Non-Traded Trick or Public TREIT? | November 2019

November 1, 2019

The acronym R.E.I.T. stands for something specific: Real Estate Investment Trust. However, REITs come in many different forms. While the Chilton REIT Strategy is comprised of only publicly traded equity REITs, some brokers have recommended ‘non-traded REITs’ to their clients as a steady source of income and a safe store of principal. For the purposes of this publication, the term ‘non-traded REIT’ refers to an investment vehicle that raises equity through many investors in an effort to package together commercial real estate for sale after a 5-10 year period. Their shares do not trade on national stock exchanges and the net asset value (or NAV) per share is usually updated only a few times per year. While we are glad non-traded REIT investors have viewed commercial real estate as an attractive asset class, we believe that they are not fully aware of the costs associated with the decision to invest in a non-traded REIT.

In this case, the ‘costs’ include direct, indirect, and opportunity costs, which we can illuminate using publicly-available information. Our research reveals that investors in non-traded REITs have received inferior returns while enduring the ‘costs’ of egregious fees, outlandish conflicts of interest, little transparency, illiquidity, and high risk in the form of leverage.

Risen from the Dead

The dawn of the Modern REIT Era in 1991 resulted in public equity REITs owning some of the highest quality real estate in the country. Over time, they demonstrated superior returns due to smarter capital allocation, shareholder-friendly governance, lower fees, and better access to capital. While the growth in market share of high quality commercial properties was significant, going from below 5% in 2004 to over 20% in 2019, we envisioned it would be even higher. Surprisingly, the non-traded REIT industry has continued to thrive in spite of the highly transparent superiority of public equity REITs.

Despite some heavily publicized FINRA and SEC violations over the past nine years, non-traded REITs have attracted over $58 billion in equity from investors1. The two most publicized incidents were the successful lawsuits against David Lerner Associates (fined $14 million for putting clients into Apple REIT Ten) and AR Capital (settled for $60 million for fraud). These transgressions took down non-traded REIT fundraising from a peak of $20 billion in 2013 to a low of $4 billion in 20171, but the industry is making a comeback. Due to Blackstone’s (NYSE: BX) entrance into the non-traded REIT market, the industry raised $1.8 billion in the first quarter of 2019 alone1!

We attribute the growth of the non-traded REIT industry to several things. First, investors are lured by a high ‘yield’ (in quotes for a reason) relative to most publicly traded REITs. Second, investors get a false sense of security from having their investment ‘marked to market’ infrequently. Third, brokers are incentivized to recommend non-traded REITs to clients instead of other alternatives due to the upfront fees they receive. Finally, non-traded REITs and their sponsors are purposefully opaque in almost every facet of the business, which helps to conceal egregious fees, little liquidity, and conflicted governance. Using our understanding of financial statements, we examined the filings of Industrial Properties Trust (or IPT), a non-traded REIT in a top performing property type (industrial) that agreed to be sold to a publicly traded REIT (Prologis (NYSE: PLD)) in 2019. Importantly, we examined several non-traded REITs and found IPT to be representative of the ‘industry average’ in terms of fees, structure, and leverage.

The Wicked Web They Weave

Some investors may not even realize it, but almost all non-traded REITs are ‘externally advised’, meaning that the REIT itself has no employees and therefore must pay outside parties for services. These services include property management, property transactions, accounting, and, most costly, fundraising. These are all necessary for the operations of the REIT. However, the most obvious downside to an external advisory agreement is that there is no ‘economies of scale’, as all of the fees for services are percentage-based. In contrast, a company with ‘internalized’ management would have less efficiency at small sizes, but much higher efficiency at larger sizes.

