2019 Chilton REIT Forecast | January 2019

January 1, 2019

Volatility certainly ruled in 2018 once again, showing that 2017 was not a fluke. Depending on what day it was, the 2018 Chilton REIT Forecast either looked eerily prescient or completely flawed. As of December 31, 2018, the MSCI US REIT Index (Bloomberg: RMS G) finished the year with a total return of -4.6%, which compares to our original base case forecast of +5-10%, and revised base case forecast of +4-6% as of June 30. However, the rise in interest rates from 2.4% to 2.7% and a second half global selloff caused performance to finish within our bear case scenario of -5% to +1%.

Importantly, we correctly predicted another year of strong fundamentals. We forecast another year of positive fundamentals in 2019, which could produce REIT price appreciation of +7-12%. With a dividend yield of 5%, we believe 2019 will produce a total return in the range of +12-17%. The biggest risks to our 2019 outlook are an economic downturn, rising interest rates, and an uptick in new construction.

2018 Review

Early in the year, REITs were attached at the hip to long term interest rates, as they had been since 2012. From January 1 to February 21, the US 10 yr Treasury yield increased from 2.4% to 3.0% and the RMS G dropped by 12%. The drop in the index value without the corresponding decline in fundamentals led us to publish our March 2018 REIT Outlook titled, “Equity REITs: An Asymmetric Investment Opportunity.” In it, we summarized our belief that REITs were historically inexpensive, presenting an entry point that occurs only a few times every cycle. We also highlighted the extreme divergence in performance between the RMS G and the S&P 500, and showed that the divergence historically closed over the next 12 months, resulting in significant REIT outperformance. From when the outlook was published on March 1, 2018 through December 31, 2018, the RMS G produced a total return of +7.7%, besting the S&P 500 which had a total return of -4.9%.

Surprisingly, the US 10 yr Treasury yield was flat (although volatile) over that period of REIT outperformance. Although a decoupling from interest rates has been on the Chilton REIT Team Christmas wish list since 2012, this was not part of our bullish call. Instead, we merely looked at the past 20 years for other periods with similar valuation metrics. We found that such inexpensive valuation levels were only reached during and around recessions. Given our both near and intermediate term positive outlook for positive fundamentals, we felt confident that the market would eventually recognize the value of a predictable, growing income stream, especially when it is at a significant discount to where properties are trading on the private market.

Despite the RMS G finishing in bear market territory amid rising interest rates, REIT and S&P 500 total returns were almost identical. The S&P 500 produced a total return of -4.4% in 2018, only 20 basis points (or bps) ahead of the RMS G. 2018’s REIT performance, especially the rebound following the precipitous drop to start the year, should serve as a reminder that REITs can benefit in an environment of decelerating GDP growth and low inflation.

2019 Forecast

The most important takeaway from 2018 was the reemergence of the importance of diversification. In 2018, a portfolio of 55% S&P 500, 35% Barclays Aggregate Bond Index (Bloomberg: LBUSTRUU), and 10% RMS G produced a total return of -2.5% and a standard deviation of 8.8%, which compares to the S&P 500’s total return of -4.4% and standard deviation of 14.7%. Thus, a diversified portfolio produced a higher return with less risk.

Looking into 2019, we believe diversification will once again prove to be the prudent investment decision. We believe the economic environment will continue to be choppy as it was toward the end of 2018. GDP and job growth will slow for 2019 versus 2018, as consensus 2019 GDP growth is projected to be only 2.6% versus 2.9% for 2018, and 2019 consensus job growth is 157,000 per month, which compares to 204,000 per month in 2018. After commentary from the FOMC (Federal Open Market Committee) meeting on December 19, the market is now assuming only two rate hikes for 2019, which reflects a ‘data-dependent’ path. Assuming the Fed does not hike rates beyond the neutral rate and completely stave off growth, we do not believe a recession will occur in 2019.

In our opinion, the choppy yet positive economy (without a recession) could produce a near ‘goldilocks’ environment that could drive REIT prices from a current discount of over 14% to within 3-8% of NAV for the first time since 2016. If REITs achieve this by the end of 2019, and we assume a 25 bps capitalization rate (or ‘cap rate’) increase, and 3% same store net operating income (or SSNOI) growth (+3.8% with leverage), and +1% increase in NAV from retained cash flow, REIT prices should appreciate by 7-12%. Combined with a 4.6% dividend yield growing 5% during the year, the projected total return would be +12-17%.

