Equity REITs: Vulnerable to the Private Equity “Put” | June 2022

June 6, 2022

Things have changed drastically over the past six weeks in the market. Volatility has spiked, and prices have retraced back to levels not seen in 12 months. Some have been calling for a recession as early as this year. Seemingly, there is little ‘good’ news for long-only investors, especially in REITs.

However, we see several bright spots. Already, two REITs have agreed to takeovers by Blackstone (NYSE: BX) in April, and two more REITs are in play today. While the rise in the 10 year Treasury yield has certainly hurt the current prices of public equity REITs, private equity giants such as Blackstone have a mandate to invest in commercial real estate as holding cash is dilutive to their cost of capital. As such, we believe the potential for mergers and acquisitions (or M&A) activity will help REIT prices to find a floor, giving some hope to near term REIT prospects.

There are several reasons for a REIT merger to occur, and those we have seen could give a clue to what we should expect over the near term. Namely, we separate mergers between ‘strategic’ and ‘financial’. Generally, most public-to-private transactions are financial, while most public-to-public transactions are strategic. However, the announced sale of American Campus Communities (NYSE: ACC) to Blackstone is a rare transaction of a high quality company that has made the decision that the company would be worth more in private hands, making it both strategic and financial.

As of the end of 1Q22, ACC was a 3.9% holding in the Chilton REIT Composite, which compared to 0.6% in the MSCI US REIT Index, a significant overweight. While our thesis for owning ACC did include the potential for M&A as a catalyst to achieve the expected total return, we also had conviction that the company’s management team could achieve these returns in the public markets as a going concern. Our assessment after reading the proxy filed in May leads us to believe that many other companies should be considering M&A in this period of uncertainty. We believe other transactions such as this could be a driver of REIT returns in this otherwise volatile market.

Recent Volatility

As of March 29th, REITs were within 2% of the all-time high reached on December 31, 2021. The Chilton REIT Composite was briefly positive year to date, yet that was all about to change. With the April Consumer Price Index (or CPI) report coming in at +8.3%, only a slight contraction from +8.5% in March but still the highest since 1981, it became clear that the Fed would be aggressively hiking the Fed Funds Rate to cool the economy. In addition, the Fed announced the gradual roll off of the $8.9 trillion bond portfolio accumulated over the past several years, not only stopping new buying but also letting bonds mature and beginning outright sales.

The Fed rate hike in March was the first since late 2018, and was only a precursor to the 50 basis point (or bp) rate hike in May, which was the biggest individual rate hike in 22 years. Jerome Powell, the Chairman of the Federal Reserve, has indicated at least two more hikes of 50 bps at the consecutive meetings, and as of the March meeting the Fed Funds Rate was expected to reach by year end. This compares to a Fed Funds rate of 0% to start the year!

While a rate hike cycle was not a surprise for 2022, the pace and number of rate hikes caught many off-guard, sending long term bond yields higher, bringing down prices. In fact, the first quarter of 2022 was the worst quarter for the Barclays Aggregate Bond Index since 1980. REIT yields hung on briefly, perhaps out of hope that REITs could be a beneficiary of inflation and increasing dividends would make up for the higher 10 year Treasury yield. However, as the 10 year Treasury yield blew past 3% (after starting the year at 1.5%), it became clear that higher yields were here to stay. As a sign of the upcoming rate increases, the two year Treasury yield moved from 0.7% on 12/31/21 to 2.5% on 5/31/22!

Private Equity History

The track record of private equity in commercial real estate is checkered. The damage done in 2008-2009 was swift and draconian. Importantly, it followed the largest wave of ‘take-private’ transactions of REITs in history. While investors in the public REITs that were taken private were rewarded with cash at peak prices, the investors in private funds had the opposite outcome. Many were wiped out completely, while those that survived posted lackluster returns.

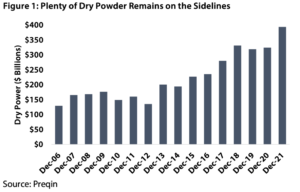

However, the Global Financial Crisis was so deep, it created the longest real estate cycle in history, lasting until 2020. Fundraising was muted for several years following the recession, but came back with a vengeance, rewarding investors with handsome profits as rents rose and cap rates declined. As shown in Figure 1, the amount of ‘dry powder’, or cash raised with the purpose of investing in commercial real estate, increased to a new post financial crisis high in 2013, and has increased meaningfully beyond that level since then.