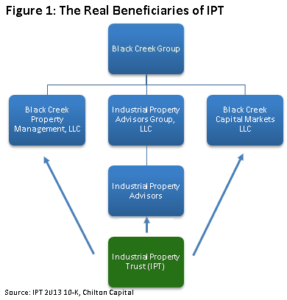

The less obvious issue with externally advised non-traded REITs is whom is receiving the fees. In the case of IPT (which is externally advised), the ‘sponsor’ is Industrial Property Advisors Group, LLC, and the ‘advisor’ is Industrial Property Advisors, LLC. The sponsor is the parent company of the advisor, and the advisor receives most of the fees for property transactions, asset management, operating expenses, financing, and other services. According to the 2013 10-K, “The sponsor and the advisor are presently each directly or indirectly jointly controlled by John H. Blumberg (now deceased), James R. Mulvihill, and Evan H. Zucker, and/or their affiliates.” They are the founders and managing principals of Black Creek Group, which owns a myriad of companies. Some of these companies provide services to IPT, as shown in Figure 1. For example, Black Creek Capital Markets, LLC is the ‘Dealer Manager’, which receives distribution fees, selling commissions, offering fees, and a ‘dealer manager fee’. In addition, Black Creek Property Management Company LLC is the ‘Property Manager’, which receives a percentage of the gross revenues for each building it manages for IPT.

Fee-Sucking Vampires

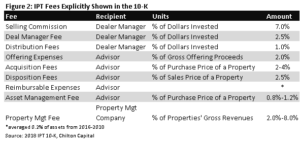

The next trick is the sheer quantity of fees that are charged to investors. IPT’s 2018 10-K filed with the SEC shows a long list of fees that are paid to various entities tied to Black Creek Group, which we have condensed in Figure 2. There are likely other fees that are paid to the financial advisor or retail broker (different from the external advisor to the REIT), and other entities that are not explicitly shown in the 10-K. It is difficult to ascertain the average fee paid by an IPT investor upfront and annually, but we believe it is safe to assume about a 10-15% upfront fee and another 1.5-3% in fees paid per year (averaged 2.6% from 2016-2018 for IPT). In contrast, the weighted average ‘management fee’ (measured as General & Administrative costs/gross assets) for a publicly traded equity REIT is 0.4% and investors increasingly can purchase shares at no cost at leading firms such as Fidelity and Schwab. Essentially, investors in non-traded REITs typically see only 85-90% of their initial purchase going directly into real estate and then start each year another 1.1-2.6% (1.5-3.0% minus 0.4%) behind the typical publicly traded REIT investor.

Although it’s not explicitly called a ‘fee’, many non-traded REITs establish a ‘redemption price’ that is below the NAV if an investor does not meet certain qualifications. IPT will only pay an investor NAV if it has been invested for four years or longer. At three years, the investor receives only 97.5% (2.5% fee), at two years only 95% (5% fee), and at one year only 92.5% (7.5% fee). Redemptions are not permitted in the first year. In addition, IPT will redeem no more than 5% of its shares per year, and even retains the right to decline redemptions if need be. Unfortunately, many investors require liquidity and redeem at a price below the stated NAV per share. In 2018, IPT granted $28.1mm in redemptions at an average price of $9.82/share. This compares to an estimated NAV/share of $11.11 on November 30, 2017 and $12.33 on November 30, 2018.

Take One Candy Only

The relationship between the owner of the external service providers and the non-traded REIT is similar to those who leave candy on the doorstep expecting kids to take only one. While the principals likely have significant equity holdings in the owner of the advisor (Black Creek Group in this case), they usually own insignificant equity in the REIT. From what we can tell, the combined ownership of IPT by of all directors and insiders amounts to between 0.1% and 0.2% of the IPT REIT as of December 31, 2018. In contrast, the average insider ownership of publicly traded REITs is 3.2% as of September 6, 2019, and they are compensated based on total returns to shareholders. The other shareholders of the IPT own exactly zero percent of Black Creek Group. Thus, there are inherent conflicts of interest, which the 10-K explicitly states couldcause the advisor to act in the best interest of Black Creek Group and its subsidiaries instead of the shareholders of the non-traded REIT.

