Essential REIT Evaluation: Industrial and Office | July 2020

July 1, 2020

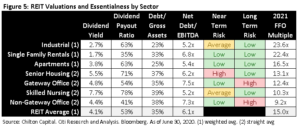

We are continuing on our ‘Essential’ theme from the June 2020 Chilton REIT Outlook. For those who have not read it, we have developed a decision tree for determining how ‘essential’ a business is, and thus where an investor should be spending his or her time. As shown in Figure 1, it focuses on the ability to pay the dividend, balance sheet strength, access to capital, and long term risk. Depending on the path followed, the company may be valued on a multiple of cash flow, land value, or dependent upon government stimulus. While difficult to estimate current cash flow in this environment or pick the right multiple, this process should determine whether the market agrees with our assessed levels of essentialness. Thus, at the end of our analysis, we can compare the market multiples for office and industrial with healthcare and residential (from last month) to determine if there is an opportunity to capitalize on mispricing.

Industrial

While the reported in-store retail sales number were the worst in history on a year-over-year basis for April, most industrial warehouses were scrambling to meet demand or operating business-as-usual (as long as it was legal). Most people can relate to the necessity for e-commerce during the stay at home orders, especially for basic items. Without the distribution warehouses and the transportation industry, the pandemic could’ve led to even more shortages and unrest. Instead, they were deemed essential and operated as normal; even the marijuana business made the cut in most states!

The fact that most of these tenants were open and doing business meant that industrial REITs have been among the most successful at collecting rent. On average, the industrial REITs have collected 95% of April rent and 92% of May rent based on disclosures up to June 22, 2020. We expect May numbers to improve as there was a significant portion of April rent that was received late. Most of the uncollected rent has been agreed to be repaid over a short period (less than one year).

In contrast to most REITs who were forced to withdraw guidance, the high collection rates allowed for many industrial REITs to at least disclose 2020 guidance using their best assumptions, albeit at a slightly lower level than pre-COVID. Even with the tenant fallout from the huge GDP decline, these companies still expect same store net operating income to be higher in 2020 than 2019. Leases have been getting signed and even property transactions have continued, although at a much slower pace. In summary, we expect the near term risks being slightly higher than office.

Despite the modest near-term headwinds caused by the current recession, the longer term outlook for industrial is excellent due principally to the demands from e-commerce. Other than grocery stores, building material stores, and sports/hobby stores, the ‘non-store’ retailers were the only category to have positive year-over-year growth in May – and non-store retailer sales growth at +31% was more than double the second best (building materials at +16%). April was similar where non-store retailer sales were up 22% and the second-best was grocery at +13%.

While some of the online spending will invariably go away when stores reopen, we believe the pandemic accelerated the adoption of e-commerce by both retailers and customers – and it’s only the beginning. In 2019, e-commerce represented 11% of total retail sales and many experts now believe it could double by 2025. Prior to COVID, the expectation was for it to double by 2030.

While it may be easy to click the item for a customer, the retailer must make significant investments to be able to deliver that item to the customer’s doorstep. Experts believe that every $1 billion in e-commerce sales requires 1.3 million square feet of fulfillment space. Assuming no change in retail sales ex-gas from 1Q20, the incremental annual e-commerce spend to become 22% of total retail spending would be $600 billion per year, necessitating 780 million square feet (or sqft) of industrial space. This compares to 2020’s estimated new supply of 140 million sqft.

Supply chains nationwide are expanding since manufacturers see the need for higher inventory to sales ratios to handle unexpected spikes in demand for numerous products. The old school ‘just in time inventory’ methods proved inadequate over the past several months. CBRE estimates that just a 5% increase in inventories would create an additional 400-500 million sqft of demand for industrial space.

In addition, many now see the need for more ‘on-shoring’ of manufacturing in multiple products, most notably medical and pharmaceutical items. Despite the higher costs in the US, companies now believe that tariffs, automation, taxes, national security, and carbon footprints make it worthwhile to have a larger presence domestically. This transition should produce significant tailwinds for industrial demand.

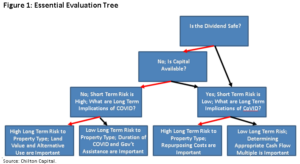

Developers have for years seized on the opportunity set. According to REIS, new supply has been running at an annualized pace of over 100-150 million sqft for the past three years, and has only recently caught up with demand. But, the pandemic is causing a major deceleration of construction activity in 2020 that should help bring demand back into balance by the end of 2021. As shown in Figure 2, REIS forecasts significant imbalances between demand and supply for 2022-2024 which should create an extended period of rent growth. All of the REITs with development pipelines have substantially reduced and/or suspended activities until normalcy returns or a vaccine is found to deal with the pandemic. Coming out of the recession, we expect development to be a significant driver of value creation for most of the REITs.