One of the biggest surprises was the return of the ‘non-traded REIT’. Non-traded REITs have been ‘infamous’ since their creation for conflicts of interest, high fees, poor returns, and lack of liquidity. The punishment exacted on them from the 2008-2009 recession was almost a death knell. To add fuel to the fire lawsuits in the aftermath of the recession forced major fines and negative publicity, bringing the non-traded REIT industry to its knees for years.

However, Blackstone, Starwood, and KKR have launched a nuanced version of these non-traded REITs, and found unparalleled success in fundraising. For example, as of April 21, Blackstone had raised over $12 billion for its non-traded REIT (BREIT) thus far in 2022, $3 billion+ per month! At the precise moment of bringing in that equity, each vehicle must start the clock on paying dividends. Therefore, any gap in time from the cash being invested in commercial real estate makes it difficult to meet the required payout. Including its other funds, we believe Blackstone needs to acquire about $30 billion of real estate in 2022 (including the use of leverage) just to keep the machine going!

2022 M&A

In 2022, there have been announcements of 6 privatization transactions as of May 31 (we include one deal announced in December 2021 that hasn’t closed yet). What do they have in common? They were trading at a discount to Net Asset Value (or NAV), and did not have any readily identifiable catalysts to close the gap. As of May 31, the companies that have been acquired or are under contract to be acquired include: Bluerock Residential (NYSE: BRG), PS Business Parks (NYSE: PSB), American Campus Communities (NYSE: ACC), Preferred Apartment Communities (NYSE: APTS), Cedar Realty Trust (NYSE: CDR), Healthcare Trust of America (NYSE: HTA), Switch (NASDAQ: SWCH), and CatchMark Timber Trust (NYSE: CTT). Separately, Healthcare Realty (NYSE: HR) and Duke Realty (NYSE: DRE) are ‘in play’.

This compares to a total of 12 deals completed in 2021, which was the most active year for REIT M&A since 2007. The total market cap of the 8 potential deals equates to nearly $53 billion, which compares to 2021’s total of $77 billion and 2007’s total of $90 billion. Of these 9 potential deals, Blackstone is the acquirer in 4 of them! We classify Blackstone and most private buyers of public REITs as ‘financial buyers’, while a public to public transaction is usually a ‘strategic’ buyer. In the case of Blackstone, the financial buy is dependent solely on achieving some spread over its cost of capital. A strategic buy will depend on cultural fit, synergies, and transaction costs. In general, most M&A have a spotty historical track record for driving long term returns. It is difficult to measure the success of privatizations for the acquirer, though it usually is a good outcome for the public investors in the target.

Bluerock, Preferred Apartment Communities, CatchMark and Cedar are examples of companies that needed a takeover as a catalyst to create any value whatsoever for its investors. With a poor cost of capital and limited access to the capital markets, they were ‘dead in the water’ and had no chance of trading in line with their higher quality peers. HTA could also fall into this category as the company was operating without a CEO and undergoing a strategic review of alternatives. Any member of the board of directors of these companies were under an obligation to find the best possible candidate to acquire the company at prices close to NAV. Rumors are that Switch will announce a transaction shortly, and it similarly was expected to find a financial buyer given that 3 other data center REITs had been taken private in the past 6 months.

In contrast, Healthcare Realty’s potential transaction with Healthcare Trust of America and Welltower’s hostile bid for Healthcare Realty are more strategic in nature. Both acquirers believe they can achieve synergies by eliminating general and administrative costs (accounting, board of directors, office rent, executives/management), and raising operating margins. Both already are in the business that is employed by the target, and thus do not need to bring on platform (leasing, property management, best practices). As such, they are essentially reaffirming their desire to be in that particular business (in this case, medical office buildings), and believe they can do it more efficiently than if they were separate (1+1=3). Time will tell if either of these transactions close or if they do, whether they are beneficial for shareholders of either company. However, we certainly understand the rationale.

The third type we would like to highlight is not necessarily dependent upon the acquirer; instead, it is the target company that could be sending a message to the rest of the market. On April 19, 2022, American Campus Communities (NYSE: ACC) announced that it had agreed to an all-cash offer from Blackstone to be acquired for $65.47 per share, a 14% increase over prior day’s closing price. The transaction was approved unanimously by the board of directors and should close in the 3rd quarter. What makes this transaction unique is that ACC has been a ‘blue chip’ REIT for much of its public life. The company debuted on the NYSE in 2004 and never had to cut the dividend, including during the Global Financial Crisis and COVID. The announced acquisition price implies an annualized total return of 12.5% from the IPO to the deal announcement, which compares to FTSE NAREIT All Equity REITs Index (Bloomberg: FNER) total return of 9.9% and the S&P 500 total return of 10.5% over the same period. CEO Bill Bayless is well-respected in the industry, and the balance sheet was rated BBB by S&P Ratings.

