Revisiting the 2019 Chilton REIT Forecast | September 2019

September 1, 2019

On August 29, the US 10 year US Treasury yield was 1.5%, approximately one basis point (or bp) below the US 2 year Treasury yield. This ‘inverted’ yield curve has predicated each recession by an average of 19 months for the past 50 years. Figure 1 shows the past 20 years of the spread between the two metrics, with the shaded areas representing recessions. Accordingly, the inverted yield curve sent the market into a freefall for several days in August, and has continued to fuel volatility.

Despite the recessionary signal, equity markets have historically rallied after the inversion. As such, the S&P 500 is near record highs and may continue to climb higher. The prospect of a lower yield environment coupled with positive near term fundamentals also bodes well for the near term total return of REITs.

Since we published our 2019 REIT Forecast in January, the MSCI US REIT Index (Bloomberg: RMZ) has produced a total return of +21.9% through August 28. This compares to our prediction of +12-17% for the full year. A major assumption underlying our forecast was that the 10 year Treasury yield would be somewhat ‘range-bound’ around the January 1, 2019 yield of 2.7%. Obviously, that has not been the case, and we now believe it will finish the year well below any of our forecasted scenarios. Given the increased relative attractiveness of the REIT dividend yield, we believe total returns should be positive for the balance of the year, which would result in a full year 2019 total return of +24% to +29%.

The volatility and broad upward move in REIT prices has created an opportunity to reposition the portfolio for a lower interest rate environment. As such, we have decreased our exposure to malls and shopping centers, while increasing our exposure to sectors that are less dependent upon economic growth such as residential, triple net, and data centers/cell towers.

How We Got Here

Practically speaking, an inverted yield curve is signaling that the market is willing to pay a premium (higher price = lower yield) for long term safety. At the same time, the short end of the curve is controlled more by the Federal Reserve; specifically, the Federal Open Market Committee (or FOMC) sets the overnight borrowing rates for banks, known as the ‘Fed Funds Rate’. An inverted yield curve is also implying that the FOMC will cut the Fed Funds Rate at future meetings.

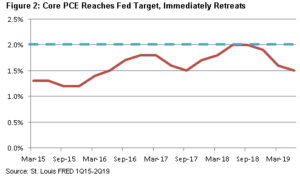

In this case, the Fed’s decision to raise short term rates four times in 2018 increased the Effective Fed Funds Rate from 1.4% to 2.4% in a mere 12 months. The Fed stated that the decision was ‘data driven’ by a strong economy with inflation (as measured by Core PCE) that was getting close to the long-term target of 2%. While this was true for the most part as shown in Figure 2, many speculated that it was also in an attempt to give the Fed room to cut rates again in the future (the lower the rate, the less ‘room’ to cut rates).

What the Fed may not have realized was how protracted the trade war with China (and other countries) would become. While we don’t claim to know any more than the ‘experts’ about the potential outcomes of a trade war, or whether it is for the right reasons, we can say the effect on the US economy has been visible. GDP growth slowed from +3.5% in 2Q18 to only +2.1% in 2Q19. Similarly, Core PCE decelerated from +2.0% in 3Q18 to 1.5% in 2Q19, as shown in Figure 2.

As a result, the Fed cut the Fed Funds Rate by 25 bps in its August 2019 meeting, marking one of the shortest intervals between a rate hike and a rate cut in 20 years. Furthermore, the market is anticipating at least two more rate cuts in 2019 and another one in 2020, which would bring the Fed Funds Rate target to 1.25-1.50%. Ideally, these rate cuts would stimulate lending and investment, helping to increase Core PCE and stave off further GDP deceleration. History has shown that this can sometimes delay a recession (hence the stock market increases after yield curve inversion), but it cannot completely stave one off.

What’s Different This Time?

While GDP growth has decelerated, some pockets of the economy are standing very tall. For example, unemployment is at a mere 3.7% and retail sales rose 3.4% in June versus the same month in 2018. This is the lowest unemployment in 50 years and the second highest year over year retail sales growth in 2019. While GDP growth and hiring has slowed, the country still has added 165,000 jobs per month in 2019 through July (inline with the consensus heading into 2019), and unemployment has actually decreased year to date from 4.0% in January to 3.7%.

