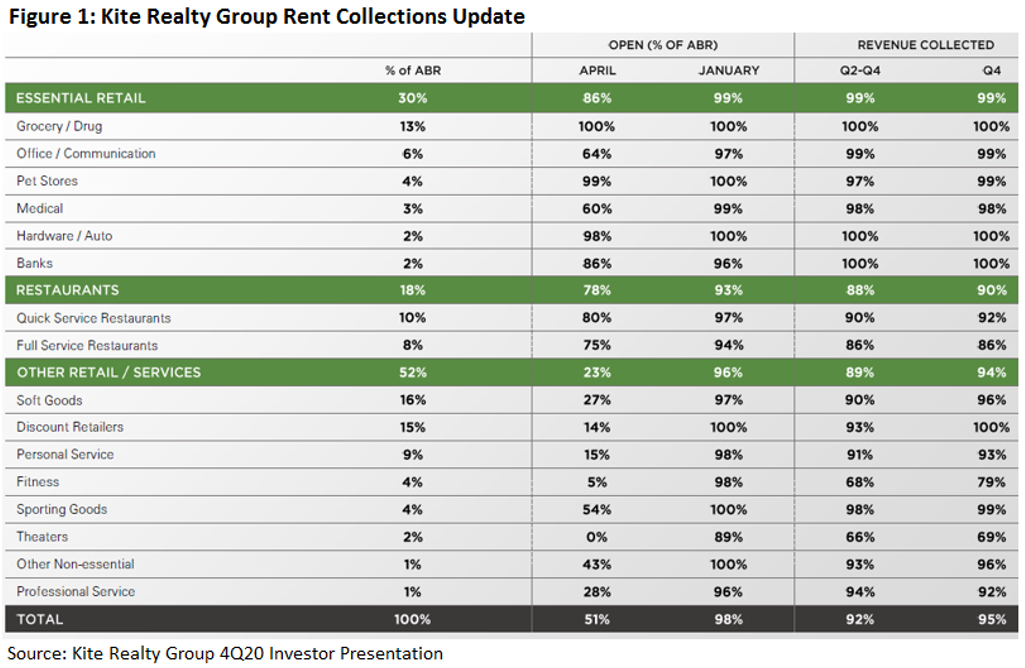

We met with Kite Realty Group (NYSE: KRG), Alexander and Baldwin (NYSE: ALEX), and RPT Realty Trust (NYSE: RPT). All three were able to boast strong leasing volume and positive leasing spreads (!!), which they believe is not being accurately presented in the press. While movie theaters and fitness centers are still problem tenants, they make up a small percentage of rent for all three REITs. Outside of these two sectors, other tenant rent collections have been essentially normal since September, as shown in Figure 1. In fact, many retailers have had such strong stock price performance that they are announcing expansion plans or reversing downsizing plans.

Office

We met with Corporate Office Properties Trust (NYSE: OFC), an office REIT focused on leasing the government entities in key Department of Defense (or DOD) markets. The approval of the recent DOD budget has caused to experts to slightly increase forecasts for future funding of the department, which has historically been correlated with leasing activity for OFC. Notably, OFC is more immune than peers against the work from home trend due to the high sensitivity of most of the work files, which may not be secure in outside locations. While the national office market is only ~25% back in office (using Kastle Systems card swipe data), OFC’s portfolio is at 50% in office, 40% working in shifts of in and out of office, and 10% only ‘lightly used’.

We also participated in a panel with Boston Properties (NYSE: BXP) and Gensler, a leading global architecture and design firm for commercial real estate. Both conceded that working from home was ‘satisfactory’, but it is not sustainable due to the lack of collaboration opportunities. Even as companies start to make more permanent decisions about working from home, or some hybrid of in-office and work from home, they will need to invest in more collaboration opportunities which may not necessitate less demand for office space.

