The Real Estate Cycle Is Maturing, but Is Not Over | November 2016

November 1, 2016

Equity REITs, as measured by the MSCI US REIT Total Return Index (Bloomberg: RMS), were down 5.7% in October for a variety of reasons, including the fear of rising interest rates and, to a lesser extent, a slowdown of growth rates in some, but not all, property types. In an environment of low GDP growth, low interest rates, and low inflation, we are comfortable with estimates of funds from operations (or FFO) increasing in the 5-6% range annually looking out over the next several years. An objective look at the current valuation of REITs provides a mountain of evidence that the depth of this pullback is unwarranted, and investors stand to be the beneficiaries of a potentially historic buying opportunity.

Where We Are

The 4.2% dividend yield of the MSCI US REIT Index as of October 27, 2016 reflects a significant cushion of 236 basis points (or bps) relative to the 10 year US treasury yield of 1.84% as of the same date. 236 bps compares to the average spread in the modern REIT era of only 110 bps! And, this is before one adjusts for the record low payout ratio on adjusted funds from operations (or AFFO) of 72%, or any future growth in the dividend. In the early days, payouts in the 100%+ range were the norm. Conservatively, we maintain our view that dividend growth should average 5% annually for at least the next several years. However, if REITs wanted to increase payout ratios closer to historical averages, dividend growth could be significantly higher.

In addition to laying a predictable runway for dividend growth, low dividend payout ratios offer REITs free cash flow to utilize in a variety of ways, namely acquisitions, development, and/or debt retirement. This enables equity REITs to generate internal growth much like any corporation. For the typical REIT, it is not unreasonable for this capital to add 1-2% to AFFO per share annually over a full cycle.

Same store net operating income (or SSNOI) is the main engine of cash flow growth. A combination of rent, occupancy, and expense controls, it can be difficult to maintain growth trajectories for extended periods of time as occupancy becomes full and rent growth slows, usually due to an increase in supply or a decline in demand. Historically, SSNOI growth has averaged about 3% over a full cycle, and 2016 looks to be in the +4% range. Occupancy is essentially full as of June 30, 2016, with the REIT average close to 95% versus a historical average of 93%.

Finally, expense savings can lift cash flow per share, either through economies of scale or from accretive refinancing of debt. In particular, REITs have been beneficiaries of refinancing higher cost debt and preferred stock into lower rate options. Though there will still be opportunities for accretive refinancing going forward, we believe that refinancing will play a lesser role in AFFO per share growth going forward. Notably, the weighted average interest rate on debt maturing drops from mid-4% in 2017 to mid-3% in 2018.

In summary, the cycle is more than 7 years past the trough in 2009, and most or all of the low hanging fruit has been picked. The rising tide of the US economy lifted all boats, and a culmination of years of strong fundamentals and a favorable interest rate environment resulted in breaking through the 2007 MSCI US REIT Price Only Index (Bloomberg: RMZ) highs on August 1, 2016. Remarkably, the prices on August 1 reflected a premium to net asset value (or NAV) for only the second time since January 2013, which can be seen in Figure 1. While we were excited for the new highs, we were extremely active in our portfolio, selling out of names trading at large premiums to NAV and recycling capital into names at a discount. A pullback from such levels could be expected, but what has transpired over the past 3 months is nothing short of a pendulum swinging much too far in one direction.

Valuation Swing

From the peak on August 1 to October 27, 2016, the MSCI US REIT Index produced a total return of -12.8%, and went from trading at an NAV premium to an 11% NAV discount. According to Figure 1, this is only the 7th time since the start of the Modern REIT Era when REITs have traded at an 11% or higher NAV discount.

The main drivers of NAV for commercial real estate are the net operating income (NOI) produced at the property level and the capitalization rate (or ‘cap rate’) used to value the cash flow stream. We do believe it is prudent to factor in an increase in cap rates (which would result in a decrease in NAV), but current valuations have gone too far.

REITs are now trading at a weighted average implied cap rate of 6.0%, or 6.5% using a straight average. The historical spread relative to corporate bonds (BAA rated) is 150 basis points, but today it stands at 260 bps! In addition, the historical spread to the 10 year US treasury yield is 360 bps, but today’s prices imply a spread of 420 bps! Furthermore, if one applies the estimated growth in NOI over the next three years, the weighted average implied cap rate would increase to about 7.0% in three years holding stock prices constant at today’s level.

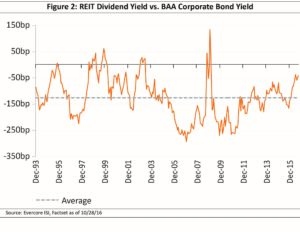

Using another spread metric, the dividend yield spread to corporate bonds (BAA rated) was -42 bps as of October 27, 2016, which compares to the historical average of -125 bps. As shown in Figure 2, the spread is the highest since 2009! As mentioned earlier, the spread to the 10 year US treasury yield was 236 bps, which, excluding 2016, had not been seen since 2009 either. If REITs stay at current prices, 5% annualized growth over 3 years applied to the current dividend stream would bring the REIT dividend yield to 4.9%.

