Essential REIT Evaluation: Residential and Healthcare | June 2020

June 1, 2020

The word ‘essential’ has become very popular recently in its use by governing heads nationwide to delineate which businesses can remain open during the pandemic. A common definition uses the words, “…of upmost importance, something necessary or indispensable.” We have been using the term long before 2020 in describing our portfolio, but today it has relevance beyond what we could have ever imagined. Equity REITs come in all shapes and colors or in property talk, over fifteen different property sectors that comprise over 150 different companies. Not all are essential!

By now, the market is well aware of what the government has deemed essential or not, and stock prices thus already discount the current consequences of a stay-at-home order and shut-downs of various businesses. However, the market is unsure of how to discount the duration of the order, as well as what may change permanently as a result of the pandemic. In other words, will the essentialness of property types or geographies change in the next 12 months, 5 years, or 10 years?

The current valuation of a stock should reflect some probability that fundamentals will stay the same, get better, or get worse for its underlying properties. Over the next few publications, we will provide our current assessment for each property type, and how we are expressing that view in the Chilton REIT portfolio. We begin this series with an evaluation of the apartments, single family rentals, and healthcare sectors. Note that the liquid nature of public REITs gives us the luxury of changing the portfolio to match any new views that may arise as we gather more data during this unprecedented period.

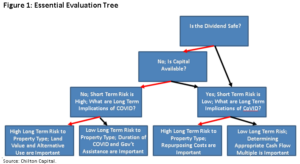

Essential Evaluation Tree for REIT Investors

In our opinion, there is a process that must be followed to determine how essential the company is, and thus where it should trade. First and foremost, is cash flow able to cover the dividend, or will it need to be cut? Balance sheet strength and access to capital must then be analyzed to determine how long the company can survive in the current environment. Finally, we ascertain the long term risk, and the corresponding alternative uses that could be implemented, and how much it would cost. The result is an ‘Essential Evaluation Tree’, and shown in Figure 1. The level of ‘essentialness’ should determine the multiple on cash flow at which it should trade. While difficult to estimate current cash flow in this environment or pick the right multiple, this process should determine whether the market agrees with our assessed levels of essentialness.

Some of our readers may notice in the Essential Evaluation Tree that we did not mention net asset value (or NAV). The current environment is not conducive to using NAV for several reasons. First, there are not any comparable transactions in the private market to provide an ‘applied cap rate’ to the formula. Second, next 12 months net operating income (or NOI) is equally difficult to determine given the wide disparity in rental collection rates and the lack of understanding of the duration of the stay-at-home orders. We do believe it will be relevant again when this passes, but until then cash flow and ‘essentialness’ are most relevant.

Apartments

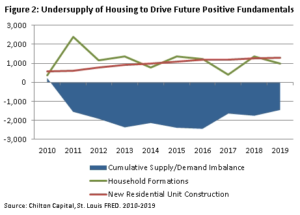

The U.S. housing market totals 125 million households, of which about 64% of households own a home and the other 36% rent. Of the rental market, apartments represent a 60% share and single family rentals account for 36%, with the remaining 4% in mobile homes and other accommodations. In the 10 years ending December 31, 2019, approximately 11.4 million households were formed, which compares to 9.9 million total single family and apartment units started over the same period. This has led to a 1.5 million supply/demand imbalance that should persist until construction picks up or household formation declines.

Prior to COVID, leading economists expected growth in household formations at a rate of 1.2-1.3 million annually over the next decade. This compares to 1.3 million total residential units started in 2019. Thus, even if COVID causes some people to double up with friends, move back in with their parents, or delay moving out of their parents’ house, the deceleration of demand should not be enough to offset the cumulative 1.5 million undersupply of housing from the past decade, as shown in Figure 2.

As of May 31, 2020, the Chilton REIT Portfolio had a 12.5% allocation to apartments, which compared to the MSCI US REIT Index (Bloomberg: RMZ) at 12.7%. The average apartment REIT has a dividend payout ratio (calculated by 2020 estimated dividend divided by 2021 estimated funds from operations) of 70%, which compares to the REIT average of 53%. Note that the REIT average reflects the dividend cuts that have occurred in lodging, retail, and healthcare. Given that rent collection for the three Chilton REIT Portfolio apartment REITs in April was 95% on average and May is tracking better than April, we believe the dividends of all three securities to be extremely safe.

Balance sheets in the apartment REIT sector are among the best, with debt averaging about 28% of gross assets as of March 31, 2020 with a 6.1x net debt/EBITDA ratio. Camden (NYSE: CPT), Essex (NYSE: ESS), and AvalonBay (NYSE: AVB), the three holdings in the Chilton REIT Portfolio, have each completed debt offerings since February, which proves they have access to capital if needed. Thinking further ahead, this capital could be earmarked to take advantage of any distressed owners that do not have the same access to capital.

