All Yield is Not Created Equal: MLPs vs Public REITs | February 2020

February 1, 2020

MLPs or REITs? These two have been linked ever since Apache (NYSE: APA) established the first MLP in 1981 due to their above average yields and tax-advantaged status. Other than MLPs having a K-1 for tax reporting versus public REITs having 1099’s like traditional C-corps, both structures provide tax benefits and serve as yield alternatives. However, the types of companies that chose between the two structures differed, and thus the returns have diverged significantly.

While it is our opinion that it should not have been a decision of one or the other, the market cap of the energy MLPs grew by 1,175% from 2003 to 2014 while the market cap of equity REITs grew only 313% over the same period. We believe this shows that investors were more interested in buying MLPs than REITs. We can’t be sure why, but it is our contention that much of the investor flows into MLPs was based on a thirst for yield from retail (individual) investors. Given that MLPs had a higher yield than REITs, that was one ‘check’ in the MLP box. Additionally, when looking at the relatively shorter history of MLP performance, MLPs provided top-notch returns with low volatility and a low correlation with other asset classes.

However, as we’ve mentioned many times before in this publication, we do not believe that volatility and risk are synonymous. We believe an assessment of risk includes analyses of corporate governance, regulations, distribution coverage, balance sheet leverage, and predictability of future cash flows. As such, many MLP investors may not have been fully aware of the risks associated with the higher yields, and were therefore caught by surprise when the ‘perfect storm’ of several events starting in late 2014 highlighted these risks and resulted in a systematic repricing of the whole sector.

Thankfully, many MLP management teams made tough decisions to restructure their companies in a manner that carries much lower risk (our definition), though the volatility may continue now that the risks are more readily known by investors. Understanding that we are not MLP experts, we are not recommending a buy or a sell on the asset class. However, we advocate prospective investors in MLPs or REITs learn about the risks and rewards associated with each, and that current MLP investors with zero REIT exposure add an allocation to REITs to diversify return streams and lower overall portfolio risk.

History of MLPs (1981-2014)

The first MLP (or Master Limited Partnership) was created in 1981 in an effort to raise money from smaller investors, who could then trade the units in a more liquid manner than a typical private partnership interest. Many industries took advantage of the tax-advantaged structure, including real estate ironically. In 1987, Congress signed into law Section 7704 of the tax code, which laid out the rules that are still in place today governing the structure. Namely, it limited the eligible income to only natural resource activities, commodity investments, capital gains, and rental income. This cleared the way for energy companies to use the structure more exclusively, but oil prices soon collapsed, limiting its use until years later.

As prices recovered and integrated oil and gas companies needed to raise capital for higher growth projects, they created MLPs to buy their ‘midstream’ assets (e.g. pipelines) at cash flow multiples higher than their own, which would contribute immediately to earnings per share. In theory, the MLP would trade at a higher multiple than the integrated company because pipelines functioned as a ‘toll road’ that generated revenue based only on volume, and thus should have an earnings stream that was more predictable than a company doing exploration and production (or E&P) or refining, which were more sensitive to oil prices. A higher multiple on the MLP would justify more acquisitions (at higher prices), which meant that it would grow distributable cash flow (or DCF) per share faster, thus creating an apparent virtuous cycle. In addition, most MLPs had a relationship with one of the integrated companies that would ‘drop down’ these assets periodically, which comforted investors that there would be a steady ‘pipeline’ of acquisitions in the future.

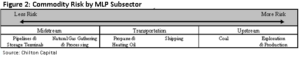

However, as the saying goes, “anything worth doing is worth overdoing”. Integrated companies began to put a wide variety of other subsector assets into MLPs. As shown in Figures 1 and 2, the lower risk subsectors of pipelines, storage, and gathering and processing gave way to subsectors with much more commodity risk, such as coal and E&P, which was the very thing that the original MLPs were trying to avoid!

Furthermore, the ‘relationship’ between the LP and the integrated company was not all roses. Each MLP also had to have a General Partner (or GP) which initially owned 2% of the MLP. The GP could be the integrated company or a third separate entity, but the issues were the same. The arrangement is eerily reminiscent of the ‘external management’ structure that was prevalent in the early days of public REITs, and is unfortunately still alive and well in the non-traded REIT arena. All of the entities shared board members and sometimes even management team members. The ‘limited partners’ of the MLP were just that – limited by few shareholder rights. The obvious issue that could arise from these shared board members would be conflicts of interest on a variety of issues among them acquisition prices between the entities.

