Equity REITs: Takeaways from NAREIT REIT Week | July 2022

July 8, 2022

After meeting with over 25 companies in New York for the first in-person NAREIT sponsored conference since November 2019, we came away extremely positive on the fundamentals for REITs. Across the board, leasing, occupancy, and rent growth are tracking at or above expectations, and the recent increase in interest rates has already slowed new construction, further tilting the supply and demand dynamics toward current landlords. Additionally, REITs are much better prepared than most private operators (lower leverage, less floating rate debt), which should support the relative attractiveness of REITs.

Of course, REIT CEOs were aware of plunging stock prices, not just for them but also for their tenants. However, except for life science and technology companies, the recent pullback had not begun to affect leasing activity. On the contrary, retailers, for example, were allocating more capital to in-store sales and diverting capital away from e-commerce. Self storage and apartment landlords were pushing rents higher than they otherwise would have due to their high occupancy and pricing power during their seasonally heavy leasing season.

As such, we came away from the conference with a positive outlook for REITs, understanding that price volatility may dominate the picture until interest rates stabilize and inflation is under control. Below we provide more details on our thoughts around inflation and what the current valuations could mean for REIT investors, along with our takeaways by property type from our REIT Week meetings.

Inflation

Inflation has been a popular topic for the past 12 months as easy monetary policy (0% interest rates) finally combined with loose fiscal policy (stimulus payments) to create the perfect storm for inflation. Importantly for real estate, it created the first v-shaped recovery we have had in a long time (arguably not since the Recession of 1953), almost bringing back 95%jobs lost in 2020 as of April 2022. However, the resulting increase in the money supply combined with higher gasoline prices and other goods with a strained supply chain has caused the consumer price index (CPI) to grow at its highest pace in 40 years!

Even using the Federal Reserve’s Core PCE (Personal Consumption Expenditures) Index, which backs out gasoline and food, inflation is growing at 4.7% (as of May 2022) versus the long term target of 2%. The Federal Reserve has decided to increase interest rates extremely quickly to cool the economy, though it can be argued that they should’ve started sooner. So far, however, inflation has yet to diminish. Therefore, we expect that the market will remain volatile until inflation at least begins to decelerate.

On the positive side, there are some tough comparisons for items such as used cars, copper, shipping rates, and lumber, which have already started to decelerate and should drag on CPI. On the negative side, there does not seem to be any slowing of year over year increases in energy, food, or rent. Eventually, we believe that the rapid increase in mortgage rates, which have doubled in the past two months from 3% to 6%, will pull down the housing market and help to slow CPI growth.

The good news for REIT investors is that real estate landlords are beneficiaries of inflation, albeit timing varies by property sector. Multifamily rent is an excellent example, as higher wages coupled with a nationwide shortage of housing have allowed landlords to push rents with current tenants. In addition, the increase in property prices and mortgage rates makes it more difficult to purchase a home, thus increasing demand for multifamily and single family rental landlords. We can look back to the last period of rapid inflation (CPI over +11% on average) from 1979 through 1981 when then NAREIT Equity REIT Index was able to produce an annualized total return of over 21.4%, which compared to the S&P 500 at 14.3% and even worse, fixed income at 3.6%.

Valuation

With all the activity on interest rates, the impact to capitalization rates (or ‘cap rates’, defined as net operating income divided by market value). We’ll dive into some of the property type specifics below, but overall the message was similar – cap rates haven’t really moved (e.g., maybe 25bps in select areas) but most management teams expect modest increases over the medium term.

Fortunately, REIT management teams appear much better positioned for the current environment relative to private operators. As we’ve mentioned before, REITs, particularly the names we favor, spent much of the pandemic battening down the hatches, building out robust and flexible balance sheets (low absolute leverage, longer maturities, less floating rate, etc.). The combination of well positioned balance sheets for REITs and rising cap rates pressuring private operators could lead to more accretive acquisitions across the space.