A residence is obviously essential and its importance has mushroomed even more under the various stay-at-home, work-from-home edicts. Collection rates have been lower for lower class apartments, but the average tenant at a Chilton apartment REIT has an income over $100,000. Thus, their tenants likely have been able to dodge the initial layoffs, or have adequate savings to maintain their residence. Stimulus checks from the government have proven effective for those with income below $100,000 as well. Even so, many REITs are not increasing rents on renewals and are also providing rent relief to the tenants that can prove the loss of employment. Helping offset this is a significant reduction in turnover rates which reduces operating costs. Regulatory overreach in certain jurisdictions to help residents such as restricting evictions and going so far as proposals of rent moratoriums add further uncertainty near term. While occupancy remains high today, it is difficult to know what will happen to collections once emergency government support ends. Even the ‘white collar’ renters will be at risk if the economy remains in a recession beyond a few quarters. Thus, while near term risk is low, the intermediate term risk is average.

Long term, the apartment supply and demand outlook is extremely favorable. We expect the supply curve to flatten as new developments slows and new starts are put off indefinitely. Any decline in household formation should be temporary, and should only create more pent-up demand for housing in later years. If work from home becomes permanent for some jobs, we would expect workers to allocate more of their income to rent to ensure a solid internet connection, privacy, and space. We do believe there is average long term regulatory risk from municipalities that may try to fix budget issues through increased taxes on multifamily owners, but this is more than offset by the favorable supply and demand picture.

Furthermore, the pandemic may create a demographic shift away from dense, coastal, urban cities that rely on public transportation in favor of suburban or less dense cities. Though this would affect high rise apartments in coastal cities, the benefit to these lower-cost cities will offsets the demand loss elsewhere. As such, we classify apartments’ long term risk as low. As of May 31, 2020, apartment REITs are trading at 16.2x 2021 consensus funds from operations (or FFO, a REIT measure of recurring cash flow before capital expenditures), which compared to the REIT average of 14.6x.

Single Family Rentals

As of May 31, 2020, the Chilton REIT Portfolio had an 8.1% allocation to single family rents (or SFRs), which compared to the RMZ allocation of 2.7%. SFR REITs Invitation Homes (NYSE: INVH) and American Homes 4 Rent (NYSE: AMH) have reported rent collection of over 95% for April, and expect May to be even better. The average tenant household has an income over $100,000 combined from two wage-earners. We believe that this has allowed SFR tenants to continue to pay rent even if one earner has lost his or her job. On the expense side, SFR REITs stand to benefit more than the average apartment REIT from lower turnover due to higher average ‘turnover costs’ at SFRs. The average payout ratio of only 38% translates to a secure current dividend, significant free cash flow, and a long runway for dividend growth. Thus, near term risk is low.

The average debt/gross assets ratio for the two companies was 31% as of March 31, 2020 and the average net debt/EBITDA was 6.4x. Neither company has accessed the debt markets other than drawing on their lines of credit, but neither has needed to do so given the durability of their cash flows. Notably, JP Morgan Asset Management established a joint venture with AMH to invest $625 million in new builds of SFRs on May 14, which indicates that equity capital is readily available for the sector. Similar to apartments, the solid financial position of both companies gives them the opportunity to take advantage of any dislocation by other owners.

Going into 2020, AMH and INVH were enjoying record occupancy rates due to their status as an affordable alternative for families unable to afford a home purchase. Demographics are on the side of single family as millennials are entering ‘primetime’ for starting families. Demand levels could even spike upward if the pandemic forces a shift away from urban, coastal living as their portfolios are tilted toward the suburbs in cities with lower housing costs such as Atlanta, Phoenix, Dallas, and Las Vegas. Adding support to rentals is the tightened availability of mortgage financing for home purchase due to lenders imposing tougher underwriting standards including income tests and down payment requirements. Therefore, in our opinion, near term, intermediate term, and long term risk are all low. The SFR REITs were trading at 21.1x 2021 consensus FFO estimates as of May 31.

Healthcare

As of May 31, the Chilton REIT Portfolio had a 1.3% allocation to healthcare, which compares to the RMZ allocation of 11.1%. The two largest healthcare REIT segments are senior housing and skilled nursing facilities, which have proven extremely vulnerable to the pandemic given the age demographic of their tenants.

Going into the pandemic, healthcare REIT payout ratios were elevated compared to the REIT average at 77% of 2021 FFO as of December 31, 2019 (versus 63% for all REITs). With the various negative effects of COVID among the healthcare segments, dividend cuts were quick and severe. Sabra Healthcare (NYSE: SBRA), a skilled nursing facilities REIT, was the first, cutting its dividend by 33% on March 25. Following the cut, the payout ratio dropped to 71% from 106%. Thus far, Welltower (NYSE: WELL), New Senior (NYSE: SNR), and Diversified Healthcare Trust (NASDAQ: DHC) have followed suit, most of whom have significant exposure to senior housing. As a result, the payout ratio for healthcare REITs as of May 31 was 71%.