As of June 30, 2020, the Chilton REIT Portfolio had a 15.1% ex-cash allocation to industrial, which compared to the MSCI US REIT Index at 14.3% as of the same date. Portfolio holdings included Americold (NYSE: COLD), Prologis (NYSE: PLD), and Rexford (NYSE: REXR). The average dividend payout ratio to estimated 2021 funds from operations of both the Chilton holdings and the industrial sector was 64%, which compares to the REIT average of 53%. Note that the REIT average is influenced by the lodging, retail, and healthcare REITs that have suspended or cut their dividends. There has not been a single dividend cut in the industrial space.

Our investment in cold storage via Americold (NYSE: COLD) has been particularly prescient given the rapid rise in e-grocer sales nationwide. COLD is the largest publicly-traded REIT that owns temperature-controlled warehouses and it commands a 27% market share in this specialty in the US. REXR is a pure play on the enormous Southern California industrial market, owning about 28 million sqft of the 2 billion sqft market (<2%). PLD is one of the largest owners of space in the world with almost 1 billion sqft, of which 600 million is located in the US.

Balance sheets are very strong considering that debt averages 21% of gross asset value for the three above and very close to the sector average of 23%. Net debt EBITDA ratios are likewise low for these three at 4.7x as of March 31, which compares to 5.2x for all industrial REITs. In comparison, the weighted average for all REITs was 34% debt to gross assets and 6.1x net debt to EBITDA.

With slight short term risk and elevated long term tailwinds, the biggest risk to the sector is valuation. Year to date, the industrial REITs (Bloomberg: BBREINDW) have produced a total return of +2.1% year to date as of June 30. As a result, valuation parameters for this sector are at record levels, especially relative to other REITs. As of June 30, the industrial REITs are trading at 23.6x price to 2021 FFO estimates, which compares to the weighted average for all REITs at 15.0x. However, we believe the combination of all of the positives mentioned above justify this valuation and could lead to further multiple expansion.

Office

Year to date through June 30, the office REIT sector has produced a total return of -24.9% (Bloomberg: BBREOFPY), which compares to the RMZ at -18.4%. The underperformance can be attributed to concerns about the long term viability of office space given the technological advances allowing for productive work from home (or WFH) environments. Furthermore, approximately 41% of office REIT portfolios are located in San Francisco and New York City, which have serious headwinds due to COVID, unfavorable regulatory environments, and a high cost of living.

Short term risk in the sector is low due to high quality balance sheets, low dividend payout ratios, and high rental collection rates. The group’s weighted average net debt to EBITDA was 7.1x, which is above the REIT average of 6.1x but still appropriate given office companies’ longer term leases and high quality tenants. Moreover, the sector’s weighted average debt to gross asset value is 33% vs the index at 35%, which also shows leverage is not severe. As of June 30, the Chilton REIT Strategy had positions in Boston Properties (NYSE: BXP), Cousins Properties (NYSE: CUZ), Douglas Emmett (NYSE: DEI), Empire State Realty (NYSE: ESRT), and Kilroy Realty (NYSE: KRC). Notably, these companies have an average net debt/EBITDA of 6.1x and average debt to gross asset value ratio of 32%. From a liquidity standpoint, office REITs are enjoying ample access to capital with Alexandria Realty (NYSE: ARE) raising $700 million of 2030 Senior Notes at 4.9% on March 23 and BXP tapping the debt market for $1.25 billion of 2031 Senior Notes at 3.25% on May 1.

Despite the challenging environment, rental collection rates have done very well, averaging 93% in April. Although not fully reported, May has been coming in more or less inline with April. The Chilton REIT Strategy holdings averaged collection rates of 93% in April and 93% in May using data available through June 26.

The weighted average dividend yield of 4.1% is inline with the MSCI REIT Index, though the index’s yield is artificially low due to the dividend cuts outside of office (there have not been any dividend cuts for office REITs). On the surface, payout ratios are relatively low as evidenced by the weighted average dividend/2021 FFO ratio of 52%. However, office buildings are more costly to maintain than the average sector, so the payout ratio moves up to 78% as a percent of 2021 AFFO (FFO minus maintenance capital expenditures), which compares to the REIT average of 69%. As a result, we do not expect much dividend growth from the group. In comparison, the Chilton REIT Strategy office holdings had an average payout ratio of 57% on 2021 FFO and 78% on 2021 AFFO.

While there could be many long term changes to society in a post COVID world, one of the most talked about is the future need for the office. Technology has enabled a portion of the economy to work from home (or WFH) for many years. However, this is the first time that there has been such a broad adoption for a prolonged period of time. The pandemic has forced company managements to take part in a grand experiment to see if offices are really necessary.

