The Time is REIT Now | April 2024

April 1, 2024

One of the most important jobs of REIT executives and Boards of Directors is capital allocation. Depending on cost of capital, acquisition and development yields, and the point in the real estate cycle, a public REIT will have to employ different capital allocation strategies. One of the forgotten and often purposely swept-under-the-rug line items is maintenance capital expenditures.

In both residential and commercial Real Estate, maintenance capital expenditures (or ‘capex’) are defined as the money that is needed to upkeep a property and minimize obsolescence. The expenditures run the gamut, from replacing major appliances, roofs, and parking lots to tenant improvements for new or replacement tenants. In most cases, these expenditures have a decidedly negative connotation due to the cash outlay required, which can hobble a homeowner’s budget or lower a landlord’s return on invested capital. As a result, they are often delayed until absolutely necessary.

Due to the access and availability of capital, combined with a focus on long term total returns, public REITs tend to have among the highest budgets for capex and seldom neglect properties to the point where they have to be sold with ‘deferred capex’. In addition to creating a better experience for tenants, investors tend to have less downside risk in their returns. Furthermore, in periods where other landlords are capital-constrained, public REITs can gain occupancy market share versus other landlords who are neglecting properties, and potentially buy them out at discounted prices. We believe today’s market exemplifies these characteristics, and that we are embarking upon an era where public REITs will gain market share, both with tenants and in size.

Private Equity Capital Allocation Model

Capital and time are the worst enemies of the private equity ownership model. Traditionally, a private equity fund has a general partner (GP) that puts the deal together, sometimes having ‘recourse’ on the debt (personal guarantees), though not always, and can put in 2% to 5% of the equity of a deal but collect 20% to 30% of the limited partners’ (LP) profits beyond a minimum internal rate of return (or IRR). Debt leverage is commonly in the range of 50-80% based upon our observations. The IRR is calculated as the annualized percent return on the equity capital invested, whereby a longer time horizon and higher capital invested decreases the IRR, and vice versa.

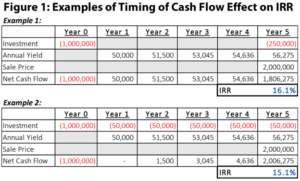

Implicitly, the GP is motivated to sell the project at the highest IRR, investing the least amount of capital. The formula also lowers IRR based on the timing of capital investment; thus, as it is with an owner of a home that renovates right before selling, a GP is motivated to defer the capex as long as possible. Figure 1 illustrates the effect on the timing of cash flows on IRR. Though it is not captured in the model, this can have serious implications on occupancy and rent as tenants may become frustrated with a landlord that is not properly maintaining a property.

If timed correctly, the private equity model can and has worked, enriching GPs and LPs alike. However, as we have said in this publication before, anything worth doing is worth overdoing, and with higher leverage. High returns tend to attract inexperienced private equity money, at best. At worst, it attracts bad actors. Either way, we are in the early innings of witnessing the effects of private equity owners who loaded up on properties at the height of the market, anticipating a hold period of three years or less. Instead, they are now stuck with deferred capex, lower net operating income, limited access to capital, rising interest expense, and pricing well below original expectations.

One example that will be the one of many private restructuring/foreclosures is Tides Equities. Tides was founded in 2016 when the company’s principals were 25 years old. Their strategy was to buy class B apartments with cheap debt, a strategy that has enriched many in the past. Returns in the first few years were fantastic, though mostly due to the benefit of low-cost leverage and declining cap rates. This attracted more investors and debt capital, leading to the deployment of billions of dollars in 2021 and 2022 – peak pricing for multifamily properties.

Unfortunately, equity investors will likely lose 100% of their money given how cap rates have moved up with rising interest rates (e.g., lower values) and cash flows have been penalized by too much high-cost variable rate debt.

One of the more surprising items we learned from the story was the low occupancy at all of their properties, as shown in Figure 2. At a time when the national occupancy is over 94% and there is definitively a housing shortage, the average occupancy of a portfolio they are trying to recapitalize was only 82% as of December 31, 2023. Real Estate Alert reported that there are $2.6 million in liens from contractors and vendors that have not been paid for work on the properties, so we can assume that deferred maintenance caused these properties to lose market share to competitors.

The ‘REIT Way’ to Maintain Properties

In contrast to Tides, average occupancy of public multifamily REITs was 95.7% as of December 31, 2023. Obviously, a prospective multifamily tenant would rather rent an apartment with working appliances, functioning HVAC, and a clean pool. We believe that the public REITs will gain significant market share from owners who have neglected the necessary capex at their properties in this cycle.

One of the more laughable assumptions we have seen in private deal brochures was that multifamily maintenance capex is budgeted at $200 to $250 per unit per year. Public REITs and equity research analysts have been leaders in debunking such a myth. For example, the average capex assumption for public multifamily REITs in 2024 is roughly $2,000 per unit per year just for normal upkeep. Renovations often run $15,000-20,000 per unit for bathroom and kitchen upgrades, for which REITs also provide detailed disclosures.

There are numerous, if not more extreme, examples in other property types beyond multifamily. Other property types with longer leases with corporations (e.g., retail, office, industrial) necessitate that the prospective tenant actually underwrite the landlord. These tenants need to know that the landlord is willing and able to maintain the property that drives employee/customer satisfaction. In retail and office in particular, public REITs are punching well above their weight in leasing and occupancy due to their ability to fund capex, which includes leasing commissions and tenant improvements (or TIs, defined as upfront money that the tenant can use to build out his or her space).