We believe that this most recent cut and the inverted yield curve are unique in that the economy could reverse course should there be a resolution in the trade war with China. For example, a major contributor to the lack of GDP growth is the slowing private capital investment, which actually turned negative in 2Q19. We believe a major contributor to the declining capital investment is the uncertainty surrounding the future tariffs (or lack thereof) with China, and the corresponding effect on the US dollar, supply chains, and customer base. Though there would be a slight lag, a trade deal would likely reaccelerate capital investment, employment, and inflation. Again, we can’t claim to know any more about the President’s plan to resolve the dispute; however, the ‘stroke of the pen’ risk cuts both ways. In other words, he could end this even quicker than it got to where it is today.

Effect on REIT Fundamentals

As we wrote in our September 2018 REIT Outlook, REIT investors are extremely protected against a trade war given their domestic focus and contractual leases. While individual property types such as industrial (though less so than historically), lodging, and retail are the most at risk within the REIT sector, they are far better off than the average S&P 500 company, which derives over 40% of its revenue from overseas.

Generally speaking, we believe this trade war will have no short-term effect on net operating income (or NOI; rental revenue minus operating expenses). Bottom-line REIT AFFO (or Adjusted Funds From Operations) could accelerate above current estimates as long term debt continues to be refinanced at accretive rates, providing a short and intermediate term boost. This would also lead to higher dividend growth. As an example, Regency Centers (NASDAQ: REG) recently set a record for a REIT when they issued 10-year unsecured debt with a coupon rate below 3%. This compares to a weighted average cost of debt for the entire company as of June 30, 2019 of 3.9% and a weighted average maturity of fixed rate debt at 10.1 years. Therefore, the lower interest rates have allowed REG to decrease risk while also driving future bottom line cash flow growth.

In the long term, rent growth could decelerate given slower inflation. In addition, a recession would depress demand, which would pressure occupancy and rent growth further. Absent a recession, we believe the accretive refinancing would offset some of the slower inflation growth, which keeps us positive on the long term outlook for REIT fundamentals.

Effect on REIT Pricing

While NOI projections may not have changed, capitalization rates (or ‘cap rates’) may come down as the relative attractiveness of a growing yield increases versus other more vulnerable asset classes. While we were bullish in our initial forecast for REITs to close the NAV discount, we also conservatively assumed that cap rates would increase by 25 bps. Given that the 10 yr Treasury yield is one of the factors that influence cap rates, this assumption needs to be revisited. We now believe that cap rates are likely to decline by 10 bps as a result of the 120 bps decline in the 10 yr Treasury yield. In addition, we assumed that REITs would finish the year between a 3% and 8% discount to NAV (or Net Asset Value). With REITs now trading at a premium for the first time in three years, we now believe they will finish the year between a 2% discount and a 3% premium, which equates to a change of 1200-1700 bps from the start of the year (14% discount!). Holding our other assumptions constant (1% NAV growth from retained earnings, 3.8% levered same store NOI growth, and a 5% dividend yield), the revised Chilton REIT Forecast calls for a 2019 total return between +24% and +29%.

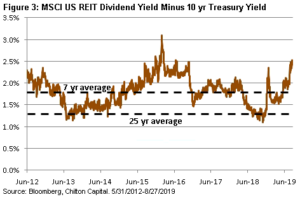

However, this forecast could prove conservative should interest rates stay around the current level. We also look at the spread between the REIT dividend yield and the 10 yr Treasury yield as a forecasting tool. From January 1995 to August 2019, the average spread between these two metrics has been 127 basis points. As shown in Figure 3, this spread has gapped out to over 250 bps as of August 27. A mere return to the historical average spread holding the Treasury yield constant would necessitate an increase of 44% in the RMZ. That may not happen if the market doesn’t price in the 10 year Treasury yield stabilizing at 1.5%; however, as we showed in the October 2018 REIT outlook, a spread larger than 230 bps had an 80% correlation with the future two year total return.

In addition, the interest rate savings could result in a slight increase to AFFO estimates, and the relative attractiveness of REITs could drive AFFO multiples higher. As of August 28, REITs were trading at 22x forward AFFO estimates, only slightly above the 3 year average of 21x. As recently as January 2015, the AFFO multiple got as high as 25x. At the time, the 10 yr Treasury yield was 1.7%, almost 20 bps higher than the August 28, 2019 10 yr Treasury yield. Using forward AFFO estimates, REITs would have to trade 14% higher to reach 25x forward AFFO.

The biggest risk to our forecast would be a significant slowdown in the economy that leads to a recession much sooner than anticipated. This would lower demand and likely lead to a rotation into cash and fixed income. Another risk would be the execution of a favorable trade deal with China that would reaccelerate the economy on a lagged basis, while also pushing up interest rates significantly higher. In such a case, REIT fundamentals would still be in great shape, but funds flows would likely leave REITs to riskier equities.