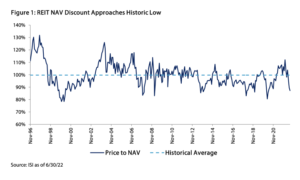

In spite of the balance sheet strength, we can’t predict when the group will find a bottom but we can note that valuation metrics are entering very attractive territory. As shown in Figure 1, the average REIT NAV discount reached nearly 20% in June, before finishing the month at 13%. While not an all-time low, one can see that the index bounced back after hitting a similar level in the late 90’s, 2008, and 2020.

Meanwhile, as shown in Figure 2, REIT leverage also at its lowest level in history, which stands in stark contrast to the other periods with major NAV discounts. Furthermore, REIT dividend payout ratios, as measured by dividend/AFFO (or adjusted funds from operations), are at an all-time low of 68%. To say it another way, REITs are trading at some of their most attractive valuations while simultaneously being the ‘safest’ in their history. Therefore, the pricing volatility is merely speculation on where cap rates and rent growth are going in the intermediate term, and in no way reflects potential dividend cuts or leverage issues. In our meetings, we challenged management teams on the security of their balance sheets, capacity to increase their dividends, and any signs of pricing, rent, or occupancy degradation.

Office

We met with Boston Properties (NYSE: BXP), who provided insight into the state of the office sector. ‘Back to office’ decisions by many large companies have been pushed back, and more companies continue to announce permanent hybrid or remote plans. BXP stated that utilization remains stubbornly low, but they have not experienced a downtick in leasing. The company does anticipate life science tenants to slow down significantly due to the massive decline in their stock prices in 2022. After the conference, we sold our only office REIT and therefore have zero allocation to pure play office REITs as of June 30, 2022. This compares to an index allocation of 8.0% as of the same date.

Industrial

Within the industrial sector, we met with EastGroup Properties (NYSE: EGP), Americold (NYSE: COLD), and Plymouth (NYSE: PLYM). Americold was excited to announce positive uptick in inventory for their tenants as well as a decline in contract labor, which made the stock a top performer immediately following the conference. The management team was hopeful that tenant inventory levels would be back to normal levels by the end of 2023, which is sooner than what they had been telegraphing prior to the conference. Plymouth was baffled by their 2022 stock price performance (down 43% as of June 30), which has occurred while business has only accelerated. The management team believes the $14 million in annualized net operating income from the development pipeline that is yet to come online (compares to 2021 actual NOI of $93 million) has not been properly valued by the market. In addition, they believe they are about six months away from cleaning up their balance sheet from several preferred issuances that were needed when the company was on less stable footing years ago. EastGroup stated that Amazon’s leasing ‘issue’ has been dramatically overblown by the market. EGP has four leases with Amazon (2.4% of annualized rent), none of which will be subleased. Meanwhile, EGP is 98.7% leased across the portfolio and has not seen any decline in market rents in their markets. After the conference, we initiated a new position in EGP, bringing the composite to an overweight allocation to the industrial sector for the first time since July 2021.

Healthcare

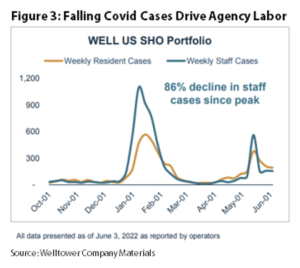

Within the healthcare sector we met with Welltower (NYSE: WELL) and Sabra (NYSE: SBRA). Welltower provided an encouraging update for senior housing fundamentals. As Figure 3 highlights, weekly staff and resident COVID cases have normalized from the early 2022 Omicron spike. Even with a modest tick up in May, agency labor is starting to normalize, rental increases remain strong (8-10% range for existing tenants), and move-ins are trending in the right direction. Management noted the prior record low for agency labor was 1.5% of expenses, and at its worst level (Omicron) hit roughly 7.5% of expenses. With the recent normalization, they estimate agency is 5.5% today and could get into the low 4%’s or even high 3%’s by early next year, which bodes well for earnings growth. On the acquisition front, WELL continues to execute on their barbell approach, which targets both high end and more moderately priced facilities to build out a full suite portfolio. Indeed, the most recent Calamar acquisition’s moderate income (average rent $1,300 per unit) nicely augments Oakmont’s high end offering ($9,000 average rent). Conversely, we heard lending has largely dried up for senior housing development and the company expects more deals to come to market as private operators contend with approaching debt maturities.

