The Bull Case for Active REIT Management | June 2023

June 1, 2023

The capital window for commercial real estate has substantially lessened if not virtually closed for all but the best borrowers, just like in the early 1990’s. In this cycle, property owners that financed with floating rate debt are seeing reduced cash flows, and many have negative cash flow after rising interest expense and other operating expenses (property taxes, insurance, maintenance costs, and labor costs). While rents and occupancy are up almost across the board, it may not be as much as was assumed in acquisition models when these deals were made. As such, valuations are under pressure due to the increase in cap rates and many risk losing properties in foreclosure actions.

With all of this negative news, it must not be a good time to buy public equity REITs, right? Wrong. These comments are specific to private market participants that loaded up on acquisitions in the past few years, and especially those that chose to be more aggressive in how they were financed. In the public REIT universe, valuations have already fallen, and we believe they assign too high of a probability of a negative scenario that may not come to pass. Public REITs were net sellers in the past 3 years, and, in our view, balance sheets have never been better. As such, we are more bullish about investing in public REITs today than we have been since 2009-2010, especially for active managers focused on risk-adjusted returns.

Office Market is Tiny for Public REITs

The office sector has been dominating recent headlines, mostly focusing on depressed occupancy rates due to work from home policies. Rising vacancy rates in office markets across the US are hard to ignore and, due to the nature of long term leases, it is just getting started. Foreclosures and distressed sales are becoming common, and will only accelerate as loans come due. As we discussed in our May 2023 Chilton REIT Outlook titled, “Office REITs: Where is the Bottom?” the office sector comprises only 5.4% of our primary benchmark (MSCI US REIT Index (Bloomberg: RMZ)) and 4.4% of our secondary benchmark (Vanguard REIT ETF (Bloomberg: VNQ)) as of May 31, 2023. Plus, with the office sector, represented by the Bloomberg REIT Office Index (Bloomberg: BBREOFPY), down over 50% from December 31, 2021 through May 31, 2023, the valuations already reflect serious distress. We believe this limits the downside, at least in the near term.

As such, we made our first investment into an office REIT in May since selling Cousins Properties (NYSE: CUZ) in June 2022. While the near term fundamentals will likely only get worse, we believe we are being compensated for that risk by paying an extremely low multiple and receiving a dividend yield that is 3x our portfolio average. By the way, the dividend on this southeastern focused office REIT is well covered by cash flow and is not at risk of being cut even if occupancy declines by 10% in the coming years!

‘Handing Back the Keys’: A Short Story

With the recent headlines on commercial real estate so negative, we are constantly asked, ‘what is going to happen?’ The answer is obviously nuanced based on property type, location, occupancy, and rent roll. But, in a somewhat unique market, balance sheets are more important than ever. Even for a property type such as multifamily where fundamentals are still strong (average same store net operating guidance for public REITs: +5.5%), the purchase price and how it was financed can completely destroy the cash flow and, ultimately, the equity investment.

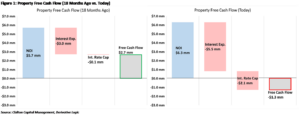

The following illustrates an example of how a typical private multifamily investment could have progressed given a purchase about 18 months ago using some basic assumptions. Assuming a purchase price of $143 million for an apartment building at a 4% cap rate financed with $100 million in floating rate debt (70% loan to value, assume year one debt cost of 3% when SOFR averaged 0.50%), the initial free cash flow was over $2.5 million (assuming no capital expenditures). In addition, the bank would have required the purchase of an interest rate cap, which would payout if SOFR (Secured Overnight Financing Rate) rose above 3%. This would have cost less than $50,000 only 18 months ago. Today, with SOFR around 5%, the cost of the same 3% cap is $2.1 million, according to Derivative Logic. In addition, the owner is now paying an all-in debt cost of 5.5% (3% plus the assumed 250 bps spread), which results in forward twelve months free cash flow of negative $1.9 million. Even if the net operating income (or NOI) of the property increased by 10%, as seen in Figure 1 above, the cash flow would still be negative $1.3 million; in fact, NOI would have to increase by over 40% just to offset the increase in debt financing costs. The shortfall may be manageable for some large funds and institutions, but partnerships and retail investors will be reticent to add cash to an investment that was previously viewed as a success and paying out a dividend.

We do not assume any near term relief on borrowing costs due to our belief that the Federal Reserve will hold rates higher for longer. Even if the economy holds and fundamentals exceed our expectations, it will not be enough to overcome the increase in interest rates. Accordingly, we believe banks and owners will hold on and extend as long as possible, but eventually “rubber will meet the road” and the property will have to be recapitalized with new equity or handed over to the bank. Therefore, we envision trillions in losses being recognized in commercial real estate across almost all property types and geographies. To put it in perspective, there is approximately $15 trillion in quality commercial real estate; assuming leverage of 50% and a change in cap rates from 4.5% to 6%, approximately half of the equity, or $3.75 trillion, would be wiped out.

