Equity REITs: Takeaways from REITWeek 2024 | July 2024

July 1, 2024

We recently attended the annual REITWeek conference, where we conducted 36 meetings with REIT CEOs and CFOs. We also attended four organized dinners, one property tour, and a run around Central Park with a REIT management team to maximize our time in New York City with REIT executives.

The key themes were: 1) a gradual thawing of the transaction market with bid-ask spreads improving; 2) development projects remain difficult to pencil until construction and financing costs regress; and 3) a general sense of optimism driven by stable-to-improving fundamentals across most property types.

We left the conference with several actionable ideas, which we present below along with key takeaways from our meetings.

Data Centers

We met with Equinix (NASDAQ: EQIX) and Digital Realty Trust (NYSE: DLR). Data centers are one of the darling sectors today given the backdrop of restricted new supply and unprecedented demand, which is being further propelled by the artificial intelligence (AI) revolution. Only a year ago, both companies were talking about the potential for AI to drive new leasing; 12 months later, AI is already a significant contributor to new leasing, which is soaking up new space as quickly as it can be built, allowing data center landlords to push rents well above forecasts from a year ago.

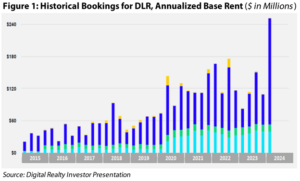

We initiated a position in DLR in October of 2022 in anticipation of restricted new supply due to power constraints across the world, particularly in Northern Virginia (the largest data center market in the world) and Singapore. Since then, the stock is up 68% through June 30, 2024, while the MSCI US REIT Index is up only 21% over the same period. DLR announced a record $252 million of annualized booking revenue in 1Q24, and hinted that the record may be broken again this year (see Figure 1 for historical quarterly booking revenue). In addition to providing strong organic growth, the higher rents and leasing numbers also de-risk and enhance the returns of the company’s massive development pipeline. It’s large deployments on owned land with power commitments put the company in prime position to capitalize on the AI revolution today. Assuming a 12% yield and a current 5% implied cap rate on its $4.5 billion pipeline (at company pro rata share), DLR should be creating $6.3 billion in value or $20 per share (versus a $152.05 per share price as of June 30, 2024).

EQIX’s core business, interconnected data centers, is experiencing organic growth of 5-6% annually as it has been for years, but has yet to benefit from AI as the early deployments of AI have been in large data center developments with hyperscalers (e.g., Alphabet, Microsoft, Amazon). EQIX is capturing this through their x-scale joint ventures, where the company brings in an 80% capital partner. Similar to the early cloud deployments, the company believes that AI leasing will eventually reach the interconnected data centers to drive rents further upwards. One comment that stuck with us from our meeting was a quote from one of their top customers, Microsoft (NASDAQ: MSFT), who said that the world will need 40 EQIX’s (!!!) to satisfy the demand that is coming.

Cell Towers

We met with American Tower (NYSE: AMT), the largest cell tower REIT in the world. AMT, along with the other two cell tower REITs (SBAC and CCI), is trading near a 13-year low AFFO multiple, indicating an extremely bearish earnings outlook. However, AMT has maintained its ‘at least 5%’ US annual revenue growth guidance through 2027, and has an upcoming catalyst in the sale of its India business for $2.5 billion. Though the sale will be dilutive to earnings, the proceeds will be used to paydown debt, which lowers risk, and therefore should increase the price to AFFO multiple. While the deployment of 5G on cell towers has been slower than hoped, the company is convinced that every cell tower will eventually have a 5G site. Beyond 5G, there is already talk of the development of 6G, which will require even more new sites than 5G.

Triple Net

While the triple net sector has been a perpetual underweight in the Chilton REIT Composite, we initiated a position in NNN Realty (NYSE: NNN) in August 2022 due to the attractive relative valuation versus shopping center REITs despite lower capital expenditures and longer leases, but similar tenants. NNN’s management team takes a conservative approach to the company balance sheet, boasting a weighted average maturity of 11.8 years on its debt. NNN produces about $200 million in free cash flow each year after paying the dividend, plus another $100 million from dispositions, which puts it in the enviable position of being above to acquire approximately $500 million of new properties each year without increasing its leverage or raising new equity. Furthermore, the weighted average year one cash yield on its acquisitions in 1Q24 was 8.0%, which means it is one of the few property types where accretive opportunities are available using debt (recent 10 year note offering was at a 5.5% coupon).

We also met with Realty Income (NYSE: O), the largest triple net REIT. O is flexing its size and global reach by borrowing in markets outside of the US to make acquisitions more accretive to earnings. For example, the company can borrow in Europe at 4%, but still achieve 7.8% year-one cash yields on its acquisitions. While bankruptcies are a regular occurrence in a portfolio with over 1,500 tenants, O can use its size to gain favorable terms with tenants through the bankruptcy process. For example, O is by far the largest landlord for Red Lobster with 216 stores. Even though they anticipate closures in the Red Lobster bankruptcy, any reorganization shouldn’t be any different than their historical average of re-capturing 80% of prior rent. Similar to NNN, the company believes it can produce 2-3% of annual AFFO growth without raising any new equity.

