Property Type Round-Up from REITWorld | December 2023

December 1, 2023

We recently embarked on a three-day expedition to Los Angeles for the annual REITWorld conference. We conducted 29 meetings, including 10 exclusive one-on-one sessions with REIT CEOs and CFOs. Additionally, we attended two property tours organized by companies with properties in the area, for which we were able to not only meet with the CEOs and CFOs, but also hear from local managers and other third parties with boots-on-the-ground.

At the onset of the conference, REITs were treated to an encouraging inflation report that pushed down the 10-year Treasury yield by ~20 bps and lent additional support towards the likelihood of a soft-landing scenario, resulting in a REIT rally of +5% on 11/14/2023, as measured by the MSCI US REIT Index (Bloomberg: RMZ), and enthusiasm throughout the conference attendees.

Common themes conferred across our 29 meetings included 1) cautious optimism on 2024 fundamentals with many REITs discussing plans to issue “extra” conservative guidance given macroeconomic uncertainty; 2) greater levels of distressed opportunities in 2024 on the back of high debt costs and decelerating fundamentals, benefiting REITs with the best balance sheets; and 3) acceptance of the challenges that lay ahead given elevated costs of capital, a stalled transaction market, and incremental consumer/recession risk.

We came away with several actionable ideas, which we present below along with key takeaways from our meetings.

Shopping Centers & Malls

Within the shopping center space, we had the opportunity to meet with management from InvenTrust (NYSE: IVT), Site Centers (NYSE: SITC), Phillips Edison (NYSE: PECO), Brixmor (NYSE: BRX), and CTO Realty Growth (NYSE: CTO), as well as Simon Property Group (NYSE: SPG) and Tanger Outlets (NYSE: SKT) in the mall and outlet sector. Similar to what we heard during the 3Q earnings season, leasing activity remains robust and, in particular, the returns achieved re-leasing the former Bed Bath and Beyond boxes have exceeded expectations (i.e., almost entirely single tenant backfills, which require less capital). Despite macroeconomic concerns, landlords are already engaging with tenants on store opening plans for 2025. At the same time, the supply picture for new retail properties remains effectively zero. Several meetings delved into the math behind rental rates required for new development (based on today’s construction and financing costs) and in most markets management would need to see rents 50-100% higher than today to make projects pencil. This dynamic, alongside near record low vacancy rates, has continued to push negotiating power towards the landlord, resulting in exceptionally strong retention rates and better leasing terms (notably landlords are achieving 3-4% annual rent bumps in small shop leases vs. 2% previously).

Turning to the transaction market, cap rates have crept higher but, thus far, the corresponding increase in most REITs’ cost of capital has kept a lid on external growth activity. Looking forward, management teams are optimistic that debt maturities and variable debt exposure for private owners will increase the quantity of high-quality retail properties coming to market.

Site Centers’ recent announcement to spin off its convenience assets into a new REIT (CURB) was a topical debate at the conference, and, management’s outlined path for capital expenditure (capex) overhead cost savings have led to strong outperformance for the stock.

For malls, SPG highlighted its attractive free cash flow outlook for next year, with expectations of roughly $1 billion after paying its dividend and maintenance capex, leaving meaningful cash for high return redevelopments. In outlets, Tanger highlighted an attractive opportunity set of projects on peripheral land, which carry a higher return than new greenfield development.

Healthcare

We met with Sabra (NASDAQ: SBRA) and Healthcare Realty (NYSE: HR). Additionally, while we did not formally meet with the Senior Housing (SH) REITs – Ventas (NYSE: VTR) and Welltower (NYSE: WELL) – we spent a fair amount of time discussing 3Q earnings with other investors and fielding comments on our recent October 2023 REIT Outlook.

SH fundamentals remain exceptionally strong driven by a combination of increasing occupancy, improving labor headwinds and minimal new supply. Overall, as we look to round out a record year for SSNOI (same store net operating income) growth, investors think 2024 growth could nearly replicate 2023 (likely double-digit growth). Additionally, as private operators contend with looming debt maturities, the opportunity set for acquisitions is substantial – highlighted by WELL’s most recent business update showing the potential for $6 billion of acquisition activity and recent commentary targeting low double digit unlevered IRRs.

