The 2021 Chilton REIT Forecast | January 2021

January 5, 2021

While forecasting has historically been a sport where the winners were ‘more lucky than good’, 2020 was a doozy for even the most contrarian predictions due to the COVID pandemic. Looking back to the Chilton 2020 REIT Forecast, there wasn’t much we got right, though the top overweights (cell towers, data centers, residential) did help to produce significant outperformance versus the MSCI US REIT Index (Bloomberg: RMZ). Accordingly, the Chilton REIT Composite produced net and gross total returns of -2.9% and -3.7%, respectively, which compared to the RMZ total return of -7.6%.

Notably, our prediction for a benchmark total return between +8% and +12% proved incorrect. However, even the RMZ total return of -7.6% seemed unlikely on March 23 when the RMZ was down 40% year to date. The ensuing onslaught of stimulus and innovation by companies across all industries helped to reverse losses. In the meantime, project ‘Warp Speed’ discovered and produced the quickest vaccine in history, culminating in the announcement from Pfizer on November 9, which gave investors confidence in a potential return to normalcy as early as the second half of 2021.

As we laid out in our September 2020 REIT Outlook titled, ‘Welcome to the New Cycle,’ we believe we are in the beginning stages of a five to ten year period of positive total returns for publicly traded REITs. The devastation from the virus and the recession will be felt for at least another year, at which point some of the hardest hit sectors will start to show gradual improvement. However, we believe the reset in prices for public REITs is behind us, and new investors can feel confident in the safety of the dividend streams for years to come.

With most of the bad news behind us about the virus and the decline in continuing jobless claims from 24 million to under 8 million, we believe 2021 will be filled with more positive headlines than 2020 despite the legacy of COVID. The low interest rate environment should provide support for low capitalization rates (or ‘cap rates’) and high multiples. At the same time, the rebound in cash flows from improved rent collections, favorable year over year adjusted funds from operations (or AFFO) comparisons, and dividend reinstatements/increases should lead to higher price targets. As such, using a blend of several forecasting methods, we believe REITs will produce a total return of +14% to +19% in 2021.

2020 in Review

One of the most interesting items related to REIT performance for 2020 is the change in the interest rate curve. We had listed rising interest rates as a risk to our forecast, implying that lower interest rates should be a positive. As the pandemic began to cause shutdowns and job losses, the Federal Reserve flooded the system with liquidity and cut the overnight banking rate to 0% on March 16, down from 1.5% only 2 weeks prior. The 10 year Treasury yield declined precipitously to a record low of 0.5% on August 4 and finished the year at 0.9%, down from 1.9% at the start of the year. Ironically, our forecast would’ve been even rosier if we would’ve known interest rates would fall this far!

Impressively, the Fed’s quick action and commitment to buying bonds in the open market prevented any REITs from having to raise dilutive equity as many were forced to do in 2009. Instead, the fixed income market was wide open, allowing REITs to borrow at record low interest rates, a trend we expect to continue into 2021, helping growth in reported earnings. In addition, the stimulus package announced on March 27 created a swift rebound in REIT equity prices, which assuaged any Boards of Directors from having to take drastic actions that could have resulted in long term consequences (e.g. asset dispositions or full company sales at ‘fire sale’ prices).

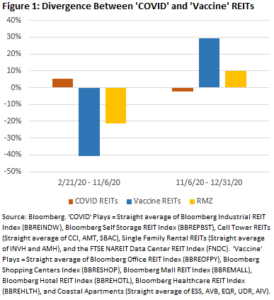

In spite of the broad fiscal and monetary stimulus, the virus did create a massive bifurcation in performance among sectors and individual stocks. As a result, the performance in REIT securities for the periods from February 21 to November 6 and November 6 to December 31 was extremely uneven.

In general, owning cell towers, data centers, industrial, self-storage, and single family rentals proved to be the best decisions for the period of February 21 through November 6. All of these sectors fell into what we deemed the “Essential” category, using a popular phrase from the government, and have also been referred to as the ‘COVID’ REITs. The average performance of these sectors for the period was +5.3%, which compared to the RMZ at -21.2%. In contrast, the office, shopping center, regional mall, lodging, healthcare, and coastal apartment sectors (also called ‘Vaccine’ REITs) were victims of the economic/physical dislocation caused by the virus and underperformed the benchmark. The average performance of these sectors was -40.8%.

The announcement on November 9 by Pfizer of the 95% effective rate on its COVID vaccine began a reversal in performance of a magnitude we have never seen before. On that day alone, the Bloomberg Shopping Center REIT Index (Bloomberg: BBRESHOP) was up 30.0%, the Bloomberg Mall REIT Index (Bloomberg: BBREMALL) was up 25.3%, and the Bloomberg Hotel REIT Index (Bloomberg: BBREHOTL) was up 27.7%! In comparison, the RMZ was up (only) 4.6%.