Since 2005, employees who work from home at least half the time have increased 115% from 1.8 million to 3.9 million people according to Flexjobs and Global Workplace Analytics. This equates to 2.5% of the workforce. As a result of the recent experience with WFH, many argue this number is set to increase dramatically over time. WFH proponents argue that it saves time commuting, reduces office space requirements thus saving money on rent, reduces environment impact, increases or maintains productivity, and keeps people safe from pandemics and other tragic events. Companies such as Facebook, Morgan Stanley, Google, and others have made comments that they will use less office space in the future for these reasons.

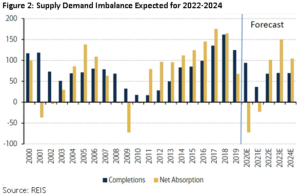

If WFH materializes as a long term trend, cities such as New York, Washington DC, and San Francisco would be affected more than others. Some cities may actually benefit as they could be destinations for employees looking for a lower cost of living and higher quality of life. As shown in Figure 3, most of the Sunbelt cities such as Austin, Denver, Charlotte, and Phoenix would be beneficiaries of the WFH trend. According to Green Street Advisors, the WFH Utilization rate is derived by dividing the percent of the population with the ability to WFH (per academic studies) into the current percent of the population that is already working from home. Thus, a high WFH utilization rate would mean that the city is a desired destination for WFH employees.

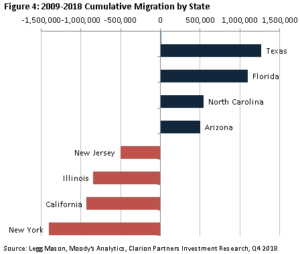

Two of the main reasons that Sunbelt cities tend to be destinations for WFH relocations is the cost of living and lower tax rates. As shown in Figure 4, the trend of outmigration from high tax cities and immigration to low tax cities has been underway for some time. However, the trend was exacerbated by the Federal Government’s limitation of State and Local Tax (SALT) Deductions in 2017, which disproportionately affected states and cities with income tax. This has already set in motion a ‘spiral’ where higher tax rates are needed to balance the budget, but the higher tax rate only accelerates outmigration, thereby lowering tax revenue.

As of June 30, the office sector traded at a weighted average 11.1x 2021 FFO. However, the multiple on gateway city office REITs* was 12.4x, while the non-gateway city REITs** traded at 9.2x. The Chilton REIT Portfolio had a 13.8% ex-cash allocation to office as of June 30, which compares to 11.0% in the MSCI US REIT Index. The portfolio’s geographic allocation is overweight to the Sunbelt and West Coast, while underweight to New York.

We believe that the current valuation statistics more than discount what may happen in the future with office space, especially in the Sunbelt cities that may actually benefit from a change in working habits. Companies, employees, and local governments tend to move slowly, which bodes well for the stability of the current cash flows of office REITs. Furthermore, while WFH may sound great, it can have negative lasting effects. For example, it can diminish corporate culture, training, and the ability for new employees to advance within the organization. In addition, tenants have been densifying the office by reducing the average square feet per employee from approximately 283 in 2000 to about 200 or less today. Much of the motivation for this is lower costs and, more recently, collaboration among workers. This trend could reverse and help lessen the impact on office demand if WFH becomes more significant longer term.

Observations Thus Far

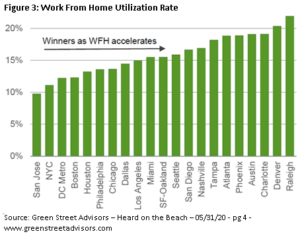

As shown in Figure 5, non-gateway office is being priced as if it is the least essential sector that we have covered thus far, while industrial is ranked as the most essential. We believe that gateway office, ranked as the third highest risk, is potentially not reflecting a long term change in population migration patterns. Non-gateway office, on the other hand, appears to be priced too low given that the long term risk may be mitigated by the same migration trends that could hurt the gateway office REITs. Industrial REITs appear to be correctly valued by the market on a relative basis, in our opinion. Thus, we believe an overweight position to non-gateway office REITs, an underweight position to gateway office REITs, and a slight overweight to industrial REITs is warranted.

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

Richard J. Pickert, CFA

rpickert@chiltonreit.com

(713) 243-3211

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

*straight average of ARE, JBGS, KRC, DEI, VNO, BXP, HPP, ESRT, CXP, PGRE, SLG

**straight average of CLI, OFC, CUZ, HIW, PDM, BDN, FSP, OPI, EQC

RMS: 1959 (6.30.2020) vs 2402 (12.31.2019) vs 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.