A Silver Lining?

In the early 1990’s, Wall Street came to the rescue of excellent private real estate companies by providing a source of permanent capital to over leveraged owners at risk of losing everything. The popular question at the time: Do you want 100% of something worth zero or a smaller percentage of a going concern. Fortunately, a good number of managements “bit the bullet” and went public and the modern REIT era was born. Investors benefited from the ability to invest in some of the finest real estate in the country with the best management teams allowing the new equity REITs to prosper in a real estate industry where capital from traditional sources was extremely tight. Although a different set of circumstances occurred during the Global Financial Crisis (or GFC), similarly the previous investors were able to be made whole by the company raising dilutive equity, while new investors benefited from buying in at rock bottom prices into newly public capitalized REITs.

And now, real estate is hurting once again. Different than the past two crises (excluding COVID), the property cash flow is sound, as mentioned above. While there are going to be many leveraged owners that will have to go through the same pain that the REITs went through in 1992 and 2008, the public REITs are in a completely different position. This time around, REITs will avoid a repeat of the dilutive equity raises that many employed in 2009 to stabilize operations, fulfill debt covenants, and comply with the banks. Instead, the public REITs will be able to serve as the ‘new investors’, providing capital and making accretive acquisitions from undercapitalized properties and companies. Additionally, the liquidity for construction financing has been severely squeezed for most participants, creating a halcyon supply environment for the intermediate term after construction projects started in 2021-2022 are completed.

So, what price would someone pay for an investment with favorable supply/demand dynamics, a fortress balance sheet, a growing dividend, high quality properties, and top-notch managers? In this case, it is one of the biggest discounts we have seen versus the private markets in history. Relative to the private markets, the public REITs are trading at a 15% discount, which compares to historical lows of 20% and an average of a 1% premium. On a price to cash flow (or AFFO) basis, the public equity REITs are about 9% below their 5 year average and 10% below their 10 year average.

In spite of the troubles surrounding BREIT and other non-traded REITs, Blackstone recently closed a $30 billion closed end private equity real estate fund, which at a leverage of 60% could purchase up to $75 billion in real estate. Given the cost of new debt, vehicles such as this will find a public REIT with ‘assumable’ debt especially attractive for acquisitions relative to the purchase of an asset with no existing debt. We believe this could provide a further floor to public REIT prices broadly, and create outsized alpha opportunities for active REIT managers and investors who can identify such targets beforehand.

Risks

Unfortunately, the public REITs can’t get aggressive on acquisitions until cap rates are above their cost of capital. Recent debt financings in the 5-6% range by several equity REITs are encouraging, but private market cap rates are still too low. The aforementioned financing issues for private owners will eventually result in higher cap rates and, at that time, investors should be ready to put a premium on public REIT equity prices.

The timing of this opportunity is difficult to estimate, however. We believe that the Federal Reserve is going to ‘pause’ interest rate hikes at the next meeting, or possibly do one more 25 basis point hike. Employment has been stubbornly positive, and likely needs to rollover before the owners and banks decide to throw in the towel. Inflation metrics have been decelerating, but are still above the long term average. If the economy gets to the point where inflation is under control, the Fed will feel more confident in taking a pause, or even cutting rates if need be.

If the economy doesn’t cool to the satisfaction of the Fed, there could be further rates hikes, which would put upward pressure on long term rates. This would only accelerate the issues facing the highly levered private owners. Again, we would feel comforted by the expected dividend growth by the public REITs, which, after taking an initial hit, would be primed to raise earnings estimates into such an economy given the low construction starts.

Conclusion

All of this means is that the defensive characteristics that come from owning a diversified portfolio of public equity REITs should take center stage with investors. But, the recent price action of REITs suggests investors are not paying attention to the long term benefits of investing at what could be this cycle’s low point. The average yield for the RMZ is 4.5% as of May 31, 2023, and, as we have stated repeatedly, dividend payout ratios are low enough to support growth over the next several years. The combination of a high dividend yield with above average growth could give way to double digit returns similar to what we witnessed after the 1998-99 period. Debt maturities are manageable and many REITs have free cash flow after paying dividends. Furthermore, competition from new properties should not only subside but the higher rents necessary to rationalize new construction should aid the growth profile of existing landlords.

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Isaac A. Shrand

ishrand@chiltoncapital.com

(713) 243-3219

RMS: 2,407 (5.31.2023) vs. 2,398 (12.31.2022) vs. 3,177 (12.31.2021) vs. 1,433 (3.23.2020) and 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index performances [MSCI and VNQ] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.

Leave a Reply Cancel reply

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.