HR, a 100% medical office building (MOB) REIT, rehashed its 2024 earnings bridge from its 3Q presentation (see Figure 1 below). Importantly, management provided more color on their retention expectations, noting the ~4% NOI (net operating income) growth target reflects retention around 80%, which is conservative relative to their historical average. Overall, while we are cognizant of spending needs and the elevated payout ratio, we believe HR’s 8.1% yield and meaningful recent underperformance present a strong total return outlook.

Multifamily, SFR, & MH/RV

Within the multifamily sector, we met with the management teams of Equity Residential (NYSE: EQR), UDR Inc. (NYSE: UDR), Mid-America Apartments (NYSE: MAA), Independence Realty Trust (NYSE: IRT), and Centerspace (NYSE: CSR). Three key topics of discussion stood out: continued regional divergence of supply challenges into 2024, renter demand remaining relatively healthy, and anticipation for elevated distress of institutional quality properties within the next 12 months.

With new apartment deliveries across the Sun Belt expected to remain elevated throughout 2024, the Coastal markets are in a position to outperform given lower supply and relatively easier comparisons. However, with deliveries expected to peak in mid-2024, private capital sidelined, and less new construction, improved pricing power is anticipated across the multifamily sector (including the Sun Belt) in 2025. Additionally, East Coast markets, particularly New York and Boston, continue to show relative strength compared to West Coast markets such as Seattle and San Francisco.

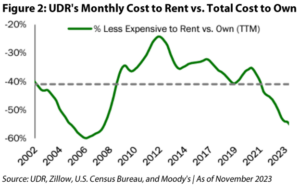

Renter demand, as evidenced by high retention rates and strong renewal growth, remains quite healthy heading into 2024 alongside the highest mortgage rate levels in 23 years, causing the age-old rent vs. own debate to heavily favor renting at this time as shown below in Figure 2.

While distress in the transaction market remains limited and idiosyncratic for now, management teams reiterated their expectation for larger pockets of dislocation to surface over the next 12-18 months. As owners begin to face debt maturities for assets bought at sky-high prices in 2021-2022 and typically financed with variable rate debt, they will be forced to either unfavorably recapitalize or sell the assets at distressed levels. We believe well-capitalized multifamily REITs will be able to take over the properties at an attractive cost basis that reflects the current fundamentals and debt markets.

In the single-family rentals (SFR) sector, we met with Invitation Homes (NYSE: INVH). Akin to our meeting with management in June, SFR fundamentals remain remarkably strong on the back of higher mortgage rates, favorable demographic trends, and low supply. For reference, rental payments are currently 32% (~$1,100 per month) cheaper, on average, compared to monthly home ownership costs in INVH’s core markets. With occupancy of ~97%, renewal lease spreads north of 7%, and new residents boasting a rent-to-income ratio of 5.2x, the SFR sector remains well-positioned to demonstrate resilient demand compared to its multifamily peers over the next 12-18 months.

Lastly, we met with Sun Communities (NYSE: SUI) and Equity Lifestyle Properties (NYSE: ELS), both focused on manufactured housing (MH), RV parks, and marinas. Pricing power continues to be solid across each business segment with rental increases being sent out for 2024 in the 5% – 7% range, much higher than current expectations in the multifamily sector. Additionally, investor sentiment surrounding SUI has remarkably improved since the last NAREIT conference in June (see thoughts here) on the back of SUI finally being able to shift investor focus towards its well-performing core business (~95% of NOI) and less so on its UK Home Sales (~5% of NOI) by improving its balance sheet, adding disclosures, and strong internal growth.

Self-Storage

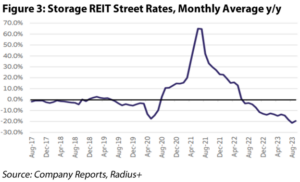

We met with Public Storage (NYSE: PSA), Extra Space Storage (NYSE: EXR), and National Storage Affiliates (NYSE: NSA) within the self-storage sector. Following up on our relatively cautious stance taken towards the sector, detailed in our August 2023 REIT Outlook, fundamentals continue to look rocky heading into 2024. For example, three out of the four public storage REITs are guiding towards negative same-store net operating income growth in the fourth quarter of 2023, a vast difference than the near +20% SSNOI growth seen in 2022. As shown in Figure 3, move-in rent growth (“street rates”) are well into the negative territory on a year-over-year basis, ultimately creating a lower starting base for 2024 and playing a large role in the negative SSNOI. Additionally, given rent roll downs in the 20-25% range, existing customer rent increases (“ECRIs”) will need to be much higher and more frequent to get new customers in line with today’s in-place rental average.