Chilton Portfolio Positioning

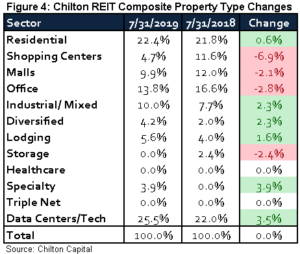

As shown in Figure 4, the Chilton REIT Composite property type allocations have changed significantly since July 31, 2018.

The most significant sales/trims occurred in the shopping center sector. While we believed the sector would be a safe haven relative to malls given its lack of department store exposure, junior anchor and small shop tenant bankruptcies have halted cash flow growth in a similar manner. As of July 31, 2019, the Chilton REIT Composite is underweight shopping centers relative to the MSCI US REIT Index due to the above risks and the lack of a near term catalyst to close the valuation gap.

The most significant purchases were in the diversified, specialty, industrial, and data centers/tech sectors. We classify VICI Properties (NYSE: VICI) as ‘specialty’ given its high tenant concentration in the gaming industry and Consolidated Tomoka (NYSE: CTO) as ‘diversified’ since it is transforming from a land rich Florida company toward a geographically diverse triple net portfolio. Today, both companies receive most of their rent from long term triple net contracts but are trading at very attractive valuations relative to the triple net sector. As a result, we would expect these companies to benefit disproportionately from a decrease in long term interest rates.

The addition to Equinix (NASDAQ: EQIX) in early 2019 resulted in it becoming the largest holding in the Chilton REIT Composite, the first such time that a data center REIT has held that honor. We believe that the long term high organic growth companies such as EQIX will benefit regardless of the interest rate environment, especially relative to other sectors. Virtually all companies are requiring more computing power and have shifted much of this demand to online software/technology (the cloud), and many enterprise customers are shifting away from proprietary data centers. We also added to our cell tower exposure given higher conviction in longer term growth in spite of the consequences of a potential merger between Sprint (NYSE: S) and T-Mobile (NASDAQ: TMUS).

Finally, we added to the industrial sector, which continues to defy the limits with all-time low cap rates and an elongated runway for rent growth due to the growth of e-commerce. We still believe that some of the smaller companies are best positioned for higher per-share growth, but the rising tide appears to be raising all boats at the moment.

Current Positioning

The second biggest overweight in the Chilton REIT Composite as of July 31 was Residential, which includes apartments and single-family rentals. Both are major beneficiaries of the affordability issues with a home purchase, high levels of student debt, delayed marriage, and an increasing secular preference to rent a residence. In addition, we see these REITs producing above average growth in NOI for the foreseeable future, which could bring down cap rates further. While these companies have historically done well in periods of rising interest rates, they should also outperform in the current environment given the necessity of having a place to live. If the lower interest rates do actually lead to a recession, consumers may cut back on spending and corporations may cut back on hiring, but residential should fare well.

As we mentioned above, the underweight to triple net is not as large as it may seem given the allocations to VICI and CTO. However, the Chilton REIT Composite maintains a large underweight to healthcare despite the potential benefits in a lower interest rate environment. Interestingly, healthcare has not been as correlated to interest rates as it has historically because many of the top healthcare REITs have moved away from long term triple net leases. The ‘Big Three’ (HCP, VTR, and HCN) have increasingly been adding senior housing assets where the REIT participates in the both the upside and the downside (called RIDEA). As a result, these REITs outperformed last year despite a rise in the 10 yr US Treasury yield, and have underperformed in 2019 despite a decline in the Treasury yield.

Positive Near Term Outlook

We believe the portfolio is still positioned to outperform regardless of the economic scenario. However, we have been mindful of the changing yields and macro conditions, and have acted accordingly.

As a sector, Equity REITs appear undervalued despite the large move upward we have witnessed this year. And due to the relatively high yield of 4% for the index and estimated dividend growth in in the 5% range, they offer a compelling addition for any investor looking for a better yield alternative given how low interest rates are at the present time. We are increasing our near term outlook for total returns significantly as a result, and believe asset allocators should consider a tactical shift to US REITs given the defensive and offensive characteristics, especially relative to other asset classes.

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

Richard J. Pickert, CFA

rpickert@chiltonreit.com

(713) 243-3211

RMS: 2354 (8.31.2019) vs 1909 (12.31.2018) vs 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.