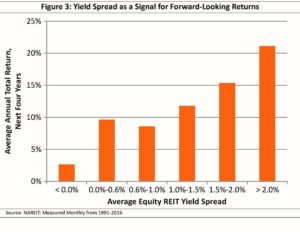

Using analysis by Brad Case at NAREIT, investing in the FTSE NAREIT All Equity REITs Index (Bloomberg: FNER) at times when the dividend yield spread to the 10 year US treasury yield was over 200 bps produced an average 4 year annualized total return of 21.1% since 1991. As shown in Figure 3, this is best of any of the scenarios analyzed.

Looking at cash flow multiples as a valuation metric, the benchmark price to 2017 estimated FFO multiple now stands at 14.9x, the lowest level in 6 years. This compares to the 20 year average of 12.7x. The property quality of today’s REITs would more than justify the current multiple versus the historical average based upon our analysis. In addition, the pristine nature of today’s balance sheets is almost incomparable to those that produced the historical averages. Debt is near 30% of enterprise value – a record low – and net debt to EBITDA (earnings before interest, taxes, depreciation, and amortization) now averages 5.9x.

Cracks in the Armor?

The third quarter earnings season, now underway, has been good but not great. Considering the maturity of the current real estate cycle, now nearing 8 years in length, it would be normal to see some deceleration in rental growth. The statements that the best years of market rent growth are potentially behind us is the single most negative comment coming out of earnings calls thus far.

We have said in many previous outlooks that the current real estate cycle will be one for the record books and we have not changed this view. Commercial real estate in the US represents a total investment of approximately $12-15 trillion and consists of at least 14 different property types such as office, shopping centers, regional malls, industrial, self-storage, lodging, and data centers/tech, to name some of the most prominent. REITs tend to own the “best of the best” real estate in each property type, in the best locations across the country. Each sector, albeit sharing many characteristics, has independent fundamental drivers for investment consideration. It is our job as portfolio managers to position our holdings where we believe we can attain the best performance using a 2-3 year investment horizon.

We have been vocal in the past (specifically 2006-2007) when we believed REITs were poised for a downturn, and put our money where our mouths were by raising significant cash levels. Today’s prices and fundamentals do not warrant such action. We continue to believe REITs can deliver total returns in the range of +6-8% annualized given the current favorable backdrop of supply and demand that is driving cash flow and dividend growth, albeit slower than in recent years. While we don’t claim to be experts on other market sectors, we believe this forecast should be appealing given high predictability of future dividend growth associated with an investment in REITs today.

Not All in a Name

As we mentioned in the October REIT Outlook, generalist investors are increasingly investing in REITs as a result of the GICS (Global Investment Classification Standards) change. While we believe they have a lot to learn about what drives long term individual REIT performance, we must also do our best to accommodate this new shareholder base. There are several things that REIT management teams can be doing to better appeal to these new shareholders, as they should be treated differently than the REIT-dedicated shareholders.

First and foremost, we would like to dispel any prejudices levied on public equity REITs that are a direct result of the acronym, ‘REIT’. We understand that there have been many REITs that have not done well for investors, mostly non-traded REITs or mortgage REITs. Even we would concede the public equity REITs prior to the dawn of the Modern REIT Era in 1991 not only owned properties of questionable quality, but also could not measure up to the improved standards that have come about as a result of the many real estate cycles since then. Notably, the REITs of old were externally managed and had payout ratios above 100% of cash flow, thus making a REIT merely a collection of properties with an associated yield. Today, most REITs are internally managed and use free cash flow as a source of capital, making them operating companies just like any other S&P 500 company. Recall that there are 27 equity REITs in the S&P 500 today versus zero only 20 years ago.

The truth is that public equity REITs have since distinguished themselves as the premier owners of commercial real estate, leaving non-traded REITs and mortgage REITs far behind, particularly as it relates to total returns. Especially given the ongoing litigation against non-traded REITs and the firms who sold them, it is understandable that the word ‘REIT’ may conjure up negative biases. Because public equity REITs are so different from both mortgage REITs and non-traded REITs, we would suggest a change in nomenclature to better differentiate the constituents of this new GICS sector from the black sheep of the REIT ‘family’. The REIT trade association, called NAREIT, has discussed the potential to get rid of the ‘REIT’ name for public equity REITs, which could be a good start. In the meantime, management teams could explore taking ‘REIT’ out of their company names.

The Simplicity Premium

While we believe that REIT disclosures are among the most comprehensive when compared to traditional equities, simplicity could accelerate acceptance by the new shareholder base. As NAREIT CARE Award Judges, the Chilton REIT Team claims to know a little bit about disclosures. We would not propose less information, but an easy-to-follow, well-organized supplemental could attract more investors than a complicated one that has information spread between the 10-Q filing, earnings press release, earnings presentation, earnings call transcript, and the supplemental. If companies are interested in attracting investors that can accurately and quickly determine the relevant metrics, then an overhaul of the investor materials, particularly consolidating all necessary information in the supplemental, would be wise.

