REIT Week Takeaways | July 2019

July 1, 2019

Equity REITs have become a ‘mirror’ of the US economy, and it’s increasingly difficult to make generalizations about all REITs since fundamental drivers vary among the 15 REIT sectors. But, as yield-oriented companies, they do benefit when interest rates move downward as we have seen recently. As of June 30, 2019, Equity REITs are up 18% year-to-date based upon the total return of the MSCI REIT Index (Bloomberg: RMZ), while the 10 year US Treasury yield is down 68 basis points (or bps) over the same period.

The Chilton REIT team recently attended the REIT Week Convention in New York City, meeting with over 50 management teams and conducting several property tours over four days. We used the opportunity to update ourselves on current holdings and also to broaden our knowledge of some of the new sectors; namely, Timber and Gaming REITs. We returned to Houston with valuable knowledge from our meetings, and include some of the most poignant below.

Malls

Several management teams felt we are near a tipping point on the outlook for brick-and-mortar retail following years of decline in market share due principally to e-commerce. Many retailers are adapting to the necessity of a better customer experience, and the ‘buy on line and pick up in store (or BOPIS) has gained considerable traction.

Department store closures led by Sears and BonTon have created major vacancies in malls across the country. In their place, management teams are implementing a variety of repositioning programs that is replacing conventional retail space with diverse categories such as health & wellness, off-price, dining, entertainment, and arts and crafts. In addition, these closures have freed up underutilized land for densification with apartments, office, and hotels, particularly for well-located properties in densely-populated cities. These efforts take time to implement and require huge capital expenditures.

At the same time, in-line tenant health remains a big concern as many malls are ‘stuck in the eighties’ with outdated stores and insufficient capital to make up for lost time. Thus, store closures should remain above average for the foreseeable future. So, it is not surprising that these REITs are selling at 10.9x 2020 FFO estimates as of June 27, the lowest multiple since the great recession of 2009. This compares to the REIT weighted average of 15.9x, and the mall 20 year average of 12.1x. We are slightly overweight to the mall sector, and our largest holding is in Simon Property Group (NYSE: SPG). We hold smaller, speculative positions in Macerich (NYSE: MAC) and Washington Prime Group (NYSE: WPG). All three are selling at discounts (17% or more!) to net asset value (or NAV), which we believe adequately discounts the aforementioned risk factors.

Shopping Centers

Grocery-anchored centers remain the favorite in this sector due to fundamentals holding up much better than power centers and unanchored strip centers. The strongest grocers such as Publix, Whole Foods, and HEB have significant expansion plans, and are reinvesting in the current store base. Regency Centers (NYSE: REG), our largest holding in this sector, cites record volume of grocer sales averaging $650 per square foot in 2018, or $32 million annually, up for the first time after three years at $31 million. The top tier centers that account for 85% of total grocer rent average $700 per square foot.

In contrast, the typical power center ‘big box’ retailers such as Bed Bath & Beyond, Petco, Office Depot, and Pier 1 are likely to reduce their store bases. Management teams claim there has been sufficient demand from other retailers such as TJX, Ross, Burlington, and Ulta to at least stabilize most assets, which is allowing REITs to maintain a high leased percentage. However, the cost of re-tenanting and the time between lease-signing and rent-paying status has resulted in lackluster trends in FFO that will prevail for another year or two.

However, balance sheet strength is considerably better than most malls REITs with leverage ratios averaging less than 35%. In addition, most shopping center REITs produce sufficient free cash flow to fund redevelopment. And, portfolio quality is at a historical high for most as lesser quality properties have been sold over the past several years, resulting in improved population density and average household income metrics. The Chilton REIT Composite is slightly underweight the sector due to the lack of near term cash flow growth.

Single Family Rentals (or SFR)

Within the sector, American Homes 4 Rent (NYSE: AMH) is distinguishing itself from Invitation Homes (NYSE: INVH) through a development program, which enables the company to own homes for 15% below what it would cost to buy from a builder. Furthermore, the home design is ideal for renters, focusing more on durability than aesthetics. AMH plans to deliver 1,000 homes in 2019, and will ramp up to 2,000 homes in 2020. In addition to achieving higher yields, the new homes will also benefit from higher margins and lower capital expenditures due to efficiency and durability of a brand new product. AMH has the luxury of aggressively pursuing development due to its low leverage of only 4.9x net debt/EBITDA.