We believe that REITs will be able to trade closer to NAV as REIT fund flows reverse course from the past four years, as shown in Figure 1. Over that time period, REITs struggled to trade at a premium to NAV partly due to massive flow of funds away from REITs. In the meantime, broad equity investors were rewarded for taking more risk, enjoying annualized returns well above those produced by REITs. However, we believe the elevated risk in the stock market in the fourth quarter of 2018 combined with the discounted valuation and lower risk profile of REITs sets the stage for a reversal of fund flows in 2019.

While we don’t forecast total returns for the S&P 500, we do feel the predictability of REIT earnings, NAV, and dividends over the next 12 months is higher than the predictability of S&P 500 earnings. REITs are also insulated from any direct effects from tariffs that could dampen S&P 500 earnings growth by upwards of 300 bps in 2019, according to Barclays and UBS. In addition, due to the one-time nature of the benefits from corporate tax reform in 2018, S&P 500 earnings growth is set to decelerate meaningfully in 2019. In contrast, REIT SSNOI and adjusted funds from operations (or AFFO) growth in 2019 should be as strong or stronger than in 2018. Therefore, investors may be interested in rotating out of sectors that have outperformed over the past four years and are now in a stage of decelerating growth.

The forecast is supported by benign new construction, attractive valuations, and the potential for merger and acquisition (or M&A) activity. Though construction has increased steadily during this cycle, we are still below the historical average for construction starts at 1.5% of existing stock. Despite what the Fed has said about inflation remaining subdued, construction costs have increased almost 33% since 2012. The result is positive for landlords as it increases replacement costs and, in most cases, eventually leads to higher rents.

As of December 31, 2018, REIT valuations are in the ‘extremely’ inexpensive range, which could attract generalist investors. According to ISI Research, the discount to NAV was 14%, which compares to the long term average premium of 1%. The AFFO multiple was 18.7x, which is above the 25 year average of 16.7x, but well below the 21.2x average over the past three years. Finally, the dividend yield of 4.6% compares to a US 10 yr Treasury yield of 2.7%, which equates to a spread of 190 bps. When compared to the 25 year average spread of 125 bps, REITs are almost 100 bps undervalued. As we mentioned in our October 2018 REIT Outlook, a spread that is 100 bps or more above the historical average has had an 80% correlation with positive total returns over the next two years.

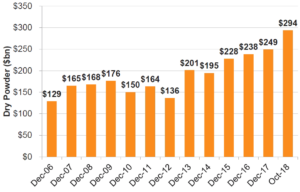

Finally, according to Preqin, a real estate private equity consultant, there is $294 billion in capital raised in private equity funds as of November 2018 with the purpose of investing in commercial real estate, an all-time record and up $45 billion from 2017 (Figure 2). The volatility of REITs in 2018 and high availability of capital generated appealing scenarios for both public to public and public to private transactions. As a result, there were $87 billion in M&A transactions in 2018, the most since 2006. We believe the ‘wall of capital’ combined with a positive US commercial real estate outlook will lead to another year of elevated M&A activity, which could be a catalyst to close the discount to NAV.

Sector Overweights

As a reminder, the REIT industry has come a long way toward inclusion of new sectors away from core real estate such as office buildings and apartments. We believe the differentiation between REITs and REIT sectors is not fully appreciated by most investors and it therefore makes generalizations about “all REITs” unreliable. Figure 3 shows the total returns of 16 REIT sectors in 2018. Within sectors, the results of individual REITs differed as well. For example, the best mall REIT produced a total return of +2.5% (SPG, owned in the Chilton REIT Composite) versus the worst at -60.0% (CBL, not owned in the Chilton REIT Composite). We believe this is why active management in REITs allows for the generation of alpha over long periods.

Going into 2019, the largest overweights in the Chilton REIT Composite are cell towers, residential, and malls. The largest underweights are healthcare, triple net, and lodging.