In addition, if a REIT would like to be valued based on NAV, then it would behoove each company to provide an ‘NAV page’ in the supplemental that summarizes all of the relevant information that would be necessary to compute the figure. REIT management teams should also concede that multiples will always be relevant to some extent, and thus needs to provide a calculation of AFFO. A better-advertised AFFO figure could also help to dispel any myths that dividends are paid out of net income, thus making payout ratios look elevated and unsustainable.

Simplicity also applies to corporate strategy. The use of joint ventures, both consolidated and unconsolidated, can make deriving AFFO and NAV more difficult. If joint ventures are used, then investors should demand for all figures to be listed at the pro rata ownership level. Recent rule changes at the SEC have actually served to obscure ownership levels of REIT assets by not allowing a combined pro rata balance sheet and income statement. Instead, REITs will need to disclose 3 balance sheets and income statements, which can then be added together to obtain the necessary pro rata figures to accurately measure NAV and AFFO. This is a huge step in the wrong direction, and yet another sign of the lack of understanding of REITs by the SEC.

Eventually, FFO, AFFO, and NAV by company and weighted average figures of each should be publicly available. Conceivably, less complex and more apparent disclosures would improve data provided by third parties such as SNL, FactSet, and Bloomberg, making comparison among REITs even easier. Finally, making the relevant figures available will hopefully rid the public of any data that is based on GAAP items such as book value, earnings per share, and price to earnings ratio, which we believe has done nothing but harm to the sector.

Be Careful What You Wish For

It is safe to assume that most REITs and REIT investors were optimistic that the newfound attention on the sector as a result of the GICS change would be positive for valuations and growing the shareholder base. Performance since the GICS change however has been disappointing, which we believe should be a wake-up call that the industry can do more to cater to the new shareholders. Being in the spotlight certainly brings with it more potential, but it also comes with a responsibility to educate.

We envision a world where equity REITs are a ‘full cycle’ investment, commanding a minimum 5% of ‘portfolio share’ among individuals and institutions regardless of market conditions, and a potentially higher allocation based on a combination of fundamentals and valuation. We believe this is one of those times where a higher allocation is appropriate, as the downside risk is limited by valuation floors mentioned above and the dividend growth machine is firing on all cylinders.

Parker Rhea, prhea@chiltonreit.com, (713) 243-3211

Matthew R. Werner, CFA, mwerner@chiltonreit.com, (713) 243-3234

Bruce G. Garrison, CFA, bgarrison@chiltonreit.com, (713) 243-3233

Blane T. Cheatham, bcheatham@chiltonreit.com, (713) 243-3266

RMS: 1904 (1.31.2017) vs. 1904 (12.31.2016) vs. 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltonreit.com/reit-outlook.html.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.

for more info on our strategy

go now →

for more info on our strategy

go now →

VIEW CHILTON'S LATEST

Media Features

go now →

Contact Us

READ THE LATEST

REIT Outlook

go now →

disclaimers

terms & conditions & FORM ADV

SITE CREDIT

Navigate

HOME

TEAM

REITS 101

Approach

OUTLOOKS

media

Contact

back to top

VISIT CHILTON CAPITAL MANAGEMENT

This property and any marketing on the property are provided by Chilton Capital Management, LLC and their affiliates (together, "Chilton"). Investment advisory services are provided by Chilton, an investment adviser registered with the SEC. Please be aware that registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Further, registration does not imply or guarantee that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its advisory clients. Please consider your objectives before investing. A diversified portfolio does not ensure a profit or protect against a loss. Past performance does not guarantee future results. Investment outcomes, simulations, and projections are forward-looking statements and hypothetical in nature. Neither this website nor any of its contents shall constitute an offer, solicitation, or advice to buy or sell securities in any jurisdictions where Chilton is not registered. Any information provided prior to opening an advisory account is on the basis that it will not constitute investment advice and that we are not a fiduciary to any person by reason of providing such information. Any descriptions involving investment process, portfolio construction or characteristics, investment strategies, research methodology or analysis, statistical analysis, goals, risk management are preliminary, provided for illustration purposes only, and are not complete and will not apply in all situations. The content herein may be changed at any time in our discretion . Performance targets or objectives should not be relied upon as an indication of actual or projected future performance. Investment products and investments in securities are: NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF,OR GUARANTEED BY A BANK • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities including possible loss of the principal amount invested. Before investing, consider your investment objectives and our fees and expenses. Our advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide tax advice, nor financial planning with respect to every aspect of a client’s financial situation, and do not incorporate specific investments that clients hold elsewhere. Prospective and current clients should consult their own tax and legal advisers and financial planners. For more details, see links below to CRS (Part 3 of Form ADV) for natural person clients; Part 2A and 2B of Form ADV for all clients regarding important disclosures.