The 2017 Chilton REIT Forecast | January 2017

January 1, 2017

In our 2016 Chilton REIT Forecast, we were optimistic on total returns, forecasting a base case of +10% to +12% assuming flat interest rates and cap rates. Our projection was close as the MSCI US REIT Index (Bloomberg: RMZ) finished 2016 with a total return of +8.6%. For reference, the Chilton REIT Composite produced a total return of +9.1% gross of fees, and +8.1% net of fees. The 10 year US Treasury yield finished the year at 2.4%, which compares to 2.3% as of December 31, 2015. While GDP growth was lower than expected, job growth was strong enough to drive REIT occupancies to all-time highs. We cited Citi’s projected adjusted funds from operations (or AFFO) growth of 6.6% in our 2016 forecast; the actual number looks like it will be closer to +7.2%. Dividend growth appears that it will come in around +9.0%, again above our expectations.

2016’s total return finished closer to our bear case of +6% to +8% than our base case because interest rates continued to be the tail wagging the dog. Turmoil in non-US markets and Fed comments about delaying interest rate hikes propelled the 10 year US Treasury yield to an all-time low of 1.37% on July 8, and REITs (as measured by the RMZ) to an all-time high on August 1. When it became apparent that the economy was doing a little better, REITs fell significantly due to the fears of a December interest rate hike by the Federal Reserve.

In our December 2016 REIT Outlook titled ‘The Trump Effect on Equity REITs’, we expressed our frustration that REITs were down while the broader stock market was up significantly after the election. It is our firm belief that if a new administration is favorable to non-REITs, then it can only mean good things for equity REITs. Since the publish date, REITs have bounced back slightly, but remain well below the S&P 500’s total return of 12.0% for 2016.

2017 Total Return Projection

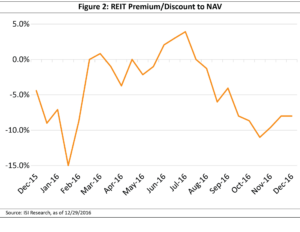

As of December 29, REITs were trading at an 8% discount to Net Asset Value (or NAV), which compares to the 12% discount at which they were trading upon publication of the 2016 forecast. The recent increase in inflation expectations should increase rent projections, but also return hurdles, potentially causing an increase in capitalization rates (or ‘cap rates’). We have been modeling a 25 basis point (or bp) increase in cap rates for the past several years, so this is not new to us. Assuming a starting applied cap rate of 5.9%, a 25 bp increase results in a 6% decrease to current NAVs. Thus, we believe REITs are undervalued, especially when considering that NAVs should grow by 6.5% in 2017 merely due to same store net operating income (or SSNOI) growth and accretive reinvestment of free cash flow into properties or debt reduction. We assume payout ratios remain at historical lows, thus dividends should increase by 7% (equivalent to Citi’s projected increase in AFFO). Assuming that REITs trade at a 5% discount to NAV (adjusted downward for a 25 bp increase in cap rates), 2017 REIT total returns should be in the vicinity of +5% to +7%.

Risks to our projection are mostly tied to capital flows into the sector, policy changes (particularly tax reform), interest rates, job growth, and new construction. Notably, we believe active managers will have an outsized ability to produce differentiated returns in 2017 due to the above uncertainties creating binary outcomes of winners and losers.

Interest Rates

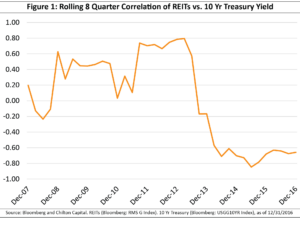

While we have been hoping that REITs would de-couple from interest rates for years now, it doesn’t seem to be happening anytime soon. While most real estate professionals would say that interest rates are not even in the top three most important considerations when investing in commercial real estate, REIT correlations with interest rates have been stubbornly negative since 2012 as shown in Figure 1. A highly negative correlation implies that increases in interest rates were highly predictive of decreases in REIT prices, and decreases in interest rates were highly predictive of increases in REIT prices. In contrast, there were many years from 2005 to 2011 when the correlation was close to zero, or even positive!

If rates rise significantly from the 2.4% level as of December 30, there would be negative implica-tions for REIT prices in 2017. However, it could have a very positive long term effect due to higher growth and inflation expectations, as well as throttling back new construction significantly due to higher return hurdles. In other words, though it would produce some short term pain, a rise in interest rates would extend the real estate cycle for at least a few more years.

If the economy goes back to the lukewarm scenario and investors look to long term treasuries as a flight to safety, new development could spike, thus bringing an end to the cycle. REIT pricing may experience a short term boost, potentially stimulating 2017 total returns above our base case scenario. But, a fall in interest rates without a drop in rents would spur new development to levels we have not seen in this cycle. As is typical in real estate cycles of the past, the sudden delivery of too much real estate when the economy is not on a strong foothold would result in declining occupancy rates and lower rental income, signaling that the peak of the cycle has passed.