The momentum continued, leading to outperformance versus winners of the previous period for the rest of the year through December 31, 2020. The average performance of the Vaccine REITs was +29.4% from November 6 to December 31, 2020, which compared to the RMZ at +10.1%. In contrast, the average performance of the COVID REITs was -2.3% over the same period.

2020 proved that the REIT space is anything but homogeneous. The divergence between REIT securities approached ten year highs in 2020 due to the uneven effects of the virus. As a result, the opportunities for outperformance by active managers were more prevalent than we have seen in a decade! We believe that this will continue into 2021, leading to further opportunities for active REIT managers.

2021 Forecast

Our annual forecast is based on the performance for the RMZ, which is the compilation of 14 different underlying property sectors. Broadly speaking, we use several metrics to forecast RMZ performance. Namely, we estimate AFFO growth, Net Asset Value (or NAV) growth, and dividend growth. All of these should be positive in 2021 due to the pull back in each of these metrics in 2020.

We estimate that AFFO will grow 5.5% in 2021 based on levered same store net operating income (SSNOI) growth of +3.5% and interest expense savings of 2%. We assume that AFFO multiples will increase by 1.0x to 21.8x from 20.8x as of December 31, 2020. This compares to the long term average of 17.0x; however, the AFFO multiple was 23.3x in July 2016 when the 10 yr Treasury yield was 1.4%. When combined with dividend yield of 3.7%, the result is a total return of +14%.

We estimate NAV growth in 2021 will be +9.5%, based on cap rate compression of 25 bps from 5.3% to 5.1%, combined with levered SSNOI growth of 3.5% and reinvestment NOI from free cash flow of 1.5%. We believe the blended NAV premium will increase to 0% from -3% as of December 31, 2020. When combined with a dividend yield of 3.7%, the result would be a total return of +16%.

Finally, we believe dividend growth will be +7% in 2021, after falling 15% in 2020. The growth is based on the resumption in dividends in 2021 from cuts and suspensions in the retail and lodging sectors, as well as a pause in many sectors that were doing quite well but pursued a conservative approach to capital preservation in 2020. Assuming the REIT dividend yield compresses 25 bps to 3.5% from 3.7%, the resulting price change would be +15%. When combined with a dividend yield of 3.7%, the total return would be +19%. Notably, even if the 10 yr Treasury yield increases by 50 bps to 1.4% by the end of 2021, the spread between our expected dividend yield and the Treasury yield would be 210 bps, which is well above the 25 year average of 130 bps.

The combination of the three methods leads us to a projection of +14% to +19%, though we do expect volatility to continue as headlines on vaccinations, shutdowns, the economy, and stimulus could move the stocks below or above our targets throughout the year.

Chilton Working Assumptions

We are operating under the assumption that the vaccine rollout is successful, and people approach a more ‘normal’ lifestyle in the second half of 2021. This includes travel, school, work, dining, and shopping. The vaccine should give companies the confidence to invest in their business and begin hiring, leading to job growth in the range of 400,000-500,000 per month (versus job loss of 850,000 per month in 2020). We believe the Federal Reserve will remain accommodative, sticking to the words of Jerome Powell on September 16 when he committed to no rate increases through 2023. Regardless of what happens in the Georgia Senate race, we believe that the government will not put any massive sweeping tax overhauls into effect in 2021 that could derail a recovery. Finally, we assume that Americans will have a short term memory when it comes to the virus, but we do think there could be several lasting effects from the pandemic and recession.

First, we believe that ‘Work from Anywhere’ (or WFA) will be a more impactful change to working than ‘Work from Home’ (or WFH). While we do assume some decline in demand for office space, the movement of people away from cities such as New York City and San Francisco to warmer, cheaper cities such as Phoenix, Austin, Charlotte, and Nashville will have dramatic effects on the local residential, retail, and office markets. Though a vaccine will allow for public transportation to resume normal schedules, one of the underappreciated lasting effects of the virus is the massive hits to city and state budgets. This will lead to higher local tax rates, which will only accelerate the movement away from such cities.

Second, we believe that a large portion of e-commerce’s gain on brick and mortar retail in 2020 will be permanent. Many people that previously were not using e-commerce for certain items, namely food, staples, and even cars (!!) found the ease and speed for the first time, and will likely not go back to their previous routines. Similarly, retailers did their own ‘project warp speed’ to invest in their e-commerce business to meet customers’ needs. The desire to be close to the consumer for ‘essential’ needs will drive occupancy and hopefully some rent growth at select retail centers, but broadly we believe that there will be too many bankruptcies to experience a rise in rent and occupancy across retail real estate for the foreseeable future.

Third, we believe the pull-forward of e-commerce adoption will continue to fuel higher rents and lower cap rates for industrial warehouses of all shapes and sizes, as they are the prime beneficiaries of the staggering growth in e-commerce and the necessary upgrading of the supply chain nationwide.