After a long list of conflicts, the 10-K even goes onto say: “Conflicts of interest such as those described above have contributed to stockholder litigation against certain other externally managed REITs that are not affiliated with us.” We sympathize with investors who were duped into investing in non-traded REITs, but strongly believe anyone who reads the marketing materials (or does a quick internet search for ‘non-traded REIT’) should have been fully aware of its long history of issues.

How Much Candy Is in the Bag?

On July 15, 2019, Prologis and Industrial Properties Trust announced a definitive merger agreement for $3.99 billion, which equated to $12.54 in cash per IPT share. After the deal closes on January 8, 2020, investors will have an NAV of $0.72/share leftover according to an investor presentation, giving a total value to the investor of $13.26/share. Plus, investors have been receiving dividends along the way starting at $0.41/share and finishing at $0.57/share. Assuming a 10% upfront fee at a $10/share NAV as of December 31, 2013, the internal rate of return (or IRR) to the investor comes out to +7.8% over a six year period. A $1 million investment would be worth $1.6 million after six years. Not bad, right?

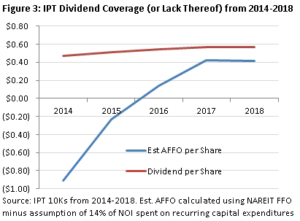

However, that return is a bit deceiving. A portion of the dividends were actually funded by other investors’ money, and thus were treated as ‘return of capital’. In fact, the dividends were almost 100% return of capital for the first two years before going down to about 48% in 2018, indicating that the dividend was never covered by Adjusted Funds From Operations (or AFFO), as shown in Figure 3. We assumed 2019 treatment of dividends was equivalent to 2018, as the 10-K has not yet been published for 2019. Assuming a 23.8% long term capital gains rate and a full distribution of the $13.26/share, the after-tax distribution received in 2020 will actually only be $11.99/share, which equates to an annualized IRR of only 6.2%. A $1 million investment in 2014 would have finished year six at $1.4 million after-tax. Again, not bad by some standards.

Escape the Haunted House

The only way an investor in IPT could be satisfied with a +6.2% after-tax return over that period would be if he or she did not look at the performance of similar investments over the same time period (as the Chilton REIT Strategy is benchmarked against the MSCI US REIT Index). Unknowingly, these investors are paying a massive ‘opportunity cost’, equal to the difference between what they actually received and what they would have received from a similar investment. Over the same period, publicly traded PLD appreciated from $36.95/share on December 31, 2013 to $87.68/share as of October 30, 2019. The dividend began at $1.32/share in 2014 and grew to a projected dividend of $2.12/share in 2019. Assuming the price of $87.68/share on October 30, 2019 is sustained through January 8, 2020 to make it comparable with IPT, the annualized pre-tax IRR of an investment in PLD would be 19.4%. Assuming 10% of PLD’s dividends were return of capital (the REIT average), the after tax IRR for PLD was 16.6%. A $1 million investment in 2014 would have finished year six at $2.5 million after-tax, which is $1.1 million higher than the IPT investor.

PLD was not an exception to the rule, as it was merely ‘inline’ with the other publicly traded industrial REITs. The FTSE NAREIT Sub Sector Industrial Total Return Index (Bloomberg: FNINDTR) produced an annualized total return of +19.6% over the same period (pre-tax). The best industrial REIT was Rexford Industrial Trust (NYSE: REXR), a Chilton REIT Composite holding, which produced an annualized total return of +28.0%. A $1 million investment in REXR on December 31, 2013 would be worth $4.4 million (pre-tax) as of October 30, 2019. Even the worst performing industrial REIT, STAG Industrial (NYSE: STAG), produced an annualized total return of +13.8% over the same period! A $1 million investment in STAG would be worth $2.2 million as of October 30, 2019 (pre-tax). Therefore, even the worst industrial REIT produced $600,000 more than IPT over a comparable period, despite taking much less risk, allowing for immediate liquidity, and charging zero upfront or back-end fees.