For example, Simon Property Group (NYSE: SPG), a mall/outlet REIT, leased over 18 million square feet in 2023, bringing its occupancy to 95.8% at the end of 2023. The compares to nationwide mall occupancy of 85.6%, a number that would be significantly lower if REIT-owned malls were excluded. Similarly, Boston Properties (NYSE: BXP), a Coastal office REIT, leased 4.5 million square feet in 2023, bringing its year end occupancy to 88.4%. In contrast, the national occupancy for office properties as of the same date was only 80.4%. Even more specifically, BXP’s San Francisco properties were 84.4% leased as of year-end, which compared to the city’s average occupancy of 64.4%.

Public REIT Capital Allocation

Most public REITs are astute capital allocators. Because they are infinite life vehicles, they are not forced to deploy capital after raising a fund, or forced to sell after a certain time period. When the transaction market is ‘hot’, it is easier for potential buyers to put less emphasis on maintenance capex and deferred capex’, and public REITs tend to be net sellers. In contrast, when markets are effectively frozen, public REITs are in the position to be acquirers at attractive prices that often are at significant discounts to replacement cost, in part due to the deferred capex that the seller is either unable or unwilling to spend. As shown in Figure 3, public REITs have historically been net sellers at peak pricing and net buyers in recessions.

Since real estate held in private hands tends to be heavily leveraged (typically with floating rate debt), private owners often have to cope with reduced cash flows in periods of rising interest rates due to higher interest expense. In such cases, they may be forced to sacrifice “best practices” used in property management. However, the superb access to capital and low leverage (mostly with fixed rate debt) of public REITs gives them a significant advantage during such times to attract tenants who are looking for a landlord that isn’t strapped for cash. Furthermore, public REITs can also use this capital advantage to buy out owners that are suffering negative cash flow or are under pressure from lenders.

Today, most REITs do not have the cost of capital to issue equity to make accretive acquisitions. If accretive opportunities don’t exist, reinvesting in the portfolios is the best use of capital to grow or maintain occupancy and ensure the long-term price appreciation of the properties. We expect public REITs to have elevated capex budgets for 2024 and 2025 (particularly in office and retail properties) while they wait for the transaction market to open up, which should create abundant accretive acquisitions (for some property types that time has already arrived; e.g., senior housing). For example, we expect public multifamily REITs to spend an average of 16.7% of their net operating income on maintenance capex in 2024 and 2025, after which we assume it will go back down toward their historical average of 10.6% (note that standard private equity assumption of $250 per unit would only equate to 1.4% of the average REIT NOI per unit).

Gaining a Bigger Piece of the Pie

The tumult of higher interest rates in 2023-2024 should result in REITs gaining market share as they did in 2008-2009 for the reasons above. Similar to the dynamic today, most real estate owners did not have the capital to provide TIs or maintain properties in 2009, leading to REITs maintaining occupancy much better than peers. We are already seeing evidence of this phenomenon in the leasing statistics. However, the hope in 2009 was that REITs would also be the beneficiaries of the tumult to buy properties at ‘distressed’ prices.

Unfortunately, this did not happen. The government bailed out the banks, allowing equity owners to roll loans at favorable terms while the Fed was cutting interest rates to zero. One of the biggest private to public transactions was BXP’s purchase of the GM Building in New York City from Harry Macklowe, alongside three other Midtown assets, for $3.9 billion. The other landmark deal was the purchase of Archstone from Lehman Brothers by Equity Residential and AvalonBay for a combined price of $6.5 billion. While neither was at fire sale prices, they were at significant discounts to replacement cost and were properties that the REITs would never have gotten if not for the financial stress of the previous owners.

In late 2024 and 2025, we believe public REITs will have a real opportunity to take advantage of distress. Instead of cutting interest rates to zero, the current expectation calls for only six 25 basis point cuts, leading to a Fed Funds Rate of 4% by December 2025. Assuming the interest rate curve is not inverted, a normal borrowing spread of 150-250 bps would lead to borrowing costs of at least 5.5%, likely not enough to help heavy borrowers with near term maturities. In addition, the government does not seem motivated to backstop bank commercial real estate loans as they were in 2009. Furthermore, even though many bank loans will go bad, there are even more risky loans held by credit funds. We are already seeing this market start to break, for which the government is certainly not motivated to backstop.

As such, though counterintuitive, public REITs are hoping for carnage. They have been preparing for this since 2009, as they watched private high leverage owners reap significant returns from 2010-2022 in a period where they had a blended cost of capital much lower than public REITs and record availability of capital. As shown in Figure 4, debt ratios are near record lows for REITs, both as net debt/EBITDA and debt/enterprise value. Dividend payout ratios are also near historic lows, giving them more free cash flow than ever.

For now, spending on capex and upgrades remains the best use of capital, combined with dividend increases and even stock buybacks. Compared to many private owners, the free cash flow is a luxury they could only wish for.

The 2024 Chilton REIT Forecast included ten bold predictions for 2024, many based on this exact dynamic. So far, we are on pace for at least one of them to come true. We predicted at least three REIT IPOs, and received one so far, driven by the cost and availability of capital dynamic. The other one that is related to this would be that REITs are able to increase portfolio size by 20% or more; we don’t know when this will happen, but the clock is ticking….

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Isaac A. Shrand, CFA

ishrand@chiltoncapital.com

(713) 243-3219

RMS: 2,719 (3.31.2024) vs. 2,727 (12.31.2023) vs. 2,398 (12.31.2022) vs. 3,177 (12.31.2021) vs 1,433 (3.23.2020) and 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index and ETF performances [MSCI and VNQ and FNER and LBUSTRUU] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.

Leave a Reply Cancel reply

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.