2020 Portfolio Changes

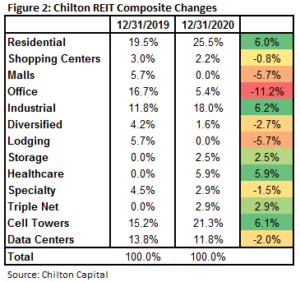

In light of these conclusions, we made several large changes to the portfolio during 2020. As shown in Figure 2, the largest changes were the increases to the cell tower, residential, healthcare, and industrial sectors.

The increase in cell towers was largely due to the fact that they all possess a superior business model relative to most REITs, which was only enhanced by the events of 2020. Note that this is before we witness any tangible benefit from the rollout of 5G expected later in 2021 and lasting for several years thereafter. We let the outperformance of the underlying companies versus the benchmark grow unabated due to the high predictability of dividend growth in the future.

In 2020, we initiated positions in healthcare REITs for the first time since 2016, and the first time to senior housing REITs since 2013. Senior Housing and Skilled Nursing were particularly hard hit by the virus given how susceptible older residents were to COVID. Occupancy rates fell due to the higher death rate and the fact that most facilities were in shutdown mode for most of the year, preventing operators from attracting new residents. Not helping was excess supply in senior housing going into 2020. However, the rollout of the multiple vaccines should tamper current fears by seniors considering this lifestyle and, longer term, the demographic tailwinds should lead to a significant demand spike.

We added to the residential sector, specifically in the manufactured housing (or MH, e.g. mobile homes) and student housing space, while choosing NOT to rebalance away from the single family rental REITs as they appreciated versus the rest of the portfolio. MH provides one of the lowest cost alternatives for individuals seeking shelter, but local ordinances and tough building codes act as major obstacles to new supply. Accordingly, MH communities enjoy very high occupancy rates nationwide, which should continue given the lack of new supply to meet demand. In addition, MH REITs have diversified into recreational vehicle (or RV) parks and marinas. One of the surprising beneficiaries of the shutdown in air travel was the boom in sales of RVs and boats, driving record occupancy rates and rental income during a recession. Furthermore, we added to student housing as it should return to normal conditions as the vaccine rolls out completely.

In addition to letting the prior industrial positions grow as they appreciated against the rest of the portfolio, we added a new name with exposure to tertiary and secondary industrial markets that has yet to experience the premium valuation at which the rest of the sector trades. We believe industrial fundamentals are so strong that there should not be such a large discrepancy between industrial valuations today.

The above changes were largely funded by decreases to the office, malls, and lodging sectors, as detailed below.

The office sector has not seen the worst of the pandemic on occupancy and rent levels considering the long term nature of leases that heretofore has made it an attractive place to be during an economic downturn. Observers are speculating about the long term implications from the WFH and WFA but most now believe it will result in a 10-15% reduction in demand that will play out in the next few years. Exacerbating the impact on office demand has been the accelerating trend of companies relocating from gateway cities such as NYC and Los Angeles to cities in the Sunbelt such as Austin and Phoenix. As such, we sold office REITs with exposure to coastal cities in favor of a company with exposure to the potential beneficiary cities.

Malls were particularly hard hit by the various shutdowns, causing rent collection rates to be among the lowest of all property types. Already under pressure from the growing e-commerce share of retail sales, malls were hard hit by the record rate of store closures and retail bankruptcies for both in-line tenants and department stores. As we have written in previous publications, we believe the majority of the 1,100 malls in the US will be closed or redeveloped into alternative uses. This will take years to play out and involve huge capital investment, likely resulting in major losses for landlords. Also, the impact on occupancy rates and rents is highly unpredictable even for the 300+ malls that will survive and prosper, making the sector unappealing. As such, we completely sold out of our mall exposure on March 12.

Lodging, always viewed as one of the most speculative property types due to the ’daily’ lease, has been dealt multiple fundamental setbacks by the pandemic. Despite the obvious pent-up demand that is building for personal and business travel as the population gets vaccinated, we now see business travel most at risk and expect it to take years for fundamentals to return to 2019 levels, if ever. Companies are saving billions from reduced travel budgets and are acclimating to video conferencing as a substitute. Admittedly, while it is difficult to assess to what degree business travel has been permanently impacted, the fact remains that occupancies, room rates, and operating expenses will be under pressure. Accordingly, we completely sold out of our lodging exposure on March 10.

To 2021 and Beyond!

Annual forecasting is an inaccurate science where we can look back to see what worked and what went wrong over a 12 month period. However, our long term track record of significantly outperforming the benchmark suggests that our process is accurate in isolating the best companies to own. While 2020 calls into question any annual absolute return forecasts going forward, we feel even more confident about the long term necessity for an active public REIT manager in all portfolios.

We understand that 2020 has not been easy for most people, so we would like to thank our clients for having the confidence to trust us with their money. We look forward to continuing upon our track record for many years to come.

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

RMS: 2220 (12.31.2020) vs 2402 (12.31.2019) vs 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.