Our base case for 2017 REIT index total returns of +5% to +7% assumes the 10 year US Treasury yield is between 2.6% and 2.8% by the end of the year. Assuming a constant implied cap rate spread versus the 10 year US Treasury yield and a 10 year US treasury yield between 3.0% and 3.2% by the end of the year, our forecast drops to -1% to +2%. If interest rates fall such that the 10 year US Treasury yield is between 2.2% and 2.4% but the implied cap rate spread increases to historical averages, we would project a total return of +8% to +11%.

Supply and Demand in Equilibrium…for Now

New supply is being built to meet demand for the first time in history. Despite REITs boasting all-time high occupancy, we witnessed a meaningful drop in new construction during 2016. While new construction never hit the long term average of 1.8% of all commercial real estate, it did creep above 1.5% and was trending well above 1.8% in a few sectors. However, over the past year, annualized construction starts dropped from 1.0 billion square feet (or sqft) to less than 900 million sqft, bringing new construction to only 1.2% of all commercial real estate.

Notably, new construction is less than 1% of existing space for the office, regional malls, and shopping center sectors. In contrast, new construction for the lodging, self-storage, industrial, and multifamily sectors are above 1.5%. If supply continues to stay in check only to meet demand, the environment for rent growth (albeit to varying degrees across sectors and geographic regions) should continue, thus extending the cycle further.

M&A

There was a decrease from 15 announced public to public or public to private transactions in 2015 to only ten in 2016. While there was a decrease in the number of transactions, it could be argued that the potential for M&A helped to put a floor on prices. As shown in Figure 2, there were two periods when REITs traded at NAV discounts at or below 10%, but each period was extremely short.

We believe that investors have made 10% a floor for the public to private arbitrage such that anything higher than a 10% discount would attract private equity to close the gap. With an NAV discount of 8% going into 2017 and a record $225 billion in private equity dry powder to invest in real estate according to Preqin as of September 30, the threat of M&A should continue to linger.

Fund Flows

At first glance, 2016 appears to be a strong year for positive fund flows into REIT ETFs and mutual funds, especially after 2015’s year of net outflows. However, the final fund flows number would have been much higher if not for the last two months of the year. As we mentioned in the December 2016 REIT Outlook, the year to date period ending October 31, 2016 had positive net funds flows of $21.6 billion. As of December 29, the 2016 net funds flows was only a positive $14.5 billion, reflecting outflows of $7.1 billion in the final two months of the year.

We believe that the large inflows in the months leading up to the Global Investment Classification Standards (or GICS) change in September and the quick reversal in the months following the change may reflect a short term trade that has now ended. Thus, despite the hype around this trade, the GICS change has not resulted in a significant increase in REIT holdings by long term institutional investors. In our October 2016 REIT Outlook, we discussed that the short term money seemed to favor companies with high dividend yields and low earnings multiples. Looking into 2017 and assuming the shareholder base has re-stabilized, we believe that stock performance will be once again influenced by the tenets that are most important to our methodology: property quality, NAV, balance sheet strength, dividend growth, and management prowess.

Conviction is Key

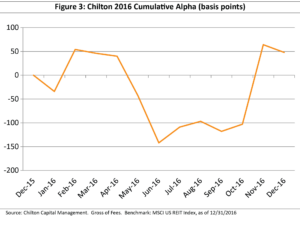

The active management of the Chilton REIT Com-posite has been able to produce an annualized gross of fee return of +11.1% (+10.3% net of fees) since inception in 2005, which compares to +7.8% for the benchmark over the same period. We attribute our outperformance to both the top-down and bottom-up driven methodology, and the conviction in the process. As shown in Figure 3, the Chilton REIT Composite was underperforming the benchmark for much of 2016, but eventually produced outperformance by the end of the year.

One recent example of conviction was our on-the-ground research of Houston-associated REITs. Despite outperforming in 2014 and 2015, the Chilton REIT Composite’s relative performance was dragged down significantly by exposure to Eastgroup Properties (NYSE: EGP), Camden Property Trust (NYSE: CPT), and Cousins Properties (NYSE: CUZ), each of whom has more than 10% of its Net Operating Income (or NOI) from Houston. Instead of panicking, we added significantly to each of these positions throughout 2014 and 2015, eventually building a combined portfolio weight more than seven times the benchmark in these three companies as of December 31, 2015.