In contrast, INVH is pursuing acquisitions selectively as it attempts to lower its leverage (8.4x net debt/EBITDA currently, versus the REIT average of 5.4x). Funding will come via free cash flow and dispositions in slow-growth markets where it can achieve ‘retail pricing’. Both AMH and INVH are cautious about property taxes, which are up across the board. AMH alone protested 22,000 appraisals in 2018, and anticipates protesting over 25,000 in 2019. With a historical 40% success rate, these protests can add significant value and earnings growth. We are overweight the SFR sector based on favorable supply/demand dynamics and a runway for margin expansion.

Apartments

Apartment REITs are focusing on driving top line growth through supplemental revenue items such as charging for parking and package lockers, and cutting expenses through the use of technology. As a result, these companies can grow same store net operating income (or SSNOI) faster than the typical apartment owner in a market. These programs are in the early stages, but we are optimistic that the apartment REITs will continue to be at the forefront of industry trends, resulting in market leading cash flow growth. Examples include ‘Smart Home’ technology packages (i.e.. keyless locks, smart thermostats, and smart light switches), self-guided touring, and other time-saving initiatives that have allowed 10% property level staffing cuts. UDR (NYSE: UDR) expects to cut another 20% in field personnel expenses due to outsourcing jobs that have high turnover (>40%!). We are overweight the apartment sector due to favorable supply/demand dynamics and reasonable valuation metrics (3% NAV premium vs 0% premium for all REITs, per ISI as of June 27, 2019).

Timber

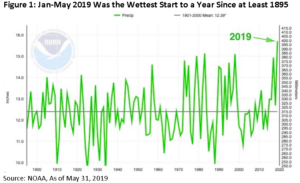

The timber REITs laid out the case for higher lumber prices due to a decrease in ‘inventory’ as new home sales have been outpacing new home starts. This creates a supply/demand imbalance, eventually leading to higher starts. Flattening home starts have been mostly attributable to one of the wettest seasons we have had in recorded history, which makes it more difficult to pour foundations for new homes. In addition, the wet weather makes it difficult for the timber companies to get their equipment deep into the forest, which made it difficult to meet volume targets.

The first five months of 2019 have been so wet (see Figure 1) that 2019 has produced three of the top five wettest 12 months since data records began in 1895 (including the top two!). As the weather dries out, housing starts should rebound, and timber companies will be able to increase their volume. We are overweight the timber REIT sector due to attractive valuations and the potential for single family home starts to reaccelerate.

Gaming

The gaming REITs touted the benefits of the ‘prop co/op co’ model, which is giving much needed capital to gaming operators to enhance their credit quality. At the same time, the REITs are acquiring properties a cap rates (7-9%) significantly higher than most other property types (REIT implied cap rate = 5.5% as of June 25, 2019), and trade at lower multiples and NAV premiums than their net lease peers. In addition, the REITs have ROFRs (Right Of First Refusals) for a pipeline of accretive acquisitions that should fuel growth for years.

On June 24, Caesars announced a merger agreement with Eldorado Resorts (NYSE: ERI), which enhances the credit profile for VICI Properties’ (NYSE: VICI) largest tenant. The transaction included the acquisition of three Harrah’s properties (New Orleans, Atlantic City, and Laughlin), along with two ROFRs on the Las Vegas strip. In conjunction with the announcement, VICI conducted a 100 million share offering which raised almost $2.2 billion, the largest equity raise in REIT history that we’re aware of. We are overweight the gaming REIT sector due to the pipeline of accretive acquisitions and the valuation gap versus other triple net REITs.

Industrial

For the third year in a row, industrial REITs were the belle of the NAREIT ball. For the first time, the themes of e-commerce and last mile supply chains dominated all industrial meetings we attended. Concerns about supply, all-time low cap rates, and obsolescence faded far into the background. Companies continued to stress their exposure to ‘last mile’ warehouses, with many applying generous definitions of the term and one large REIT decorating its room with six poster board aerials photos of its biggest ‘infill developments’. By contrast, REITs remained skeptical of the long-term prospects of multi-story warehouses being built for Amazon by merchant builders such as Hillwood and Seefried Properties, which we wrote about in our May REIT Outlook.

While industrial has outperformed all other REIT sectors since 2016, industrial REITs were particularly confident this year because of Blackstone’s (NYSE: BX) recent acquisition of 179 million sqft of US industrial properties from GLP for $18.7 billion. This was the second largest industrial real estate transaction ever, just behind the $20 billion merger of AMB and ProLogis in 2011. The portfolio was well-known, and REIT management estimated a 4.7-4.8% forward cash cap rate. All of the REITs said that the GLP portfolio was inferior to the five largest national industrial REITs, two of which had averaged implied cap rates well above 5% when the deal was announced (LPT at 5.7% and FR at 5.3%). Since the GLP announcement, industrial REITs have outperformed the RMZ by 460 bps through June 30. We are slightly underweight the industrial sector due to valuation, but have been increasing our holdings on pullbacks.