Even worse, most GP/MLP agreements had Incentive Distribution Rights (or IDRs), which changed the amount of cash flow the GP was entitled to based on the distribution per share. For example, at the outset, the GP owns 2% of the MLP and is entitled to 2% of the DCF. However, as the distribution per share increases, the GP could take up to 50% of the DCF before the limited partners get paid. Therefore, the GP was incentivized to raise the distribution per share as much as possible, either through acquisitions or increasing the payout ratio (or both). There were not usually any time limits on these incentives and thus limited partners received less incremental distributions as MLPs matured, forcing them to acquire even more to get the same growth. As an example, as of June 30, 2013, 11 of the 14 large cap midstream MLPs were paying out the maximum 50% to the GP (one of the other three was at 45%).

Further incentivizing acquisitions was the tax structure of the MLP, which requires depreciation (or depletion) to maintain the tax-deferred nature of the distributions. The need for acquisitions created a ‘treadmill’ that conflicted with long term viability of the MLP. Using depreciation or depletion as a ‘tax shield’, the MLP distributions were mostly classified as ‘return of capital’ on the K-1, meaning limited partners did not have to pay taxes on it. The cost basis of the investment was reduced by the return of capital amount such that the taxes are ‘captured’ by Uncle Sam when the MLP is sold, usually at the ordinary income rate (currently 37% at the top end). However, estate tax law allows for the cost basis of any stock to be ‘stepped up’ to the current price upon death, which would mean that the distributions were essentially tax free.

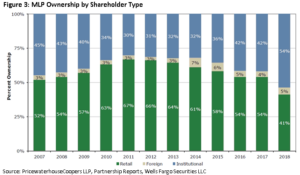

With this in mind, many retail investors scooped up MLPs with intent of holding them until death. Typically, retail investors are more enticed by yield than institutional investors, as they may not have the expertise to analyze the risks associated with complicated companies. As shown in Figure 3, the MLP shareholder base consisted of 66% retail investors in 2012, which contrasted to only 18% for REITs. The high proportion of retail investors meant that high yields were rewarded and encouraged at the expense of many of the risk factors mentioned above.

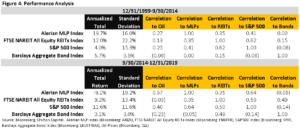

With few sellers and many yield-hungry buyers, MLP performance was outstanding from December 31, 1999 to September 30, 2014, as shown in Figure 4. In addition, volatility and correlation to other asset classes were extremely low. Even better, the ‘toll road’ story was working as the correlation to oil prices was only slightly higher than it was for the S&P 500. On paper, it was as close to a ‘perfect investment’ as one could want, and there didn’t seem to be an end in sight.

The ‘Perfect Investment’ Experiences a Perfect Storm

However, the fall in West Texas Intermediate Crude (or WTI) prices from almost $100 per barrel in 2014 to below $30 per barrel in 2016 tested the security blanket that many MLP investors thought they were getting. First, though the midstream MLPs were not explicitly price-sensitive, the counterparties of their volume-based contracts proved to be very sensitive to oil prices. E&P companies need a certain price to justify drilling and transporting that volume. Thus, the falling oil prices caused a slowdown in drilling, which of course results in a slowdown in volume. The balance sheets of their counterparties were also of concern, as many E&P companies had leveraged up to participate in the American Shale Revolution. A midstream MLP company would have a difficult time collecting payment from a bankrupt counterparty.

In particular, E&P MLPs were crushed by falling oil prices, leading to many bankruptcies. E&P MLPs peaked at over 8% of the Alerian MLP Index as of June 30, 2012, which compares to 0% as of December 31, 2019. Most notably, Linn Energy LP filed for bankruptcy protection with $8.3 billion of debt in May 2016. Linn’s unit price peaked at $42.50 per unit in November 2012, and was below $1 per unit by February 2016, wiping out $8.2 billion in unitholder value. To add insult to injury, the unitholders were also stuck with a taxable gain due to the cancellation of debt in the bankruptcy despite watching their units trade down to $0!

The acquisition of Kinder Morgan Energy Partners LP (NYSE: KMP) by Kinder Morgan Inc. (NYSE: KMI) announced on August 10, 2014 was another blow to retail investors who thought they had a safe growing yield to hold until death. As a result of increasing the distribution too much at the MLP (the GP was receiving 40% of DCF at the time of the acquisition pursuant to the GP-LP IDR agreement), the relative cost of capital no longer made sense for acquisitions from the C-corp. The only way to ‘cut’ the distribution without hurting payments to the C-corp was through an acquisition of the MLP, which came at a 12% premium to the prior day’s closing price. However, the MLP shareholders were forced to recognize all of the taxes that were supposed to be avoided by holding until death. Many shareholders may not have been aware that their cost basis was declining with every distribution payment such that even those that may have been taken out at a price below where they initially bought were forced to pay taxes. The cherry on top was that the acquisition was structured such that the MLP owners’ gains were taxed as ordinary income (for which the top bracket at the time was 39.6%) instead of long term capital gains (23.8% tax rate) as a typical stock (or REIT) sale would be taxed.