More Tricks Than Treats

Another deception of a non-traded REIT is the appearance of low risk because of the low volatility of its NAV/share. In the case of IPT, the NAV/share was only updated once per year! The lack of a frequently updated market price does not relate to the risk of the investment. Accordingly, we believe that volatility associated with market price fluctuation is not an accurate measure for comparing risk between publicly traded and non-traded REITs. In addition, we believe that a lack of liquidity only increases risk due to the inability to sell or reallocate should circumstances change. Instead, we view corporate governance, leverage, and property/earnings quality as the best ways to measure risk.

We have already established the long list of conflicts of interest from investing in non-traded REITs. While we will concede similar property quality in this case (PLD’s CEO stated that about 80% of the IPT portfolio is comparable to PLD in quality), earnings quality is much higher in publicly traded REITs given the lack of upfront and annual fees.

Lastly, non-traded REITs typically employ much higher leverage than publicly traded REITs. In fact, as of December 31, 2018, the debt to gross assets of IPT was 52%, meaning debt was higher than equity! From 2014-2018, debt to gross assets averaged 50% for IPT, which compares to the average publicly traded REIT at 32% as of September 30, 2019. Therefore, while a publicly traded REIT may have had more volatility in its price, the non-traded REIT had double the leverage (1:1 debt to equity for IPT versus 0.5:1 for the average publicly traded REIT), thus making it twice as risky in our view.

Given that 2014-2019 has been a bull market for industrial real estate, the higher leverage at IPT enhanced its returns relative to the average publicly traded REIT. For example, PLD’s average net debt to gross assets over the period was 31% (finishing at 25% as of September 30, 2019). For a true apples-to-apples comparison, we can normalize leverage between the two by calculating what the return would have been if someone had levered up his or her investment in PLD to equal the leverage at IPT. In this case, the investor would borrow about $11/share of the $36.95/share price as of December 31, 2013, and pay a 3.3% interest rate annually (equal to IPT’s 2018 weighted average interest rate). The apples-to-apples annualized IRR in PLD would have been a whopping 26.7%, resulting in a final value of $4.1 million (pre-tax), which compares to IPT’s 7.8% annualized IRR and $1.6 million pre-tax!

TREIT Yourself

In contrast to non-traded REITs, publicly traded REITs can be bought and sold at Fidelity or Schwab without any upfront or redemption fees. Furthermore, investment managers such as Chilton Capital can construct a portfolio of publicly traded REITs that is diversified by property type and geography, and take advantage of real time liquidity to actively manage the portfolio in order to maximize risk-adjusted returns.

These publicly traded REITs are evaluated using a proprietary process refined over 60+ years of combined experience. Our fees are clearly shown on investor statements, and our returns are GIPS-verified and comprised of actual client net-of-fee returns going back to 2005. Our clients have exposure to ten property types, many of which are not available to non-traded REIT investors (i.e. cell towers). There are no upfront fees, and withdrawals can be made same-day if necessary, without any additional cost.

In addition to filing 10-K’s and 10-Q’s with the SEC, publicly traded REITs publish ‘supplemental disclosures’ with detailed data on the company, provide annual guidance, conduct quarterly earnings calls, and are available for property tours. Shareholders have the ability to vote on Board of Director seats annually, and management teams are aligned with shareholders through carefully reviewed (and sometimes voted upon) compensation plans. We believe publicly traded REITs should be in every investor’s portfolio, both retail and institutional, and non-traded REITs should be avoided at all costs.

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

Richard J. Pickert, CFA

rpickert@chiltonreit.com

(713) 243-3211

RMS: 2455 (10.31.2019) vs 1909 (12.31.2018) vs 346 (3.6.2009) and 1330 (2.7.2007)

1: Robert A. Stanger & Co Presentation Dated May 8, 2019

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.