Mall REITs: Charting New Territory | August 2019

August 1, 2019

Another month, another retail bankruptcy, another ‘win’ for e-commerce, and a ‘loss’ for brick-and-mortar. Houston-based Charming Charlie’s filed for Chapter 11 bankruptcy on July 11, which will result in 261 store closings across the country. It is the second bankruptcy in as many years for Charming Charlie’s, which the media roundly blames on the impact of e-commerce. In our opinion, this retailer was doomed to fail, and e-commerce only accelerated its demise.

As such, we believe that e-commerce is only a threat to retailers that do not have what it takes to be successful. Some of the recent retail bankruptcies can blame stock-buybacks (Sears) or too much debt (Toys ‘R’ Us), but, regardless of the reason, those that were not able to (or chose not to) invest in both the brick-and-mortar and the e-commerce platforms were likely already on a path toward bankruptcy that would be difficult (or impossible) to reverse. The same is true for many retailers that are operating today that have yet to figure it out, but are already following that same path. Barney’s and Pier One are examples of retailers that are on the brink, and we doubt a Chapter 11 reorganization will fix the core issues with these businesses.

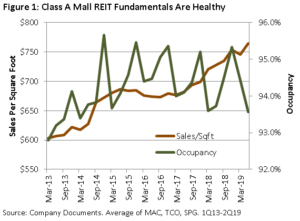

As of June 30, there have been 7,062 store closures announced, the largest in history through this date according to CoreSight Research. However, the ‘wave’ of store closures has directly resulted in a surge of leasing at the mall REITs. Although occupancy has dipped slightly, particularly due to the large footprints vacated by department stores, the REITs have been successful in backfilling these spaces with various new tenants that are enhancing the experience at the mall. As shown in Figure 1, the Class A mall REIT fundamentals have been solid over the past six years.

In addition, the retailers closing were on a path toward failure (or may have already failed) and thus were not contributing to the mall ecosystem, while the new tenants are bringing in new visitors and shoppers, thereby creating a ‘positive feedback loop’ that strengthens the mall. Furthermore, retail doesn’t have to be the end-use anymore. Residential, hotel, office, medical, and even an NHL practice rink are taking the place of formerly dying department stores. The temporary effect on earnings and capital expenditures is undeniably painful; however, we believe that the end-result will be the resumption of positive long term growth.

E-commerce Blame Game

The regional mall essentially changed the course of many downtowns in America by attracting retailers due to the draw of multiple department stores in one place. The formula worked extremely well for years as suburbs grew in most cities and people needed convenient places to shop. But for a few exceptions, the in-line tenants were the same, the department stores offered the same merchandise, and the destinations increasingly became boring and ‘over-stored’ with too many apparel offerings. Over the years, demographics changed as well. Then, e-commerce came along, and many retailers found out the hard way they were either ’stuck in the past’ with tired concepts, over-levered, and/or expanded too fast geographically with stores that were too large.

Sears and JCPenney have made a name for themselves due to their declining earnings, stock prices, and store counts. Given that their average rent per square foot is about $4 per year, or less than one fourth the average rent of a self storage unit, these retailers failed miserably. The latest big box retailer to generate negative headlines is Forever 21, which expanded too rapidly with footprints that were too large, using too much debt. Especially unfortunate for Forever 21, it was not able to sign anchor leases 20-50 years ago at extremely favorable levels. While we don’t know the timing of the potential demise of each of these three retailers, we can only wonder when, not if, they will be filing for bankruptcy to break more leases, giving back more square footage to landlords.

Fortunately for mall landlords and real estate investors, the value of their investments is in the real estate, not the tenants. Though closures are elevated currently, we believe this is temporary as retailers that would’ve failed in the next several years are being pulled forward. In their places, new, vibrant, and well-capitalized retailers are taking brick-and-mortar space at higher rents than those tenants that left (MUCH higher in the case of a department store replacement) and drawing in more traffic, which will help to attract better retailers at higher rent in the rest of the mall (i.e. the ‘positive feedback loop’). As we discuss below, location-based entertainment concepts are now possible given that so much land has been recaptured by the mall owners.