To illustrate, the implied price of KMI on the day the acquisition was announced was $89.98 per unit, but KMP noted that the average investor would owe between $12 and $18 per unit in taxes. Furthermore, a WSJ article proposed that investors who had bought shares prior to 2000 could owe over $25 per unit! Considering that KMP traded for $65.12 per unit on March 31, 2010, the transaction actually wiped out over four years of price appreciation depending on the investor holding period!

The jig was up. Retail investors fled, and comprised only 41% of the shareholder base as of December 31, 2018. Many MLPs converted to C-corps, or were combined with the GP to stop the conflicts of interest and cut out the IDR. Sometimes, the MLP was the buyer of the GP, leading to even larger payouts to the same entity (and management team) that was sucking the MLP dry. Unfortunately, this is also reminiscent of the early public REIT days where external managers were eventually bought by the REIT to stop the obscene fees.

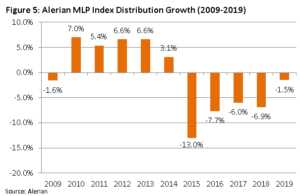

With volume declining and acquisitions drying up, many MLPs were forced to cut their distributions, once thought of as sacrosanct to the investing equation, as shown in Figure 5. The result was a complete reversal in performance from the prior 15 years. While MLPs had almost five times the annualized total return as the S&P 500 from December 31, 1999 to September 30, 2014 with similar volatility, they have significantly underperformed since then. In fact, the annualized total return was -9.1% from September 30, 2014 to December 31, 2019 versus +11.6% for the S&P 500 and +9.4% for the RMS Equity REIT Index, while the volatility for MLP’s was almost double that of the S&P 500! Furthermore, the correlation with oil prices spiked from 0.27 in the prior 15 years to 0.57 for the next five years, as shown in Figure 4.

MLP Investing Today

We believe that REITs are an essential strategic allocation for all clients. However, we also believe that carefully selected MLPs can be additive for clients looking for further diversification and higher yield in a tax-advantaged manner. As with our approach on REITs, we advocate using bottom-up fundamental analysis to determine which MLPs provide adequate total returns for the underlying risk. This has been true since before the MLP bust, as our clients avoided many of the MLPs that had the issues mentioned above by using the below criteria:

Seek assets with structural advantages: Larger integrated midstream companies with broad systems are competitively advantaged as hydrocarbon ‘hubs.’ Systems with end to end solutions for producers provide lower costs to customers, resulting in market dominance and higher returns.

Own high-quality business leveraged to growth areas: Energy exports from the US and petrochemicals are structural growth areas in a highly cyclical energy industry. The long term need for global energy growth will be increasingly met by US exports of low-cost hydrocarbons and petrochemicals to meet demand.

Avoid commodity price risk: The purpose of owning an MLP is typically for a steady, predictable income yield stream. To achieve the objective, it behooves an investor to avoid commodity price risk and focus on less cyclical businesses. We prefer ‘toll-road’ type businesses models such as pipelines, storage, and integrated gathering and processing.

Governance: We focus on shareholder friendly companies that have eliminated IDRs, seek long term returns over asset growth, and have self-funding businesses without need for equity issuance.

Diversify with REITs and High Quality Midstream MLPs

There was nothing inherently wrong with the MLP structure but, in retrospect, it turned out to be inappropriate for many energy-related businesses. Certainly there were some bad actors that were allowed to thrive due to investors’ thirst for yield, but there were also other companies that imposed more prudent policies on themselves focusing on long term shareholder returns.

REITs have had many similar instances in the past that demonstrated certain business models were inappropriate. However, they began about 20 years before MLPs and thus were able to work out the kinks a little sooner and perfect one of the best vehicles ever designed to produce above average yield with growth for a variety of investors. We believe there is room for REITs and MLPs in every portfolio that is looking for income in a tax efficient manner, but as always we stress bottom up fundamental analysis and active management. Coincidentally, some midstream companies are considering a conversion to the REIT structure!

Matthew R. Werner, CFA

mwerner@chiltonreit.com

(713) 243-3234

Randall R. Grace

rgrace@chiltonreit.com

(713) 243-3223

Bruce G. Garrison, CFA

bgarrison@chiltonreit.com

(713) 243-3233

Richard J. Pickert, CFA

rpickert@chiltonreit.com

(713) 243-3211

RMS: 2430 (1.31.2020) vs 2402 (12.31.2019) vs 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.