While storage demand in 2024 remains one of the more hotly debated topics across the REIT universe, management teams seemed rather optimistic at the conference driven by a healthy existing customer base that is accepting of ECRIs alongside promising indicators of future demand such as consumer sentiment, propensity to spend, and favorable employment levels. Lastly, while investor concerns are undoubtedly still present, it feels as if the concerns have been partially alleviated following “better than feared” third quarter results from EXR, causing the stock to rise +10% the day after its earnings release, followed by another +10% rise just four days later.

Industrial

Before the conference kicked off, our team had the opportunity to tour several industrial markets with Rexford (NYSE: REXR), a REIT that has 100% of its portfolio in Southern California, including a drive through the Ports of Los Angeles and Long Beach. The tone around leasing was upbeat, noting a pickup in activity in the past several months. Brokers from CBRE noted a flurry of proposals since August when the LA Port labor agreements were finalized. Additionally, drought conditions impacting the Panama Canal and upcoming labor negotiations at several East Coast ports supported LA’s position as the primary destination for Asian imports. Management also indicated that existing tenants were engaging in renewal negotiations earlier than normal, potentially signaling a return to positive market rent growth after a recent decline. With that said, investors remain skittish around market rent growth in Southern California, reflected in REXR’s nearly 700 bps year to date underperformance vs. the Bloomberg Industrial REIT Index (Bloomberg: BBREINDU).

Office & Life Science

We met with BXP (NYSE: BXP), one of the largest owners of office properties in the US with 53 million square feet in 190 properties, which provided additional details on the sale of a 45% interest in its two Kendall Square Life Science Properties for $746 million (100% pre-leased projects in Cambridge, MA delivering in 2Q26 and 1Q25 respectively). In aggregate, the deal values the projects at just over $2,000/sq. ft. and helps solidify financing for BXP’s ~$2 billion development pipeline.

We also met with Alexandria (NYSE: ARE), the pioneer of life science real estate with an asset base of 75 million square feet, where management reiterated a positive outlook on capital availability for core life science assets. Further, at its investor day this week, the company noted solid progress on its planned dispositions for the end of 2023.

In traditional office, the return to office push continues, with BXP noting Monday is catching up to mid-week attendance; however, everyone we spoke with agreed the macroeconomic outlook matters more for Office REITs in the medium term. Elsewhere, Highwoods (NYSE: HIW) announced an unsecured debt offering during the conference – $350 million at 7.65% due in 2034 – highlighting that capital availability still exists for high quality office landlords. Consistent with our May 2023 REIT Outlook, our team remains cautious on the property type, but believes attractive buying opportunities will present themselves as the cycle plays out and obsolete space is rationalized.

Conclusion

Overall, our participation in this year’s conference provided us with moderately improved visibility heading into 2024. Despite the majority of REITs not providing direct 2024 guidance in their respective investor updates, the tone of management teams, albeit on the back of the REIT rally to kick off the conference, was reassuring. With recent commentary from the Federal Reserve (the “Fed”) providing more certainty on the likely path of interest rates going forward, management teams can predict their business with relatively greater accuracy. As for the Fed’s commentary, it is likely done hiking rates this cycle with some Fed officials even raising the possibility for interest rate cuts as early as Spring 2024. Given our continued expectation for a Fed pivot to occur sometime in 2024, we remain focused on optimizing our portfolio to be a beneficiary of said pivot alongside fortress balance sheets and discounted valuations through bottom-up active management. We are pleased to report that our portfolio themes are producing favorable performance, both relative and absolute. As of November 30, 2023, the Chilton REIT Composite has achieved a commendable year to date return of +8.2% gross of fees and +7.6% net of fees, outperforming the RMZ at +3.5% over the same time frame. We look forward to providing more detail on our overall thoughts for REITs in 2024 in next month’s highly anticipated REIT Outlook, the 2024 Chilton REIT Forecast.

Isaac A. Shrand, CFA

ishrand@chiltoncapital.com

(713) 243-3219

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

RMS: 2,482 (11.30.2023) vs. 2,398 (12.31.2022) vs. 3,177 (12.31.2021) vs 1,433 (3.23.2020) and 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index and ETF performances [MSCI and VNQ and FNER and BBREINDU] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.

Leave a Reply Cancel reply

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.