Healthcare balance sheets were slightly above average, with debt to gross assets averaging 41% and net debt to EBITDA averaging 6.2x. However, a large part of the growth of these companies was raising equity at a premium to NAV, and acquiring properties on the private market, thus locking in a ‘spread’. When the NAV premium disappeared, equity capital dried up and, as a result, the acquisition market has shut down. Time will tell how long this persists, but it must be considered when thinking of the long term implications of an industry so dependent on external growth. Several of the largest and most well-capitalized REITs such as VTR, WELL, and PEAK raised capital, proving it is available for the blue chips.

In the short term, senior housing should be less affected by the pandemic than skilled nursing facilities, which tends to have more acute patients as well as a dependency on elective procedures.

This dynamic has held true recently, as the National Investment Center for Seniors Housing & Care released April data showed senior housing occupancy down -1.1% to 88.7% and skilled nursing facilities occupancy down -2.2% to 84.7%. Tenants such as Brookdale Senior Living, Inc. (NYSE: BKD), the largest senior housing operator, saw its April occupancy fall to 80% from 82.2% with move-ins down -35%, which was slightly worse than average due to a multi-year turnaround at the company. Going forward, senior housing REIT expectations illustrate continued negative trends. Healthpeak Properties (NYSE: PEAK) projects 2-4% occupancy declines per month while WELL forecasts similar occupancy declines of 5-6% cumulatively by the end of June. At the same time, they are having difficulty estimating what operating expenses will ultimately be due to the increased testing, personal protective equipment, and labor required to combat the outbreak. Thus far, PEAK has guided to an estimated 5-15% increase in monthly operating expenses for the duration of the pandemic.

Historically, one of senior housing’s most lauded attributes has been its private payer model that was less susceptible to government reimbursement challenges and ‘stroke of the pen’ risk. Being a relatively non-cyclical business, there was a steady rent stream through economic cycles –until now. COVID-19 has flipped the private payer positive into a negative because it is less likely to have a backstop should tenants come under severe financial stress.

Senior housing might not be completely left out in the cold though. Given the tragic reporting of many facilities across the United States, there is a good chance that aid will come to senior housing in the Health and Economic Recovery Omnibus Emergency Solutions Act (HEROES Act) that was introduced by the U.S. House of Representatives. These COVID-19 headwinds come at time when REITs have already been seeing pre-pandemic rent coverage levels decline over the last decade due to increased supply and rising expenses. Thus, we believe senior housing carries above average near term risk and average intermediate term risk.

In contrast, skilled nursing facilities receive 30% of its payments from Medicare and 50% from Medicaid, and as a result have received government aid from the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) legislation of $4.9 billion. This equates to $50,000 per facility and an additional $2,500 per bed. In contrast, senior housing only sources 2% of its payments from Medicaid and nothing from Medicare. Thus we believe government aid reduces the near and intermediate term risk for skilled nursing facilities to average.

As a result, we have initiated a position in SBRA. We believe the company’s discounted valuation at only 7.9x 2021 FFO and an 8.9% dividend yield on a 71% payout ratio does not reflect the relatively low near, intermediate, and long term risk.

Someone’s health should always be essential, so we believe the healthcare sector has below average long term risk. As of May 31, the big three healthcare REITs (VTR, PEAK, and WELL), comprised mostly of senior housing, traded at an average 12.7x 2021 FFO multiple. In comparison, the average 2021 FFO multiple of the three skilled nursing REITs was 10.7x. Given the heavily discounted cash flow multiples of the senior housing REITs and the low long term risk, we are becoming more positive on the group than we have been in a long time.

Observations Thus Far

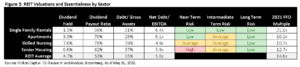

Of the sectors we have covered thus far, the market’s assessment of ‘essentialness’ is as follows, from most to least essential: single family rentals, apartments, senior housing, skilled nursing, as ranked by the 2021 FFO multiples shown in Figure 3. We also present the corresponding dividend, balance sheet, and property type risk. As evidenced by our new position in SBRA, a skilled nursing REIT, we believe that the skilled nursing segment is mispriced versus senior housing given lower risk and a lower FFO multiple. We will explore other sectors in the next few REIT Outlook publications to determine if there are some additional opportunities with favorable risk-reward tradeoffs.

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

Richard J. Pickert, CFA

rpickert@chiltonreit.com

(713) 243-3211

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

RMS: 1902 (5.31.2020) vs 2402 (12.31.2019) vs 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.