Big Boxes = Big Changes

The REITs that own malls are responding to the challenges. Unlike in the past, there is no set formula for reconfiguring the mall with traditional retailers, but one trend is apparent. Thus far, experiential tenants such a dining, entertainment, and fitness are accounting for over 50% of recent leasing activity. Additionally, many digital native stores such as Casper, Hope & Henry, Untuckit, and Peloton are recognizing that a brick and mortar presence is the cornerstone of any successful retailer’s strategy.

The list of retailers willing to take large blocks of space is much smaller than those willing to take small shop (less than 10,000 sqft) space. However, there are some prominent and successful retailers that are taking up large blocks at malls with solid demographics and well-capitalized landlords. Some of the retail tenants replacing department stores include grocery stores (Whole Foods, Kroger, Trader Joes, Publix), entertainment (Round 1, Dave and Busters, Pinstripes), discount stores (Ross, TJ Maxx, Marshall’s), furniture (The RoomPlace, Restoration Hardware), fitness (Life Time, LA Fitness), dining (outward facing restaurants, no more food courts), and even an NHL practice rink.

Naysayers would say these moves are being done out of desperation, and landlords are taking whatever deals they can get. While that may be true for some landlords, we argue the publicly traded mall REITs are thoughtfully and proactively re-tenanting their malls with vibrant tenants that will positively influence the ecosystem while minimizing credit risk and obsolescence risk. While it may appear to be a high-risk strategy, we believe that it is actually higher-risk to maintain the status quo.

Alternative Use

Similar to a retail tenant that can bring positive new traffic to a mall, a residential, medical, office, or hotel property can do the same. Such uses may not have been considered in the past because it can be costly, both in capital and downtime. Now, those investments may prove worth it as department stores no longer bring in the traffic that entitled them such low anchor rents. In contrast, apartment, medical, hotel, and office rents can be 4-5x higher and also be traffic drivers. Again, naysayers may claim that a change in use to something other than retail is just another symptom of the ‘dying’ brick-and-mortar retail market. As real estate investors, we believe that these real estate companies should always pursue the ‘highest and best use’ for the land that they own. As rents can change for property types over the years, it only stands to reason that the highest and best use will change as land values and demographics change.

As an example, many industry observers may have been surprised to hear that Simon Property Group (NYSE: SPG) was going to demolish Northgate Mall in Seattle, an A-minus rated mall that generates $15 million in annual net operating income (or NOI). Northgate is somewhat symbolic as it is known as the country’s first enclosed mall, built in 1950. We think it’s a sign that the real estate is worth much more than when the mall was built 70 years ago, and SPG can generate significant profits for shareholders by investing significantly in the property, even after factoring in the downtime. SPG plans to add 1 million sqft of office, 372 hotel rooms, 1,032 multifamily units, and even a practice rink for the NHL’s newest expansion franchise. As of March 31, 2019, SPG’s development pipeline of almost $1.5 billion is expected to produce an 8% blended return. At a 5.6% cap rate, SPG would be generating a profit of almost $700 million, or $2 per share. SPG closed at $158 per share as of July 23.

Small Shop Growth

Outside of the department stores, small shops are turning over in-line with historical averages, allowing mall landlords to get rid of failing stores and bring in new concepts. There are several new concepts currently in the infant stage that we believe could become a significant driver of traffic to the mall.

CBD

Retailers specializing in CBD products are setting up kiosks in malls across the country. CBD, or cannabidiol, is made by extracting oil from the cannabis (hemp) plant. Because it does not contain THC, CBD has gained federal approval for use in a multitude of products, including lotions and oils. Some refer to this as the next ‘gold rush’ and are predicting a multi-billion dollar business. These products are gaining momentum primarily in the health and wellness world due to their beneficial impact on a variety of ailments such as chronic pain and anxiety. SPG will have 108 properties with such offerings operating principally under the Seventh Sense Botanical Therapy brand. In addition, SPG received shares and warrants in Seventh Sense’s parent company, Green Growth Brands, which will allow SPG shareholders to further participate in the ‘gold rush’ if it is pans out. Similarly, Macerich (NYSE: MAC) is negotiating with a CBD tenant planning to add 2-3 kiosks to every MAC mall.