Healthcare

We met with Sabra Healthcare (NYSE: SBRA) and Physicians Realty Trust (NYSE: DOC). SBRA owns senior housing facilities and skilled nursing facilities across the country, and has started to see a turn in its business. SBRA’s tenants and employees were among the first people in the country to receive the COVID-19 vaccine, and the positive turn in their occupancy has coincided with approximately 90% of its tenants and employees having received at least the first dose of the COVID-19 vaccine. In fact, the week before our meeting was the first in over a year in which there were zero new COVID cases among tenants, and the week before had only two new cases.

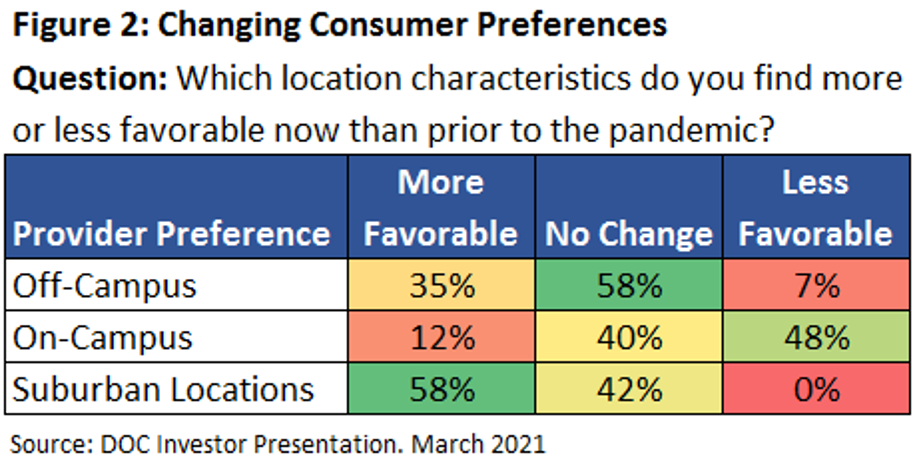

DOC owns medical office buildings that are mostly ‘off-campus’, which means they do not fall within 250 yards of a hospital campus. While historically that has been thought as ‘lower quality’, COVID has further exacerbated the desire to conduct different healthcare functions closer to the customer, as shown in Figure 2. Cap rates declined for their property type, and they are looking to upgrade their credit profile to earn a lower cost of capital for future acquisitions.

Diversified

We met with Howard Hughes Corporation (NYSE: HHC) and American Assets Trust (NYSE: AAT). HHC, a major developer of master planned communities, is a beneficiary of the single family housing boom underway in the US. It also believes the market is now healthy enough to resume its plan of shedding several non-core assets, which it expects will fetch prices equal to what brokers were quoting pre-COVID. In addition, the company announced an upcoming Investor Day that could be a catalyst to further enhance disclosures and analyst understanding of the value of the company, which also includes office, retail, multifamily, hotel, and self storage properties.

AAT, an owner of high quality real estate in Hawaii and the major West Coast markets from Seattle to San Diego, is eagerly awaiting the easing of travel restrictions into Hawaii. These restrictions have significantly dampened tourist demand at its hotel and retail assets in the state, and, as a result, reported earnings in 2020. In addition, the company has decided to build an office building without preleasing on land it already owns in the thriving UTC sub-market of San Diego due to the robust demand from life science companies in the area. AAT will be a prime beneficiary of the reopening trade, but also has lower risk profile due to signed office leases that will be commencing over the next few years.

Data Centers

We met with QTS Realty Trust (NYSE: QTS), Equinix (NASDAQ: EQIX), and Colony Capital (NYSE: CLNY). Each of them expressed confidence about the future demand of data due to increased use of the ‘cloud’ by businesses that is driving the need for more data centers. In addition, the wide adoption of streaming services by consumers is augmenting demand.