Multifamily, SFR, & MH/RV

We met with Camden Property Trust (NYSE: CPT), Equity Residential (NYSE: EQR), Mid-America Apartments (NYSE: MAA), Independence Realty Trust (NYSE: IRT), UDR Inc. (NYSE: UDR), and Centerspace (NYSE: CSR). This sector illustrates a tale of two regions. Sun Belt apartment REITs experienced gradual improvements in blended lease rate growth as record absorption and historically low turnover have mitigated the challenges presented from elevated new supply. Conversely, Coastal apartment REITs saw a more pronounced acceleration in lease rate growth driven by strong fundamentals along the East Coast, including Boston, New York, and D.C., as well as emerging positive trends in select West Coast submarkets such as suburban Seattle, San Jose, and San Francisco.

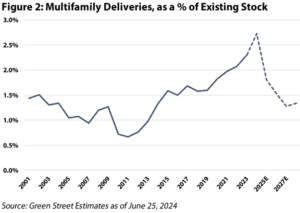

Other notable topics included the gradual thawing of the transaction market and the potential for 2026-2028 to be among some of the top years for rent growth since the post-GFC period. Recently announced deals such as Blackstone’s acquisition of AIR Communities and Lennar’s pending 11,000+ unit multifamily portfolio has helped narrow the previously widened bid-ask spread. Management teams affirmed that development starts are actively ‘falling off a cliff’, suggesting that apartment completions in 2026-2028 could be as low as those seen after the GFC, as shown in Figure 2. Reduced supply should lead to outsized rent growth, presenting an ideal opportunity for REITs able to develop and deliver in this window.

In the single-family rental (SFR) sector, we had productive meetings with both American Homes 4 Rent (NYSE: AMH) and Invitation Homes (NYSE: INVH). Strong SFR fundamentals are bolstered by a significant disparity between in-place rents and the cost of homeownership (approximately a 28% difference in AMH’s markets), favorable demographic trends, and limited housing supply. With stable occupancy around 97%, blended lease spreads accelerating north of 5%, and expenses trending favorably, the SFR sector is well-positioned to maintain resilient revenue growth for the foreseeable future.

Lastly, we met with Sun Communities (NYSE: SUI) and Equity Lifestyle Properties (NYSE: ELS), both focused on manufactured housing (MH), RV parks, and marinas. Demand remains robust across all three verticals, with each able to exercise pricing power and implement rent increases in the 5% – 7% range. While revenue growth in the transient RV segment is comparatively sluggish, this appears to be a post-COVID ‘return to normal’ rather than a sign of secular demand weakness.

Self-Storage

We met with Public Storage (NYSE: PSA) and Extra Space Storage (NYSE: EXR). Despite management’s expectations for move-in rates to potentially turn positive year-over-year by the end of 2024, they remain in the negative double-digit range (-10% to -15%) through May 2024. Consequently, these steep discounts have resulted in larger-than-normal rent roll-downs, with street rates approximately 30% below in-place rents, compared to the historical average of about 15%. In response, REITs are implementing ECRIs (existing customer rent increases) sooner (after four months) with initial rent increases of up to +30%, and pushing subsequent semi-annual ECRIs in the mid-teens range to quickly align with in-place rents.

While storage demand continues to be a hotly debated topic, management teams have expressed optimism due to better-than-expected occupancy levels, even as home sales activity, a key demand indicator, remains near historic lows. When the housing market begins to recover, whether through lower interest rates or pent-up demand, we believe the storage sector is well-positioned to capitalize. The transaction market remains relatively subdued and there is minimal new supply expected to deliver over the next few years.

Shopping Centers and Malls

Our team met with InvenTrust Properties (NYSE: IVT), Kite Realty Group (NYSE: KRG), Brixmor (NYSE: BRX), and Kimco Realty (NYSE: KIM). Additionally, we also met with mall and outlet owner Simon Property Group (NYSE: SPG). Overall, leasing velocity remains attractive for the sector, and anecdotally, investor interest appeared to pick up relative to last year. The tenant watchlist remains subdued, but landlords expect they can refill spaces at healthy premiums for challenged tenants (e.g., Big Lots, Joann’s, Michaels, etc.) similar to their success with Bed Bath and Beyond in 2023. However, the group is still struggling to translate leasing momentum into bottom line growth. It was encouraging to hear more investors focused on maintenance capex – a topic we discuss ad nauseum in the June 2024 REIT Outlook – but the inflection point for shopping centers remains elusive in 2025. Accordingly, we see better risk adjusted returns in other property types and thus have maintained a slight underweight to shopping centers.

Turning to malls, SPG continues to successfully monetize its minority interests in non-mall activities (most recently generating $1.45 billion of gross proceeds from its interest in Authentic Brands Group), adding to the company’s robust free cash flow (about $1 billion). As we’ve heard in the past, this affords management the flexibility to prudently reinvest in their core malls business ($800 million redevelopment spend underway) and selectively develop (Fashion Valley mixed use project) while also returning cash to shareholders through buybacks and dividend increases.