Esports

Recently, SPG made a small investment in Black Ridge, a company that is affiliated with Allied Esports, a global entertainment company that provides both physical and mobile locations for customers to play a variety of video games such as Gears of War, War Thunder, World of Tanks, Pokémon, and Tetris on a professional level. Simon plans physical locations in 12-15 malls across the country. Each will occupy up to 15,000 square feet and leases will run five to seven years. Management believes they will act as significant traffic generators and help attract other synergistic tenants. Notably, the avid gamer may not have historically trafficked an enclosed mall, thereby bringing a new demographic into the mall. In addition, they will launch the Simon Cup combining online and in-person elements for regional tournaments in New York and Los Angeles. Winners will advance to the HyperX Esports Arena at the Luxor in Las Vegas.

Co-Working

WeWork and Industrious are co-working companies that are finding locating in malls to be very successful. They provide well-appointed space with conference rooms, common spaces, phone rooms, and wellness rooms for a variety of tenants staffed with a dedicated hospitality team. MAC opened the first Industrious space at a mall in January, a 33,000 sqft space adjacent to Apple at Scottsdale Fashion Square. Of the company’s 75 locations, Industrious says that Scottsdale Fashion Square was its best opening ever, doubling the company’s expectations. Industrious CEO Jamie Hodari cited the ‘highly amenitized’ environment provided by a mall for its success at Scottsdale Fashion Square. As a result, Industrious signed leases with MAC to open this year at Broadway Plaza (Walnut Creek, CA) and Country Club Plaza (Kansas City, MO). SPG has one lease with WeWork at its Clearfork (Fort Worth, TX) property, and plans to open a Life Time Work facility as part of its massive Phipps Plaza (Atlanta, GA) redevelopment.

Valuation

With very few transactions of malls (and zero for class A malls), the price that investors are willing to pay for a mall is murky at best. As such, public mall REITs are the best clues we have on where prices are, or at least where they are going. Using mall REIT share prices, investors seem to believe market values have fallen significantly. The three and five year cumulative total returns of the NAREIT regional mall sector as of June 30, 2019 are -23% and -14%, respectively, which compare to the MSCI US REIT Index (Bloomberg: RMZ) total returns of +4% and +8%.

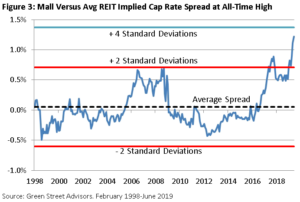

While we can’t say with certainty what the valuations should be, we are confident that the pendulum has swung too far. MAC, owner of a portfolio with average sales per sqft of over $746 as of March 31, 2019 ($869 weighted by net operating income) is trading at a 7.6% implied cap rate as of July 22, 2019. This compares to an estimated cap rate below 5% on the Westfield-Unibail transaction 18 months ago, and 6% cap rate for GGP 12 months ago, both of which had similarly productive class A mall portfolios. As shown in Figure 3, the spread between the mall REIT implied cap rate and the REIT major sector average is well above the all-time high and within spitting distance of the 4 standard deviation line. A move to four standard deviations away from the mean should only occur in 0.1% of the population in the sample, which indicates we are well into uncharted territory. A return merely to the 2 standard deviation line (5% of the population in the sample) would generate significant outperformance for mall investors relative to the benchmark.

We cannot say when this reversal will take place, but we believe that we are being compensated for the risk with historically high dividend yields and the backstop of the value of the land. A good example is MAC’s conversion of Westside Pavilion in West Los Angeles from a dying mall to an office building. Before a shovel was barely put in the ground, Google agreed to occupy the entire property (600,000 sqft) upon completion of the renovation.

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

RMS: 2276 (7.31.2019) vs 1909 (12.31.2018) vs 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.