Our meeting with Sabra allayed many of our concerns surrounding the Centers for Medicare & Medicaid (CMS) proposed Payment System rule on Medicare reimbursements. Recall, CMS’s proposal would have an effective 0.7% reduction in Medicare rates and we are expected to have a final ruling sometime in August. A phased-in approach seems most logical to us for an industry still struggling to recover from the Pandemic, though an immediate reduction would likely impact private operators more than the REITs. Additionally, better than expected Medicaid increases at the State level offset some of the federal pressure. Management also discussed the company’s desire to increase ownership in some new property types (most notably Behavioral/Drug Treatment), with Skilled Nursing Facilities (SNFs) likely declining from the mid 60%’s to the mid 50%’s of the asset base over time. The company remains constructive on SNFs but believes the market would ascribe a higher multiple on a more diversified asset base that should produce a more predictable stream of earnings in the future.

Self Storage

Despite being one of the worst performing property types since peaking on April 21, self storage had some of the best fundamentals to present at the conference. The tone in our meetings with Life Storage (NYSE: LSI) and Public Storage (NYSE: PSA) was upbeat as near all-time high first quarter occupancy has given them the ability to be aggressive on rent increases to existing tenants. Case in point, both companies have been sending rental increases in the high teens to 20% range and, although occupancy has slipped, it remains above historical norms. This should set the group up well for the seasonally slow third and fourth quarter, likely necessitating guidance increases on their second quarter earnings calls.

Shopping Centers and Malls

Retail was another property type that current fundamentals on the ground stood in contrast to price declines for the stocks. We met with RPT Realty (NYSE: RPT), InvenTrust Properties (NYSE: IVT), Site Centers (NYSE: SITC), and Phillips Edison (NYSE: PECO) among the strip centers, and Simon Property Group (NYSE: SPG) in the mall and outlet sector. Leasing activity, particularly on the strip center side of the group, remained robust. A prime example is Site Centers: after signing an astonishing 52 anchor leases throughout the pandemic, they are now seeing some of the most robust small shop demand in history. In addition, retention rates are at record highs, which minimizes the capital expenditures that otherwise would be needed to lure a new tenant. That’s not to say management teams aren’t cognizant of consumer weakness, but thus far we’ve heard zero reports of any leases being slow walked (an early indicator for sagging retail demand).

A final point, retail has been one property type mostly eschewed by bigger institutional pools of capital. However, with the leasing market heating up and the pandemic in many ways proving the need for brick and mortar space, institutional capital was a big discussion point for retail. While we don’t have insight into anything specific in the works, we think any privatization or M&A within retail would help establish a bottom and act as a catalyst for the group – refer to the June 2022 Chilton REIT Outlook for more thoughts on privatization among REITs.

Data Centers

We met with Equinix (NASDAQ: EQIX), the only Chilton holding in the data center sector. 1Q22 was the best first quarter in company history based on leasing, and marked 77 straight quarters of revenue growth. There has been no slowdown in tenant demand, and the sector should remain strong regardless of what happens with the economy. EQIX is still underwriting development to high 20% yields, which compares to most other sectors at 6-8%. The company maintained their goal of a 50% operating margin by 2025 in spite of rising power costs due to the use of hedging. EQIX is the only data center company in the Chilton REIT Composite as of June 30, 2022, and we will continue to be underweight the sector given the lack of organic growth outside of EQIX.