Healthcare

We met with the two pre-eminent senior housing owners, Ventas (NYSE: VTR) and Welltower (NYSE: WELL), as well the management for REIT land’s latest IPO, American Healthcare REIT (NYSE: AHR). Senior housing operating (SHOP) properties are moving increasingly into favor as fundamentals have almost ceaselessly exceeded rising expectations over the past two years. Based on the latest operating trends from May (as the industry enters peak leasing season), 2024 guidance figures from just a few months ago already appear too low and 2025 is shaping up for potentially another year of accelerating growth. For most participants, capital availability remains scarce, and as a result, the REITs are having success buying high quality assets at attractive entry points – WELL already closed or was under contract to close $3.8 billion of acquisitions as of June 3rd, 2024.

Turning to medical office buildings (MOBs), while we were not able to meet with Healthcare Realty (NYSE: HR) at the conference, we have circled up with management recently and spent time at the conference gauging investor sentiment following the recently announced KKR JV (generating initial proceeds of ~$300 million for HR to boost share repurchase activity). Broadly, private interest in MOBs appears more robust than we had appreciated and is continuing to bid on higher quality properties around the low 6% cap rate range, which compares to HR’s implied cap rate of 7.5% as of June 30, 2024.

Finally, AHR’s unique operating model combines SHOP with skilled nursing (SNF) through its majority stake in JV Trilogy, presenting one of the most interesting developments in REIT land. The company is the first to operate SNF exposure through a RIDEA structure (REIT Investment Diversification and Empowerment Act – giving them operating exposure rather than triple net rent). The potential upside is enticing, but SNFs are notoriously fraught with road bumps, which means success ultimately rests on the operating prowess of Trilogy. As such, members of our team traveled to Kentucky after NAREIT to meet with Trilogy’s management team and tour several facilities, ultimately coming away with a deeper understanding of this novel business model.

Industrial

Our team heard from management at Prologis (NYSE: PLD), Plymouth (NYSE: PLYM), Terreno (NYSE: TRNO), and Americold (NYSE: COLD). Although industrial REITs are still generating some of the strongest earnings growth amongst REITs in 2024 and 2025 as expiring rents are adjusted to market, the current period of elevated supply deliveries and subsequently increasing vacancy rates has been a headwind in 2024. This was displayed as PLD declined over 7% in one day following a modest 1.3% 2024 FFO guidance reduction in its 1Q earnings release (April 17th, 2024), highlighting the outsized risk of modest growth revisions for high multiple stocks. Shown in Figure 3, after holding an overweight to Industrial in early 2023 (+2.0% relative to the RMZ as of 3/31/23), we reduced our exposure during the latter portion of 2023 (-2.4% relative to the RMZ as of 3/31/24). Following the latest pullback, we believe much of the downside risk has been alleviated, and we are actively evaluating opportunities to increase our industrial exposure.

Office

We met with the management teams of Boston Properties (NYSE: BXP), Highwoods Properties (NYSE: HIW), and Cousins Properties (NYSE: CUZ) in addition to participating in a property tour at BXP’s 360 Park Avenue redevelopment. It’s no secret that office REITs resided in the doghouse for the past few years, but we are seeing a continued bifurcation between the haves and have-nots. Specifically, office vacancy nationwide is 20%, but A quality vacancy is only 12%. According to JLL, 50% of the vacancy resides in only 10% of buildings nationwide. We are also hearing tenants are differentiating based on the landlord’s financial position, and, given REITs are typically the best capitalized operators within office, this has been a material tailwind enabling REITs to capture market share. Further, we heard anecdotal evidence the return-to-work push continues to improve, and that the more publicized Kastle numbers sometimes understate the actual picture (particularly in NYC and Boston).

Overall, we expect tough sledding to continue as office recovers in fits and starts, but we remain of the view that the best positioned office REITs will emerge stronger on the other side. At this stage we remain underweight to the sector overall, but are looking closely to identify the long-term winners in the sector.

Conclusion

After several days of management meetings and property tours, our team emerged with a more positive outlook on the broader industry’s long-term prospects. In our assessment, the most crucial factor for commercial real estate remains the significant decline in development activity, which we anticipate will persist until construction and financing costs come down and rents positively adjust. Conversely, as interest rate volatility has started to normalize, we are beginning to see the transaction market heat up, a trend we expect to continue.

We believe REITs are, in most cases, one of the best-capitalized operators within their respective property types. With pockets of distress inevitable in the private real estate market, REITs could capitalize on accretive growth opportunities. Additionally, an increase in transaction activity could further highlight the disparity between public and private valuations, benefitting REITs by enabling them to grow their asset bases and contribute to dividend growth in the future. We are convinced that equity REITs are poised for growth with interest rates peaking, higher rents ahead, low new supply, and balance sheets that can support significant asset growth.

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Isaac A. Shrand, CFA

ishrand@chiltoncapital.com

(713) 243-3219

RMS: 2,721 (6.30.2024) vs. 2,727 (12.31.2023) vs. 3,177 (12.31.2021) vs. 1,433 (3.23.2020) vs. 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index and ETF performances [MSCI and VNQ and FNER and LBUSTRUU] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.

Leave a Reply Cancel reply

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.