In 2016, EGP, CUZ, and CPT were three of our top nine drivers of relative performance using data through December 16. Additionally, we saw an opportunity to add a position in the 100% Houston office REIT Parkway Inc. (NYSE: PKY) at attractive prices based on further research. It was a contrarian view as, at the time, the company did not garner a single buy recommendation from Wall Street analysts, and media reports forecasted a dire picture for Houston office. The risk paid off sooner than anticipated as the stock went from $17 per share on November 14 to above $22 per share on December 30, serving as an example that being comfortable with the long term risk and reward at a particular price is more important than trying to predict ‘the bottom’.

Sectors to Watch in 2017

Going into 2017, we have several views that differ significantly from the benchmark. The top three overweights are regional malls, office, and data centers/tech. The top three underweights are healthcare, triple net, and industrial.

Healthcare and triple net represent a combined 20% position in the MSCI US REIT Index, but 0% across the Chilton REIT Composite. Healthcare and triple net represent the two longest lease sectors in the REIT universe. As such, they have few triggers to pull to increase growth during inflationary periods, and thus consistently underperform while interest rates are rising. We believe that interest rates are more likely to stay where they are today (or rise) than to go back below 2%, thus driving our bias toward shorter lease sectors such as self storage, apartments, and lodging (all overweights in the Composite, but not in our top three due to potential supply issues). Industrial boasts excellent fundamentals, but we believe valuations have gotten ahead of themselves and thus are waiting for a better entry point.

As we covered in the July 2016 REIT Outlook, Class A malls are thriving in the current environment. Despite the strong fundamentals, as of December 28, 2016, mall REITs still trade at the steepest NAV discount of any of the major sectors. Recent reports suggest that the 2016 holiday shopping season could have the best year over year growth since 2005 according to Customer Growth Partners. In addition, a survey released on December 27, 2016 reported that consumer confidence is the highest in fifteen years. If these trends continue, mall tenant sales per sqft may reaccelerate, driving up expectations for rent and occupancy increases.

Cell towers and data centers have been an over-weight in the strategy for years, but their valuation levels relative to other sectors have not been this cheap for quite some time. We do not see the exponential data consumption increases going away anytime soon, however, which should drive REIT universe-leading cash flow and dividend growth.

Finally, our largest overweight is office, which had the largest increase in Composite weighting during the year (over 700 bps!). There isn’t one reason in particular for the increase in exposure, as office has likely the highest variability of portfolio and balance sheet quality, as well as the most constituents of any sector in the index. We believe each of our portfolio office companies is undervalued in its own individual way, and 2017-2018 should showcase the growth potential of this sector which many perceive to be slow-moving.

Tax Reform Wild Card

Tax reform could have a significant effect on REIT dividends. In particular, the changes to personal income tax rates, corporate tax rates, business interest tax deductibility, and depreciation formulas as laid out in the House GOP Blueprint from June 2016 (endorsed by Speaker Paul Ryan and Ways and Means Committee Chairman Kevin Brady) could have an outsized impact.

In the document, the top personal income tax bracket is lowered to 33%, the Obamacare and Medicare tax is repealed, and capital gains are taxed at half of the personal rate. Each of these would have significant positive effects on the after-tax dividends and capital gains for REIT investors given that REIT dividends are historically comprised of 70% ordinary income and 20% long term capital gains (the other 10% is return of capital).

Significant changes to corporate tax rates, depreciation formulas, and business interest deduction could decrease the potential benefits of filing as a REIT. The document calls for the corporate tax rate to be lowered to 20%, the business interest deduction to be repealed, and for depreciation to be 100% in year one. Changes to the business interest deduction and depreciation could significantly increase GAAP Net Income, on which the 90% distribution rule for REITs is based. Any REIT that is paying dividends close to current GAAP Net Income could be forced to increase its dividend significantly in order to maintain its REIT status, potentially into an uncomfortable payout ratio. Concurrently, the reduction in the corporate tax rate may cause some REITs to consider dropping their REIT status in favor of the flexibility to payout less than 90% of GAAP Net Income and attain qualified dividend status which would lower the tax rate on dividends to half of the investor’s top tax bracket rate.

Grains of Salt

Investing in stocks takes more than just a little humility, and we don’t claim to have a crystal ball for the dizzying array of scenarios that may occur in any given 12 month period. However, we maintain conviction in our long term themes, bottom-up theses, and ability to outperform the benchmark. We attribute this conviction to processes that have been honed over the sixty combined years of REIT experience on the Chilton REIT Team, and which we strive to improve each year.

Parker Rhea, prhea@chiltonreit.com, (713) 243-3211

Matthew R. Werner, CFA, mwerner@chiltonreit.com, (713) 243-3234

Bruce G. Garrison, CFA, bgarrison@chiltonreit.com, (713) 243-3233

Blane T. Cheatham, bcheatham@chiltonreit.com, (713) 243-3266

RMS: 1904 (1.31.2017) vs. 1904 (12.31.2016) vs. 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/reit-outlook.html.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.