While data centers may sound uniform in name, these three companies could not be more different. QTS spoke at length about future opportunities in leasing from government verticals, while Equinix continues to expect cross connects (connections between tenants) and its new hyperscale development joint venture to grow as a percent of assets. Finally, Colony Capital is in the process of transforming from a traditional commercial real estate company into once focused on digital assets such as cell towers and data centers. It has done this through the sale of non-core assets and raising private capital to make acquisitions of digital focused companies. The transformation is beginning to bear fruit as the stock price is up 270% in the 12 months ending March 31, 2021.

Industrial

We met with Eastgroup Properties (NYSE: EGP), Americold (NYSE: COLD), and Prologis (NYSE: PLD). The message is the same for all three: the incredible tailwinds from the more rapid adoption of e-commerce in 2020 continues to support increasing demand. EGP reported that its properties were 98% leased as of 4Q20, an unheard of figure for a portfolio that is approaching 45 million square feet. Industrial rent is cheaper than what is found in retail facilities and is one of the main drivers of the growing ‘last mile distribution’ system now underway nationwide. The fragile nature of the ‘supply chain’ rose its ugly head again with the recent blockage of the Suez Canal, which demonstrates the need for significant investment in industrial properties so as to not be as vulnerable to interference, which are becoming more commonplace.

Self Storage

We met with Extra Space (NYSE: EXR) and Life Storage (NYSE: LSI). Both companies highlighted the uptick in storage demand due to the consequences of COVID-19, including the need to ’clean house’ to make room for work stations at home and the feverish moving activity. As a result, occupancy rates set records (as shown in Figure 3) and price increases were easy to obtain. Importantly, development projects and recent acquisitions proved to have quicker lease-up periods, which should support excellent growth rates in 2021 and beyond.

Triple Net

A return to normalcy should be a positive for most triple net REITs, which have already had relatively high rent collections with the exception of theaters. Theaters have been particularly impacted by the pandemic, and likely will continue to see lagging fundamentals as direct to streaming trends persists after the pandemic. Management teams are still active on the external growth front, albeit not as enthusiastic as a year ago given a less attractive cost of capital. Private market cap rates tend to be stickier than public market cap rates, which could result in a tapering of external growth if rates continue to rise.

Cell Towers

We listened to presentations by American Tower (NYSE: AMT) and Crown Castle International (NYSE: CCI). Both expressed the surprisingly good outlook for leasing longer term due primarily to the rollout of 5G enabled smart phones. The major carriers have spent billions on new mid-band spectrum that is expected to be deployed in the major upgrade to faster networks. However, 2021-2022 will be characterized by the churn caused by the de-commissioning of many Sprint tower leases, potentially offset by new leases from Dish network, which should create incremental revenues in 2022 and beyond. All three major tower companies, which control roughly 60% of all towers in the US, have signed master lease agreements with Dish, which will enable Dish to expand the network rapidly.

Conclusion

One focus of the conference was on Environmental, Social, and Governance (or ESG). Each CEO was asked what they are doing to improve their ‘scores’ in each of these items, and we were impressed with the many initiatives that REITs have undertaken in all three buckets. We continue to believe that the public REITs are leaders of the industry for ESG, and will set the standard for property owners worldwide.

We reiterate our view that Equity REITs are well positioned for the future due to the expected occupancy gains that should arrive due to the above average growth in the economy as it re-opens and enjoys the benefits of the government stimulus programs. In addition, the REITs’ access to low cost capital should enable accretive external growth from new property acquisitions and/or development, most of which is not included in consensus estimates. Importantly, we also believe that should inflation rates unexpectedly increase, the value of existing real estate should once again demonstrate its inflation hedge potential. Finally, a premium valuation for REITs is warranted now more than ever due to the unique property exposure that most private investors cannot obtain elsewhere, such as cell towers and data centers.

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

Kevin Egan

kegan@chiltonreit.com

(713) 243-3211

RMS: 2415 (3.31.2021) vs 2220 (12.31.2020) vs 346 (3.6.2009) and 1330 (2.7.2007)

*SLG, VNO, ESRT, DEI, BXP, HPP, KRC, CXP, CLI, PGRE

**UDR, ESS, AIV, AVB, EQR

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.