After a tumultuous start to the year, the three cell tower REITs provided a modest contribution to the Composite’s relative total return in 2018, particularly American Tower (NYSE: AMT), which led the three REITs with a total return of +13.3%. The first half of 2018 was plagued by the rumor, and then actual announcement, of a merger agreement between Sprint (NYSE: S) and T-Mobile (NYSE: TMUS). If approved by the Department of Justice and Federal Trade Commission, the companies plan to decommission 35,000 cell sites as the leases mature over the next 10 years (average remaining term is 3-7 years depending on the tower owner). However, they have also announced plans to add 10,000 new sites and significantly increase utilization at 60,000 sites (which normally results in rent increases) in the near term. Whether or not the deal is approved in 2019, we believe the positive near-term fundamentals driven by 5G upgrades, FirstNet rollout (potentially 40,000 new leases), and international smartphone penetration will far outweigh any headwinds from Sprint non-renewals.

The residential sector was also a positive contributor in 2018, led by Essex (NYSE: ESS) which benefited from the failure of a proposition to allow for more rent control in California. The biggest laggards were the single family rental REITs: Invitation Homes (NYSE: INVH) and American Homes 4 Rent (NYSE: AMH). Both had issues controlling expenses, particularly related to Hurricane Florence. We believe the solid story of increasing demand from job growth and the lack of new supply will drive a rebound in the single family rental REITs and continued outperformance by the apartment REITs, especially if mortgage rates remain at or above current levels. Additionally, limits on deductibility of interest expense and property taxes for homeowners have decreased affordability somewhat in favor of rental options.

Finally, malls were a lightning rod for speculators who believe that e-commerce will make brick-and-mortar retail obsolete. Other than Simon Property Group (NYSE: SPG), all mall REITs underperformed in 2018, with the low quality mall REITs at the back of the pack. The Sears bankruptcy, albeit official now, is still an overhang as landlords aren’t sure if the company will ultimately close all stores, or just the ones on the initial list in the filing. In addition, JCPenney’s (NYSE: JCP) stock price was down 67.1% in 2018, leading some to believe it could be the next department store to announce store closures. And Macy’s could soon follow with more closures, though its total return was +23.7% in 2018. We maintain that high quality mall REITs with access to capital will be able to survive and thrive in the changing retail environment. As such, SPG is the largest holding in the Composite as of December 31, 2018.

Healthcare and Triple Net had improbably solid total returns in 2018. Both are known as interest rate sensitive sectors, and thus their outperformance despite the 30 bps increase in the US 10 yr Treasury yield over the year was surprising. We believe that both will underperform other REIT sectors that offer higher growth in the current environment. In addition, their outperformance this year has resulted in both sectors trading at NAV premiums at the same time that most REITs are trading at a discount to NAV. Similarly, lodging REITs are trading at premium valuations but offer little growth in the face of high supply.

What is Different This Time?

Admittedly, we are not proud of the relative performance of the Chilton REIT Composite in 2018, the first year of underperformance to the benchmark since 2010. We attribute the underperformance to the lack of healthcare and triple net exposure, which attracted investors looking for safety (in the form of long term leases) and high dividend yields. In addition, the Composite allocation to several mid-tier quality shopping center REITs and lack of exposure to a few higher quality shopping center names detracted from the Composite’s relative return.

In 2019, we believe some of our names that caused the underperformance will stabilize, and the portfolio is positioned to regain outperformance versus the benchmark. Notable changes in 2018 include an overweight allocation to the single family rental REITs (versus prior zero exposure), zero self storage exposure (versus prior slight underweight), and an overweight position in industrial (versus prior underweight).

As a result of portfolio positioning, weighted average NAV discount of the Chilton REIT Composite is 17%, which compares to the REIT weighted average of 14% as of December 31, 2018. Although the dividend yield of the Composite is lower than the index at only 3.6% (versus 4.6% for the RMZ), the 2019 expected dividend growth of the Composite is approximately 6%, which compares to industry estimates of 5%. We believe this portfolio of high growth at a discounted value will produce returns above the index in 2019, and resume the Chilton REIT Team historical trend of 190 bps net of fees (280 bps gross of fees) in annual outperformance since 2005.

Parker Rhea, prhea@chiltonreit.com, (713) 243-3211

Matthew R. Werner, CFA, mwerner@chiltonreit.com, (713) 243-3234

Bruce G. Garrison, CFA, bgarrison@chiltonreit.com, (713) 243-3233

Blane T. Cheatham, bcheatham@chiltonreit.com, (713) 243-3266

RMS: 1909 (12.31.2018) vs 2000 (12.31.2017) vs. 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/reit-outlook.html.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.