Multifamily, SFR, and MH/RV

It’s no secret that rental prices have surged and, even as home prices appear to be tapering off thanks to rising interest rates, show no sign of abating in the near term. While we didn’t meet formally with any of our multifamily REITs, Invitation Homes (NYSE: INVH) provided an encouraging update on Single Family Rentals (or SFR) while Sun Communities (NYSE: SUI) shared their outlook for manufactured housing, RVs, and marinas.

The discussion on cap rates was largely similar to other property types, with very little movement thus far but the expectation for a modest increase on the horizon. Higher interest rates have clearly started to impact the market for home purchases. Anecdotally, we heard that bidding wars had become more like 5 person bidding wars versus 25+ previously. In our view this likely makes it easier for SFR REITs to buy new homes. As we discussed earlier, REITs by and large have spent the pandemic rebuilding their balance sheets, and thus are more insulated from higher interest rates than private investors looking to acquire property.

Shifting to RVs, our biggest concern has been rising gas prices. However, SUI highlighted 12.5% revenue growth over Memorial Day Weekend (which added to very strong growth in 2021), and noted that higher gas prices have been pushing more conversions from transient to annual customers. For some numbers on conversions, 2021 saw 1,700 in total, and the company did 1,025 in just the first four months of 2022. These compare to the historical average of only 1,000 conversions! Elsewhere, increasing housing affordability issues continue to support demand for manufactured housing while the company continues to focus on annual customers at its marinas.

Diversified

We met with Alexander Baldwin (NYSE: ALEX), Armada Hoffler (NYSE: AHH), American Assets Trust (NYSE: AAT), and CTO Realty Growth (NYSE: CTO). While each of these companies have multiple property types in their portfolios, they concentrate on different geographic areas. ALEX’s 100% concentration in Hawaii makes it the only pure play for the state. They noted that conversations with their tenants have been as positive as ever and there are no signs of slowing down. The company continues to prune non-core assets, , which could generate $100 million or more in cash for reinvestment or stock repurchases.

American Assets reiterated ALEX’s enthusiasm about Hawaii. Outside of Hawaii, AAT owns properties in California, Oregon, and Washington. AAT provided an NOI ‘bridge’ showing the potential growth in NOI from signed leases and a conservative estimate for speculative leasing at two of their development projects.

Armada Hoffler articulated a balance sheet plan that would allow for the current development pipeline (almost 32% of assets) to be completed without having to raise new equity. The company has not seen any diminution in demand for their assets and expects to crystalize some profits for shareholders by selling a few properties.

CTO Realty continues to clean up their story, selling non-core assets and reinvesting in shopping centers in the Sunbelt. The dividend will continue to rise in tandem with cash flow as the company is paying the minimum amount to qualify as a REIT (yet still sports a 7.3% dividend yield as of June 30!).

Conclusion

We came away with a strong sense that the ongoing pullback in equity REIT prices was not reflecting the operating fundamentals being seen on the ground. Importantly, this was not exclusive to any particular property type – it was fairly universal across the group. One unique, and important, aspect of the current economic malaise is strong jobs data, showing not only very low unemployment but also strong wage growth, which we think helps stem the impact of rising inflation. More importantly for REITs, we see rents in most property sectors rising. REIT balance sheets are at their strongest levels in history, which should allow more external growth via acquisitions once cap rates move up. This combination, alongside a record low dividend payout ratio, inspire substantial confidence in the outlook for above average REIT dividend growth – a theme we’ve addressed in the past and a key reason why we favor equity REITs today. Overall, near term volatility could certainly remain for some time, but we view the long term set up for REITs very attractively from this point.

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Isaac A. Shrand

ishrand@chiltoncapital.com

(713) 243-3219

RMS: 2,531 (6.30.2022) vs. 3,177 (12.31.2021) vs 1,433 (3.23.2020) and 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Leave a Reply Cancel reply

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.