So why would the board of directors decide to sell the company in spite of the success on the public market? If a well-respected company such as ACC is deciding to cash out, should others do the same? The answer is not so simple. Given that 2022 is on-pace to be the biggest year for M&A transactions since 2007, it only makes sense to look for similarities between the two time periods. As shown in Figures 3 and 4, the REIT implied cap rate and dividend yield spread hit its lowest level since that period, indicating peak pricing relative to the 10 yr. Treasury yield. The housing market was extremely hot, and the Fed was trying to cool it through an interest rate hike cycle. Then, two blue chip REITs, Archstone and Equity Office Properties, decided to sell to the private market. Looking back, that was the “canary in the coal mine”; REITs that sold out in 2006-2007 looked extremely smart as the Global Financial Crisis wiped out a decade of solid returns. The other side of the coin is that the private acquirers did not look to smart. Though only one REIT declared bankruptcy, many were forced to issue highly dilutive equity and cut cash dividends or pay dividends in stock. As a result, some companies have still not yet reached their 2007 highs in spite of enjoying fantastic fundamentals through the longest real estate cycle in history and the massive stimulus following COVID.

We believe the ACC transaction with Blackstone does not suggest a repeat of what happened with REIT pricing in 2008. Though the timing seems ideal currently, with the RMZ selling off over 12% in the period since the deal was announced through May 31, other factors likely were to blame for the board’s decision. According to the proxy filed on May 10, the decision, advised by Bank of America investment bankers, the ACC capital allocation committee (somewhat unique in the REIT universe), and the board of directors, was based on favorable pricing relative to history, but also due to the risks of raising capital in the future to fund development as the company had been trading at a persistent discount to net asset value (or NAV). In addition, the fact that ACC is the only student housing dedicated REIT limited the number of buyers for the stock in the public market, and therefore enhanced the belief that the company was worth more in the private market where there was less volatility in the capital-raising environment. Notably, Blackstone does not have a student housing operating or development platform, so ACC was able to garner a premium to its assets for Blackstone to retain these key employees and best practices. We applaud the ACC board of directors and management team for their humility and focus on the best outcome for shareholders.

Call to REIT Boards of Directors

As such, we believe all REIT board of directors should take a hard look at their companies to determine what is best for shareholders. If private capital is willing to pay a price above current or forward NAV at a time when interest rates and economic uncertainty are rising, then they should carefully review any and all alternatives.

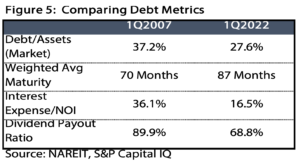

The decision may be a little bit different than in 2007 as the balance sheet risk factors hardly compare. While the weighted average debt to gross assets of REITs was 37.2% at the peak in 2007, the number is 27.6% as of March 31, 2022. The weighted average maturity of REIT debt has grown from 70 months in early 2007 to 87 months as of March 31, 2022. Finally, interest expense as a percentage of Net Operating Income (NOI) has fallen from 36.2% to 16.5% (this ratio shows how much of underlying earnings is needed to satisfy annual interest).

However, ‘surviving’ is not the goal of a board of directors. The goal is to maximize returns for shareholders. The publicly traded REITs have done an immense amount of work to get to where they are today; they have right-sized dividend payout ratios, built top notch operating platforms, upgraded property quality, become industry leaders in ESG (environmental, social, and governance) standards, and, as mentioned earlier, de-risked their balance sheets. If the NAV discount is still below peers after doing all of these things, then a strategic review is in order. At a minimum, we are proponents of the ‘capital allocation committee’ used by ACC. Those that have not met the publicly traded REIT average standard and are still trading at a discount, will increasingly be vulnerable to hostile takeovers and, again, we encourage the boards of directors to make the right decision for shareholders.

With $393 billion in private capital ready to be deployed into commercial real estate and public REITs trading at a 12% discount to NAV as of May 31, 2022, many REITs are vulnerable to such offers. In theory, the threat of a privatization could itself be enough to keep the industry from trading too far below NAV. Until the transaction market starts to show an increase in cap rates to cause a decrease in NAVs, we believe that more transactions will be announced, and, hopefully, REIT prices will find a floor.

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

RMS: 2732 (5.31.2022) vs. 3,177 (12.31.2021) vs 1,433 (3.23.2020) and 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and

assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future

Leave a Reply Cancel reply

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.