Data Centers

For the second year in a row, meetings with data center REITs focused on the expected pace of near-term hyperscale leasing, and continued cap rate compression in the space. There was a general consensus that leasing will be slightly softer in 2019 than 2018, as cloud companies are still digesting the record amount of space they leased in 2018. This is particularly pronounced in Northern Virginia, the world’s largest data center market, which has historically been dominated by Amazon Web Services. Typically it has taken 6-12 months for the top 10 cloud companies to fully occupy space leased in previous record years (2014, 2016), but as DLR and CONE reminded investors, there is nothing typical about the current level of cloud-driven data center demand.

Over the past few years private and public owners of data centers were both responsible for driving down data center cap rates, but increasingly data center REITs are letting private equity and infrastructure investors set new pricing records by selling them interests into joint ventures. In total, we estimate that over $3.5 billion of data center assets have moved from public to private hands in the past 12 months, with recent transactions setting new lows for cap rates for long-term leased data center shells (high 4%/low 5%). At least one REIT CFO suggested we may have seen the bottom in private market cap rates for the space, but, with data center REITs trading at implied cap rates of 5.5-7.5%, we would not be surprised to see additional joint ventures push cap rates down even further. We are overweight data centers, specifically Equinix (NYSE: EQIX) due to its attractive organic growth from network-dense data centers at essential worldwide internet nodes.

Towers

Notably, tower REITs and investors were less concerned about the proposed merger of Sprint (NYSE: S) and T-Mobile (NASDAQ: TMUS) than they had been at the Citi conference in March. This was mainly due to increased government scrutiny of the deal at both federal and state levels, but it was also due to a Bloomberg article on May 29 which claimed that the Justice Department was holding firm on four national wireless carriers, as well as a May 30 Reuters report suggesting that Amazon might dip its toe into the prepaid wireless market. Combined, these developments have reminded investors that there are more than three large, healthy companies leasing cell towers. SBA Communications (NYSE: SBAC) said that it has particularly benefited from leasing by Dish, which comprised ~15% of leasing in 1Q19.

We had excellent meetings with all three of the tower REITs, including SBAC, which attended the conference for the first time and has recently seen its ownership by REIT-dedicated investors approach that of its larger peers. Crown Castle (NYSE: CCI) deftly fielded several questions about Zayo Group (NYSE: ZAYO) and the 10.5x EBITDA (or Earnings Before Interest, Taxes, Depreciation, and Amortization) multiple at which it is going private, stressing that its 70,000 miles of fiber and 40,000 small cells are in much more urban locations than ZAYO, where it believes the shared infrastructure model will be much more successful.

The tower REITs also indicated that they were increasingly meeting with public and private equity infrastructure investors, the same investors whose low return thresholds and long-term time horizons have provided a tailwind for data centers. We are overweight cell tower REITs due to their high organic growth and the potential for upward earnings revisions from 5G implementation over the next few years.

Office

As one would expect, we took advantage of our time in NYC to tour several office properties. We attended tours of Vornado’s (NYSE: VNO) Farley Office project and Boston Properties’ (NYSE: BXP) GM Building, walked Related’s Hudson Yards, Brookfield’s Manhattan West, and SL Green’s (NYSE: SLG) One Vanderbilt, and visited all three of Manhattan’s large observation decks. What we saw was not particularly inspiring.

While gross absorption (demand) was strong in Manhattan in 2018 and 1Q19, Cushman Wakefield reported the worst quarterly net absorption (demand minus supply) number in three years in 1Q19 (-3.3 million sqft). Cushman projects 9.5 million sqft of new supply to deliver in 2019, the highest annual total since 1972. Several office REITs expect NYC rent growth and net absorption to be below trend for another year or two, especially in the Midtown West and Downtown markets. Preleasing at modern projects built for dense open-plan layouts (Hudson Yards, Manhattan West, and One Vanderbilt) has been strong, but they are largely consolidations of larger less dense leases in older buildings, resulting in net negative absorption overall. We are slightly overweight office due to discounted New York valuations and West Coast value creation. The difference between the NYC and the West Coast office fundamental can be seen in Figure 2.

The 20,000 ft View

The overall sentiment was decidedly positive, even for Manhattan office and class B mall landlords. Even with the RMZ within 5% of its all-time high price as of June 30, we believe the Chilton REIT Composite is poised to outperform due to opportunities available from current mispricing or an ability to exceed consensus expectations.

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

Parker Rhea

prhea@chiltonreit.com

(713) 243-3211

RMS: 2248 (6.30.2019) vs 1909 (12.31.2018) vs 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.